CarMax 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reported Historical Information

23

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

Circuit City Stores, Inc.

The common stock of Circuit City Stores, Inc. consists of two com-

mon stock series, which are intended to reflect the performance of

the Company's two businesses. The Circuit City Group Common

Stock is intended to track the performance of the Circuit City busi-

ness and related operations and the Group’s retained interest in

the CarMax Group. The effects of the retained interest in the

CarMax Group on the Circuit City Group’s financial statements are

identified by the term “Inter-Group.” During the three-year period

discussed in this annual report, the financial results for the

Company and the Circuit City Group also have included the

Company's investment in Digital Video Express, which has been

discontinued. The CarMax Group Common Stock is intended to

track the performance of the CarMax stores and related opera-

tions. The Circuit City Group’s retained interest is not considered

outstanding CarMax Group Common Stock. Therefore, the net

earnings or losses attributed to the retained interest are not

included in the CarMax Group’s per share calculations.

Holders of Circuit City Group Common Stock and holders of

CarMax Group Common Stock are shareholders of the Company

and as such are subject to all of the risks associated with an

investment in the Company and all of its businesses, assets and

liabilities. The results of operations or financial condition of one

Group could affect the results of operations or financial condition

of the other Group. The discussion and analysis for Circuit City

Stores, Inc. presented below should be read in conjunction with

the discussion and analysis presented for each Group and in

conjunction with all the Company’s SEC filings.

RESULTS OF OPERATIONS

Sales Growth

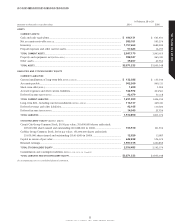

Total sales for Circuit City Stores, Inc. increased 3 percent in fiscal

2001 to $12.96 billion. In fiscal 2000, total sales increased 17 per-

cent to $12.61 billion from $10.81 billion in fiscal 1999.

PERCENTAGE SALES CHANGE FROM PRIOR YEAR

Circuit City Circuit City CarMax

Stores, Inc. Group Group

Fiscal Total Total Comparable Total Comparable

2001............. 3% (1)% (4)% 24% 17 %

2000 ............ 17% 13 % 8 % 37% 2 %

1999 ............ 22% 17 % 8 % 68% (2)%

1998 ............ 16% 12 % (1)% 71% 6 %

1997 ............ 9% 6 % (8)% 85% 23 %

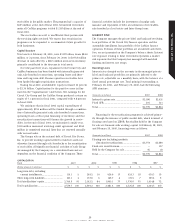

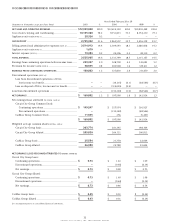

(Amounts in thousands except per share data) 2001 2000 1999 1998 1997

Net sales and operating revenues ................................ $12,959,028 $12,614,390 $10,810,468 $8,870,797 $ 7,663,811

Earnings from continuing operations ......................... $ 160,802 $ 327,830 $ 211,470 $ 124,947 $ 144,234

Loss from discontinued operations.............................. $–$ (130,240) $ (68,546) $ (20,636) $ (7,820)

Net earnings.................................................................... $ 160,802 $ 197,590 $ 142,924 $ 104,311 $ 136,414

Net earnings (loss) per share attributed to:

Circuit City Group:

Basic:

Continuing operations................................... $0.73$ 1.63 $ 1.09 $ 0.68 $ 0.74

Discontinued operations............................... $–$ (0.65) $ (0.34) $ (0.11) $ (0.04)

Net earnings................................................... $0.73$ 0.98 $ 0.75 $ 0.57 $ 0.70

Diluted:

Continuing operations.................................. $0.73$ 1.60 $ 1.08 $ 0.67 $ 0.73

Discontinued operations............................... $–$ (0.64) $ (0.34) $ (0.10) $ (0.04)

Net earnings................................................... $0.73$ 0.96 $ 0.74 $ 0.57 $ 0.69

CarMax Group:

Basic...................................................................... $0.45$ 0.01 $ (0.24) $ (0.35) $ (0.01)

Diluted.................................................................. $0.43$ 0.01 $ (0.24) $ (0.35) $ (0.01)

Total assets...................................................................... $ 3,871,333 $ 3,955,348 $ 3,445,266 $3,231,701 $ 3,081,173

Long-term debt, excluding current installments ....... $ 116,137 $ 249,241 $ 426,585 $ 424,292 $ 430,290

Deferred revenue and other liabilities......................... $ 92,165 $ 130,020 $ 112,085 $ 145,107 $ 166,295

Cash dividends per share paid on

Circuit City Group Common Stock......................... $0.07$ 0.07 $ 0.07 $ 0.07 $ 0.07

See notes to consolidated financial statements.

Circuit City Stores, Inc. Managements Discussion and

Analysis of Results of Operations and Financial Condition