CarMax 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13. INTEREST RATE SWAPS

The Company enters into amortizing swaps relating to automobile

loan receivable securitizations to convert variable-rate financing

costs to fixed-rate obligations to better match funding costs to the

receivables being securitized. The Company entered into nine 40-

month amortizing swaps with notional amounts totaling approxi-

mately $735 million in fiscal 2001, four 40-month amortizing

swaps with notional amounts totaling approximately $344 million

in fiscal 2000 and four 40-month amortizing swaps with notional

amounts totaling approximately $387 million in fiscal 1999. These

swaps were entered into as part of sales of receivables and are

included in the gain or loss on sales of receivables. The remaining

total notional amount of all swaps related to the automobile loan

receivable securitizations was approximately $299 million at

February 28, 2001, $327 million at February 29, 2000, and $499

million at February 28, 1999. The reduction in the total notional

amount of the CarMax interest rate swaps in fiscal 2001 and in fis-

cal 2000 relates to the replacement of floating-rate securitizations

with a $655 million fixed-rate securitization in January 2001 and a

$644 million fixed-rate securitization in October 1999.

The market and credit risks associated with interest rate

swaps are similar to those relating to other types of financial

instruments. Market risk is the exposure created by potential

fluctuations in interest rates and is directly related to the product

type, agreement terms and transaction volume. The Company

does not anticipate significant market risk from swaps, because

their use is to more closely match funding costs to the use of the

funding. Credit risk is the exposure to nonperformance of

another party to an agreement. The Company mitigates credit

risk by dealing with highly rated counterparties.

14. CONTINGENT LIABILITIES

In the normal course of business, the Company is involved in var-

ious legal proceedings. Based upon the Company’s evaluation of

the information presently available, management believes that the

ultimate resolution of any such proceedings will not have a mate-

rial adverse effect on the Company’s financial position, liquidity

or results of operations.

15. APPLIANCE EXIT COSTS

On July 25, 2000, the Company announced plans to exit the

major appliance category to expand its selection of key con-

sumer electronics and home office products in all Circuit City

Superstores. This decision reflected significant sales weakness

and increased competition in the major appliance category and

management’s earnings expectations for these other products. To

exit the appliance business, the Company closed six distribution

centers and seven service centers in fiscal 2001 and expects to

close two distribution centers and one service center by July 31,

2001. The majority of these properties are leased. The Company

is in the process of marketing these properties to be subleased.

Circuit City maintains control over its in-home major appliance

repair business, although repairs are subcontracted to an unre-

lated third party. In the second quarter of fiscal 2001, the

Company recorded appliance exit costs of $30 million. Most of

these expenses are included in cost of sales, buying and ware-

housing on the statement of earnings for fiscal 2001. There were

no adjustments to the exit costs as of February 28, 2001.

Approximately 850 employees have been terminated and

approximately 100 employees will be terminated as locations

close or consolidate. These reductions were mainly in the service,

distribution and merchandising functions. Because severance is

being paid to employees on a bi-weekly schedule based on years

of service, cash payments lag job eliminations. The exit costs

also include $17.8 million for lease termination costs and $5.0

million, net of salvage value, for the write-down of fixed assets.

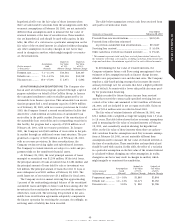

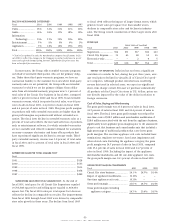

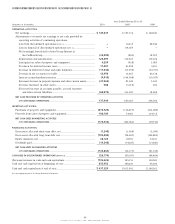

Expenses

Paid or Liability at

Total Assets February 28,

(Amounts in millions) Exit Costs Written Off 2001

Lease termination costs ................. $17.8 $ 1.8 $16.0

Fixed asset write-downs................ 5.0 5.0 —

Employee termination benefits..... 4.4 2.2 2.2

Other ................................................. 2.8 2.8 —

Appliance exit costs....................... $30.0 $11.8 $18.2

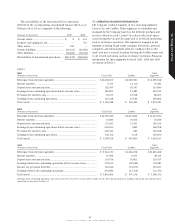

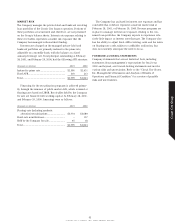

16. DISCONTINUED OPERATIONS

On June 16, 1999, Digital Video Express announced that it

would cease marketing the Divx home video system and discon-

tinue operations, but that existing, registered customers would

be able to view discs during a two-year phase-out period. The

operating results of Divx and the loss on disposal of the Divx

business have been segregated from continuing operations and

reported as separate line items, after taxes, on the consolidated

statements of earnings for the periods presented. Discontinued

operations also have been segregated on the consolidated state-

ments of cash flows for the periods presented. However, Divx is

not segregated on the consolidated balance sheets.

For fiscal 2001, the discontinued Divx operations had no

impact on the net earnings of Circuit City Stores, Inc. The loss

from the discontinued Divx operations totaled $16.2 million

after an income tax benefit of $9.9 million in fiscal 2000 and

$68.5 million after an income tax benefit of $42.0 million in fis-

cal 1999. The loss on the disposal of the Divx business totaled

$114.0 million after an income tax benefit of $69.9 million in

fiscal 2000. The loss on the disposal includes a provision for

operating losses to be incurred during the phase-out period. It

also includes provisions for commitments under licensing agree-

ments with motion picture distributors, the write-down of assets

to net realizable value, lease termination costs, employee sever-

ance and benefit costs and other contractual commitments.

46

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT