CarMax 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

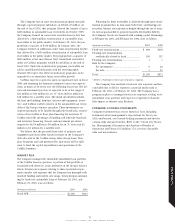

3. BUSINESS ACQUISITIONS

The CarMax Group acquired the franchise rights and the related

assets of one new-car dealership for an aggregate cost of $1.3 mil-

lion in fiscal 2001, five new-car dealerships for an aggregate cost of

$34.8 million in fiscal 2000 and four new-car dealerships for an

aggregate cost of $49.6 million in fiscal year 1999. These acquisi-

tions were financed through available cash resources, including allo-

cated debt and, in fiscal 1999, the issuance of two promissory notes

aggregating $8.0 million. Costs in excess of the fair value of the net

tangible assets acquired (primarily inventory) have been recorded as

goodwill and covenants not to compete. These acquisitions were

accounted for under the purchase method and the results of the

operations of each acquired franchise were included in the accompa-

nying CarMax Group financial statements since the dates of acquisi-

tion. Unaudited pro forma information related to these acquisitions

is not included because the impact of these acquisitions on the

accompanying CarMax Group financial statements is not material.

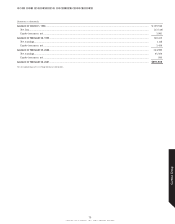

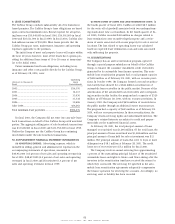

4. PROPERTY AND EQUIPMENT

Property and equipment, at cost, at February 28 or 29 is summa-

rized as follows:

(Amounts in thousands) 2001 2000

Land and buildings (20 to 25 years) .............. $101,382 $ 81,885

Land held for sale.............................................. 27,971 41,850

Land held for development.............................. 4,285 17,697

Construction in progress .................................. 14,324 18,010

Furniture, fixtures and equipment

(3 to 8 years) ................................................ 64,866 60,225

Leasehold improvements

(10 to 15 years)............................................. 21,196 19,902

234,024 239,569

Less accumulated depreciation ....................... 41,866 27,713

Property and equipment, net........................... $192,158 $211,856

Land held for development is land owned for future sites

that are scheduled to open more than one year beyond the fiscal

year reported.

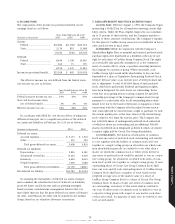

5. DEBT

Long-term debt of the Company at February 28 or 29 is summa-

rized as follows:

(Amounts in thousands) 2001 2000

Term loans ......................................................... $230,000 $405,000

Industrial Development Revenue Bonds due

through 2006 at various prime-based rates

of interest ranging from 5.5% to 6.7%..... 4,400 5,419

Obligations under capital leases .................... 12,049 12,416

Note payable ..................................................... 2,076 3,750

Total long-term debt........................................ 248,525 426,585

Less current installments................................. 132,388 177,344

Long-term debt, excluding current

installments ................................................. $ 116,137 $249,241

Portion of long-term debt allocated

to the CarMax Group................................. $191,208 $212,866

In July 1994, the Company entered into a seven-year,

$100,000,000 unsecured bank term loan. The loan was restruc-

tured in August 1996 as a $100,000,000, six-year unsecured

bank term loan. Principal is due in full at maturity with interest

payable periodically at LIBOR plus 0.40 percent. At February 28,

2001, the interest rate on the term loan was 5.97 percent.

In May 1995, the Company entered into a five-year,

$175,000,000 unsecured bank term loan. As scheduled, the

Company used existing working capital to repay this term loan

in May 2000.

In June 1996, the Company entered into a five-year,

$130,000,000 unsecured bank term loan. Principal is due in full

at maturity with interest payable periodically at LIBOR plus 0.35

percent. At February 28, 2001, the interest rate on the term loan

was 5.73 percent. This term loan is due in June 2001 and was

classified as a current liability at February 28, 2001. Although

the Company has the ability to refinance this loan, it intends to

repay the debt using existing working capital.

The Company maintains a multi-year, $150,000,000 unsecured

revolving credit agreement with four banks. The agreement calls

for interest based on both committed rates and money market

rates and a commitment fee of 0.18 percent per annum. The

agreement was entered into as of August 31, 1996, and terminates

August 31, 2002. No amounts were outstanding under the revolv-

ing credit agreement at February 28, 2001, or February 29, 2000.

In November 1998, the CarMax Group entered into a four-

year, unsecured $5,000,000 promissory note. Principal is due

annually with interest payable periodically at 8.25 percent.

Under certain of the debt agreements, the Company must

meet financial covenants relating to minimum tangible net

worth, current ratios and debt-to-capital ratios. The Company

was in compliance with all such covenants at February 28, 2001,

and February 29, 2000.

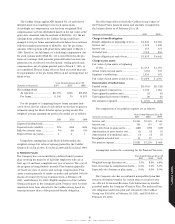

Short-term debt of the Company is funded through commit-

ted lines of credit and informal credit arrangements, as well as

the revolving credit agreement. Amounts outstanding and com-

mitted lines of credit available are as follows:

Years Ended

February 28 or 29

(Amounts in thousands) 2001 2000

Average short-term debt outstanding ........ $ 56,065 $ 44,692

Maximum short-term debt outstanding .... $365,275 $411,791

Aggregate committed lines of credit......... $360,000 $370,000

The weighted average interest rate on the outstanding short-

term debt was 6.8 percent during fiscal 2001, 5.6 percent during

fiscal 2000 and 5.1 percent during fiscal 1999.

Interest expense allocated by the Company to the CarMax

Group, excluding interest capitalized, was $12,110,000 in fiscal

2001, $10,362,000 in fiscal 2000 and $6,393,000 in fiscal 1999.

The CarMax Group capitalizes interest in connection with the

construction of certain facilities. There was no interest capitalized

in fiscal 2001. Interest capitalized amounted to $1,254,000 in

fiscal 2000 and $2,674,000 in fiscal 1999.

78

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT