CarMax 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Circuit City Group

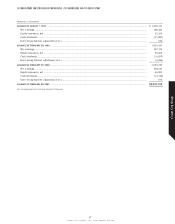

Short-term debt of the Company is funded through committed

lines of credit and informal credit arrangements, as well as the

revolving credit agreement. Amounts outstanding and committed

lines of credit available are as follows:

Years Ended

February 28 or 29

(Amounts in thousands) 2001 2000

Average short-term debt outstanding .......... $ 56,065 $ 44,692

Maximum short-term debt outstanding....... $365,275 $411,791

Aggregate committed lines of credit ............ $360,000 $370,000

The weighted average interest rate on the outstanding short-

term debt was 6.8 percent during fiscal 2001, 5.6 percent during

fiscal 2000 and 5.1 percent during fiscal 1999.

Interest expense allocated by the Company to the Circuit City

Group, excluding interest capitalized, was $7,273,000 in fiscal

2001, $13,844,000 in fiscal 2000 and $21,926,000 in fiscal 1999.

The Circuit City Group capitalizes interest in connection with the

construction of certain facilities and the development or purchase

of software for internal use. Interest capitalized amounted to

$2,121,000 in fiscal 2001, $2,166,000 in fiscal 2000 and

$2,749,000 in fiscal 1999.

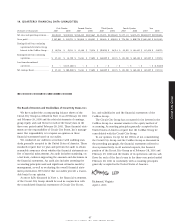

5. INCOME TAXES

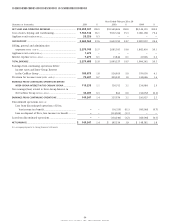

The components of the provision for income taxes on earnings

from continuing operations before the Inter-Group Interest in the

CarMax Group are as follows:

Years Ended February 28 or 29

(Amounts in thousands) 2001 2000 1999

Current:

Federal...................................... $52,846 $ 141,514 $123,001

State.......................................... 7,993 16,901 15,694

60,839 158,415 138,695

Deferred:

Federal...................................... 9,505 40,572 5,773

State.......................................... 293 1,256 178

9,798 41,828 5,951

Provision for income taxes......... $70,637 $200,243 $144,646

The effective income tax rate differed from the federal statutory

income tax rate as follows:

Years Ended February 28 or 29

2001 2000 1999

Federal statutory income tax rate........ 35.0% 35.0% 35.0%

State and local income taxes,

net of federal benefit........................ 3.0% 3.0% 3.1%

Effective income tax rate ...................... 38.0% 38.0% 38.1%

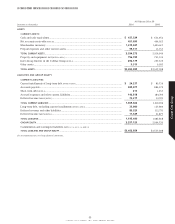

In accordance with SFAS No. 109, the tax effects of temporary

differences that give rise to a significant portion of the deferred

tax assets and liabilities at February 28 or 29 are as follows:

(Amounts in thousands) 2001 2000

Deferred tax assets:

Inventory ...................................................... $ — $ 7,264

Accrued expenses ........................................ 42,953 27,974

Other.............................................................. 7,311 7,167

Total gross deferred tax assets............. 50,264 42,405

Deferred tax liabilities:

Depreciation and amortization.................. 42,488 44,854

Deferred revenue ......................................... 32,825 29,656

Securitized receivables................................ 36,257 14,069

Inventory ...................................................... 9,927 —

Prepaid expenses ......................................... 10,788 23,023

Other.............................................................. 3,625 6,651

Total gross deferred tax liabilities....... 135,910 118,253

Net deferred tax liability.................................. $ 85,646 $ 75,848

Based on the Company’s historical and current pretax earn-

ings, management believes the amount of gross deferred tax

assets will more likely than not be realized through future tax-

able income; therefore, no valuation allowance is necessary.

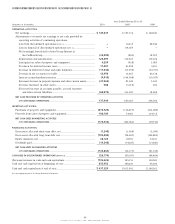

6. ASSOCIATE BENEFIT AND STOCK INCENTIVE PLANS

(A) 401(k) PLAN: Effective August 1, 1999, the Company began

sponsoring a 401(k) Plan for all employees meeting certain eligi-

bility criteria. Under the Plan, eligible employees can contribute

up to 15 percent of their salaries, and the Company matches a

portion of those associate contributions. The Company's expense

for this plan for Circuit City Group associates was $3,996,000 in

fiscal 2001 and $2,158,000 in fiscal 2000.

(B) PREFERRED STOCK: In conjunction with the Company’s

Shareholders Rights Plan as amended and restated, preferred

stock purchase rights were distributed as a dividend at the rate

of one right for each share of Circuit City Group Common

Stock. The rights are exercisable only upon the attainment of, or

the commencement of a tender offer to attain, a specified own-

ership interest in the Company by a person or group. When

exercisable, each Circuit City Group right would entitle share-

holders to buy one eight-hundredth of a share of Cumulative

Participating Preferred Stock, Series E, $20 par value, at an

exercise price of $125 per share subject to adjustment. A total

of 500,000 shares of such preferred stock, which have preferen-

tial dividend and liquidation rights, have been designated. No

such shares are outstanding. In the event that an acquiring per-

son or group acquires the specified ownership percentage of the

Company’s common stock (except pursuant to a cash tender

offer for all outstanding shares determined to be fair by the

board of directors) or engages in certain transactions with the

Company after the rights become exercisable, each right will be

converted into a right to purchase, for half the current market

price at that time, shares of the related Group stock valued at

61

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT