CarMax 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

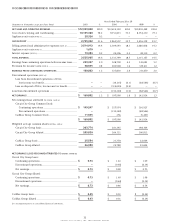

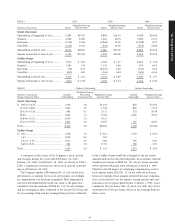

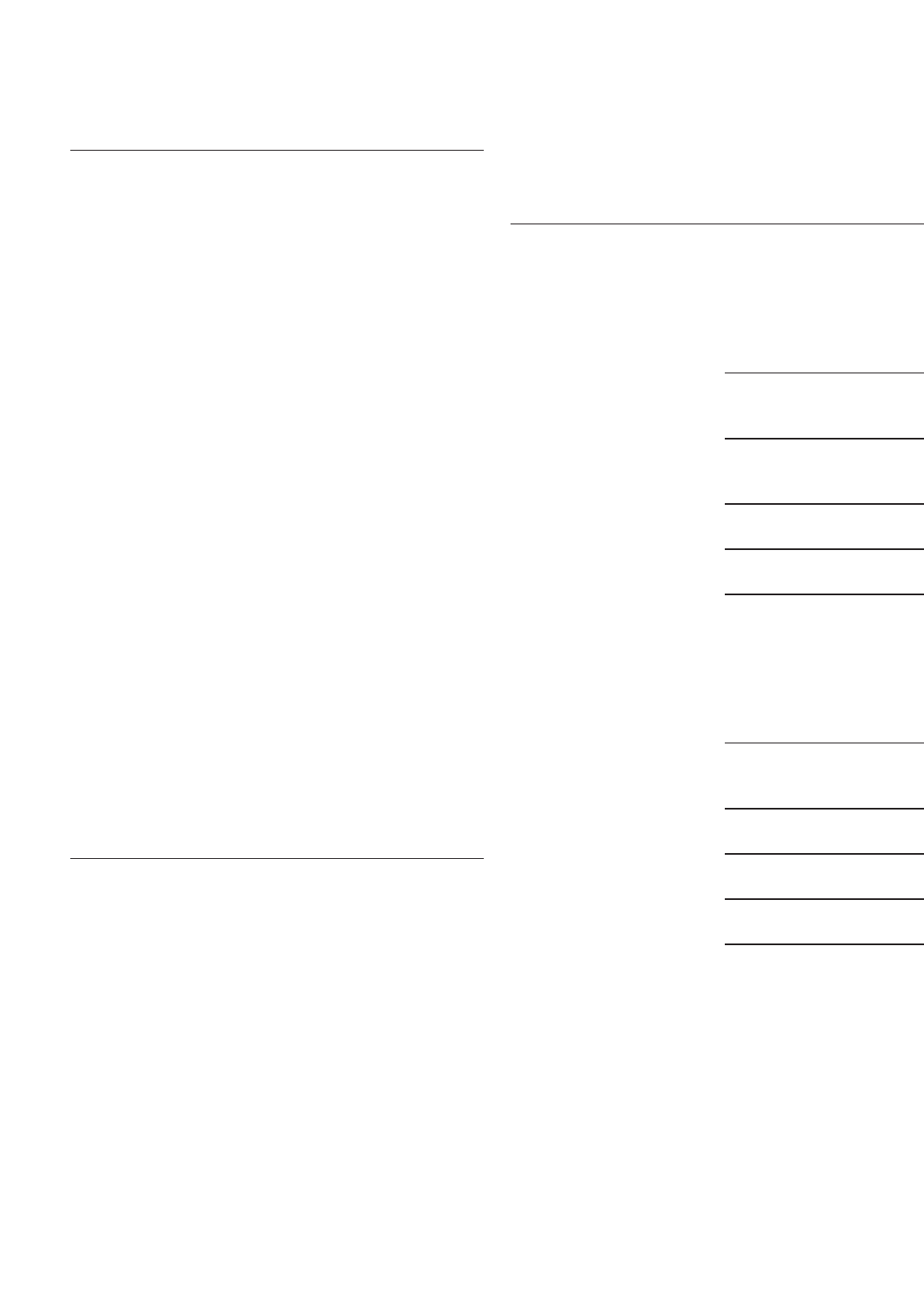

(Amounts in thousands Years Ended February 28 or 29

except per share data) 2001 2000 1999

Circuit City Group:

Earnings from continuing

operations:

As reported........................... $149,247 $327,574 $216,927

Pro forma ............................. 136,957 319,337 211,025

Net earnings:

As reported........................... $149,247 $197,334 $148,381

Pro forma ............................. 136,957 189,097 142,479

Earnings per share from

continuing operations:

Basic – as reported.............. $ 0.73 $ 1.63 $ 1.09

Basic – pro forma................ 0.67 1.59 1.06

Diluted – as reported .......... $ 0.73 $ 1.60 $ 1.08

Diluted – pro forma............ 0.67 1.56 1.05

Net earnings per share:

Basic – as reported.............. $ 0.73 $ 0.98 $ 0.75

Basic – pro forma................ 0.67 0.94 0.72

Diluted – as reported .......... $ 0.73 $ 0.96 $ 0.74

Diluted – pro forma............ 0.67 0.93 0.71

CarMax Group:

Net earnings (loss):

As reported........................... $ 11,555 $ 256 $ (5,457)

Pro forma ............................. 11,345 75 (5,537)

Net earnings (loss) per share:

Basic – as reported.............. $ 0.45 $ 0.01 $ (0.24)

Basic – pro forma................ 0.44 0.00 (0.24)

Diluted – as reported .......... $ 0.43 $ 0.01 $ (0.24)

Diluted – pro forma............ 0.42 0.00 (0.24)

For the purpose of computing the pro forma amounts indi-

cated above, the fair value of each option on the date of grant is

estimated using the Black-Scholes option-pricing model. The

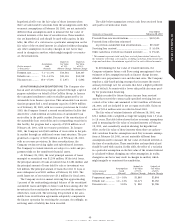

weighted average assumptions used in the model are as follows:

2001 2000 1999

Circuit City Group:

Expected dividend yield ................ 0.2% 0.2% 0.4%

Expected stock volatility ............... 49% 38% 33%

Risk-free interest rates................... 6% 6% 6%

Expected lives (in years)................ 5 5 5

CarMax Group:

Expected dividend yield ................ — — —

Expected stock volatility ............... 71% 62% 50%

Risk-free interest rates................... 7% 6% 6%

Expected lives (in years)................ 4 4 3

Using these assumptions in the Black-Scholes model, the

weighted average fair value of options granted for the Circuit

City Group is $17 in fiscal 2001, $17 in fiscal 2000 and $8 in

fiscal 1999; and for the CarMax Group, $1 in fiscal 2001, $3 in

fiscal 2000 and $3 in fiscal 1999.

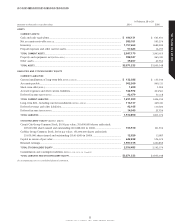

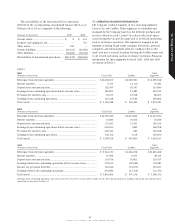

8. EARNINGS (LOSS) PER SHARE

Reconciliations of the numerator and denominator of basic and

diluted earnings (loss) per share are presented below.

(Amounts in thousands Years Ended February 28 or 29

except per share data) 2001 2000 1999

Circuit City Group:

Weighted average

common shares........................ 203,774 201,345 198,304

Dilutive potential

common shares:

Options...................................... 885 2,145 1,700

Restricted stock........................ 1,171 831 808

Weighted average common

shares and dilutive

potential common shares....... 205,830 204,321 200,812

Earnings from continuing

operations available to

common shareholders............. $149,247 $327,574 $216,927

Basic earnings per share from

continuing operations ............ $ 0.73 $ 1.63 $ 1.09

Diluted earnings per share from

continuing operations ............ $ 0.73 $ 1.60 $ 1.08

CarMax Group:

Weighted average

common shares ....................... 25,554 23,778 22,604

Dilutive potential common

shares:

Options ..................................... 1,332 1,814 —

Restricted stock ....................... 94 196 —

Weighted average common

shares and dilutive potential

common shares ....................... 26,980 25,788 22,604

Net earnings (loss) available to

common shareholders ............ $ 11,555 $ 256 $ (5,457)

Basic net earnings (loss)

per share................................... $ 0.45 $ 0.01 $ (0.24)

Diluted net earnings (loss)

per share................................... $ 0.43 $ 0.01 $ (0.24)

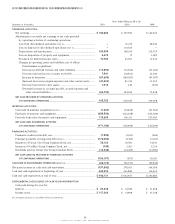

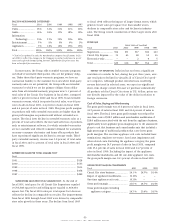

Certain options were outstanding and not included in the

computation of diluted earnings per share because the options’

exercise prices were greater than the average market price of the

common shares. Options to purchase 8,469,700 shares of Circuit

City Group Common Stock ranging from $14.75 to $47.53 per

share were outstanding and not included in the calculation at

the end of fiscal 2001; 2,900 shares ranging from $43.03 to

$47.53 per share at the end of fiscal 2000; and 2,000,000 shares

at $29.50 per share at the end of fiscal 1999. Options to pur-

chase 1,357,200 shares of CarMax Group Common Stock rang-

ing from $6.06 to $16.31 per share were outstanding and not

included in the calculation at the end of fiscal 2001, and

42

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT