CarMax 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

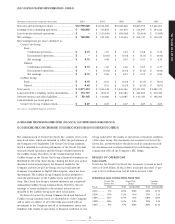

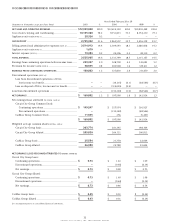

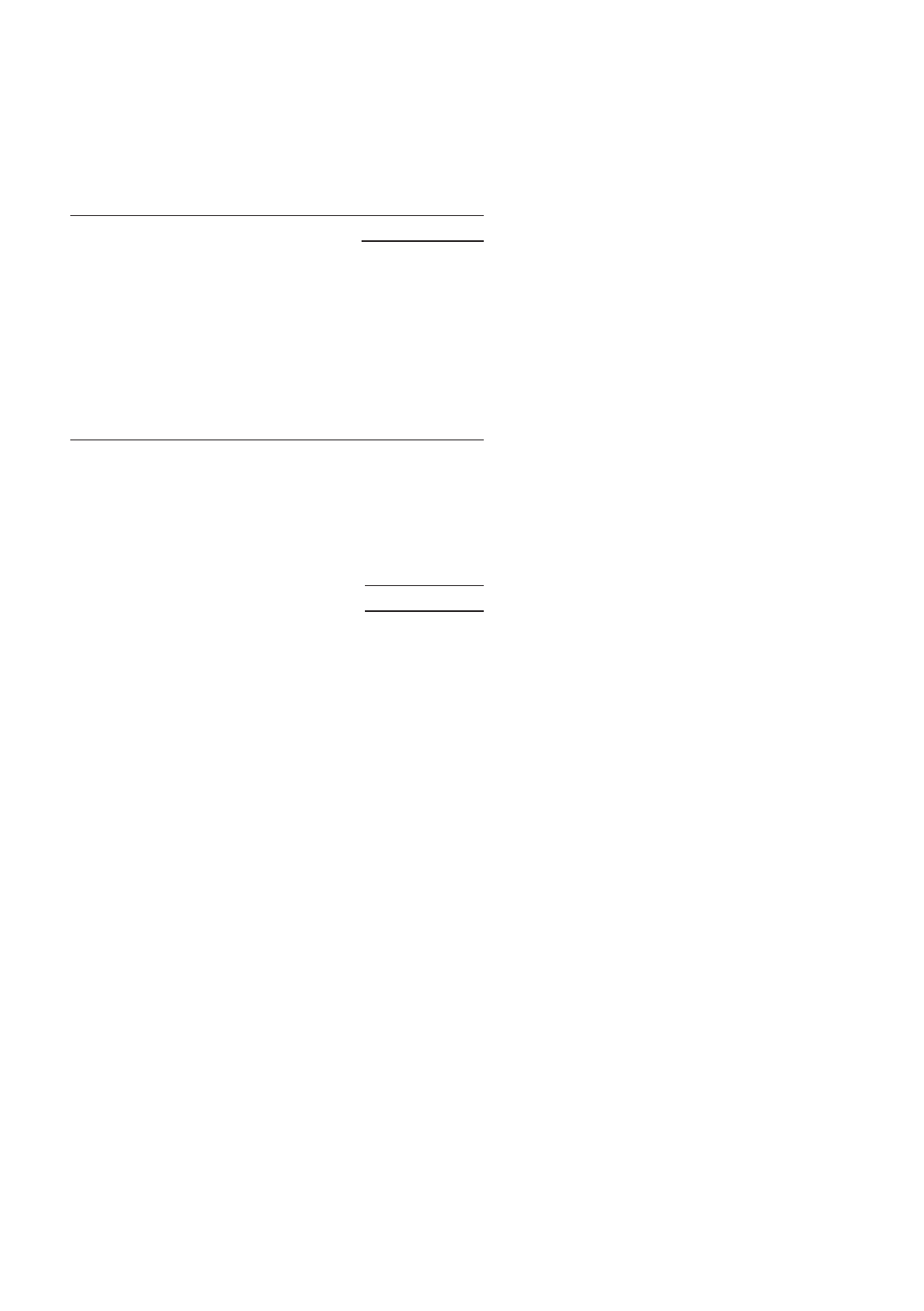

Automobile Installment Loans

Total principal outstanding for fixed-rate automobile loans at

February 28, 2001, and February 29, 2000, was as follows:

(Amounts in millions) 2001 2000

Fixed APR.............................................................. $1,296 $932

Financing for these receivables is achieved through asset

securitization programs that, in turn, issue fixed- and floating-

rate securities. Interest rate exposure is hedged through the use

of interest rate swaps matched to projected payoffs. Receivables

held by the Company for investment or sale are financed with

working capital. Financings at February 28, 2001, and February

29, 2000, were as follows:

(Amounts in millions) 2001 2000

Fixed-rate securitization ..................................... $ 984 $559

Floating-rate securitizations

synthetically altered to fixed........................ 299 327

Floating-rate securitizations............................... 1 1

Held by the Company:

For investment*................................................ 9 22

For sale............................................................. 3 23

Total........................................................................ $1,296 $932

* Held by a bankruptcy remote special purpose company.

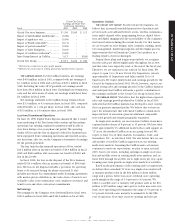

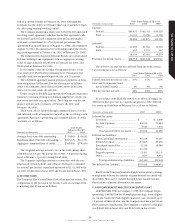

The Company has analyzed its interest rate exposure and has

concluded that it did not represent a material market risk at

February 28, 2001, and February 29, 2000. Because programs are

in place to manage interest rate exposure relating to the con-

sumer loan portfolios, we expect to experience relatively little

impact as interest rates fluctuate. The Company also has the

ability to adjust fixed-APR revolving cards and the index on

floating-rate cards, subject to cardholder ratification, but does

not currently anticipate the need to do so.

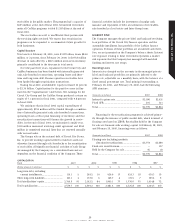

FORWARD-LOOKING STATEMENTS

The provisions of the Private Securities Litigation Reform Act of

1995, which became law in December 1995, provide companies

with a “safe harbor” when making forward-looking statements.

This “safe harbor” encourages companies to provide prospective

information about their companies without fear of litigation. The

Company wishes to take advantage of the “safe harbor” provi-

sions of the Act. Company statements that are not historical

facts, including statements about management’s expectations for

fiscal 2002 and beyond, are forward-looking statements and

involve various risks and uncertainties. Factors that could cause

the Company’s actual results to differ materially from manage-

ment’s projections, forecasts, estimates and expectations include,

but are not limited to, the following:

(a) changes in the amount and degree of promotional inten-

sity exerted by current competitors and potential new competi-

tion from both retail stores and alternative methods or channels

of distribution such as online and telephone shopping services

and mail order;

(b) changes in general U.S. or regional U.S. economic condi-

tions including, but not limited to, consumer credit availability,

consumer credit delinquency and default rates, interest rates,

inflation, personal discretionary spending levels and consumer

sentiment about the economy in general;

(c) the presence or absence of, or consumer acceptance of,

new products or product features in the merchandise categories

the Company sells and changes in the Company’s actual mer-

chandise sales mix;

(d) significant changes in retail prices for products sold by

any of the Company’s businesses, including changes in prices for

new and used cars and the relative consumer demand for new or

used cars;

(e) lack of availability or access to sources of supply for

appropriate Circuit City or CarMax inventory;

(f) inability on the part of either of the Company’s businesses

to liquidate excess inventory should excess inventory develop;

(g) unanticipated adverse results from the remodeling of

Circuit City Superstores;

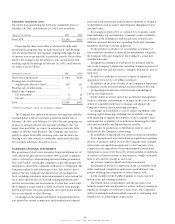

(h) the ability to attract and retain an effective management

team in a dynamic environment or changes in the cost or avail-

ability of a suitable work force to manage and support the

Company’s service-driven operating strategies;

(i) changes in availability or cost of capital expenditure and

working capital financing, including the availability of long-

term financing to support development of the Company’s busi-

nesses and the availability of securitization financing for credit

card and automobile installment loan receivables;

(j) changes in production or distribution costs or cost of

materials for the Company’s advertising;

(k) availability of appropriate real estate locations for expansion;

(l) the imposition of new restrictions or regulations regarding

the sale of products and/or services the Company sells, changes

in tax rules and regulations applicable to the Company or its

competitors, the imposition of new environmental restrictions,

regulations or laws or the discovery of environmental conditions

at current or future locations or any failure to comply with such

laws or any adverse change in such laws;

(m) adverse results in significant litigation matters;

(n) changes in levels of competition in the car business from

either traditional competitors and/or new nontraditional com-

petitors utilizing auto superstore or other formats; and,

(o) the inability of the CarMax business to reach expected

mature sales and earnings potential.

The United States retail industry and the specialty retail

industry in particular are dynamic by nature and have undergone

significant changes over the past several years. The Company’s

ability to anticipate and successfully respond to continuing chal-

lenges is key to achieving its expectations.

30

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT