CarMax 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Circuit City Group

The Circuit City Group applies APB Opinion No. 25 and

related interpretations in accounting for its stock option plans.

Accordingly, no compensation cost has been recognized. Had

compensation cost been determined based on the fair value at

the grant date consistent with the methods of SFAS No. 123, the

net earnings attributed to the Circuit City Group would have

changed to the pro forma amounts indicated in the following

table. In accordance with the transition provisions of SFAS No.

123, the pro forma amounts reflect options with grant dates

subsequent to March 1, 1995. Therefore, the full impact of cal-

culating compensation cost for stock options under SFAS No.

123 is not reflected in the pro forma net earnings amounts pre-

sented because compensation cost is reflected over the options’

vesting periods and compensation cost of options granted prior

to March 1, 1995, is not considered. The pro forma effect on fis-

cal year 2001 may not be representative of the pro forma effects

on net earnings for future years.

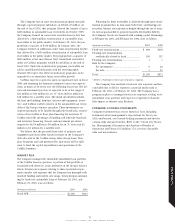

Years Ended February 28 or 29

(Amounts in thousands) 2001 2000 1999

Earnings from continuing

operations:

As reported ............................ $149,247 $327,574 $216,927

Pro forma............................... 136,957 319,337 211,025

Net earnings:

As reported ............................ $149,247 $197,334 $148,381

Pro forma............................... 136,957 189,097 142,479

For the purpose of computing the pro forma amounts, the fair

value of each option on the date of grant is estimated using the

Black-Scholes option-pricing model. The weighted average

assumptions used in the model are as follows:

2001 2000 1999

Expected dividend yield.................. 0.2% 0.2% 0.4%

Expected stock volatility................. 49% 38% 33%

Risk-free interest rates..................... 6% 6% 6%

Expected lives (in years)................. 5 5 5

Using these assumptions in the Black-Scholes model, the

weighted average fair value of options granted for the Circuit

City Group is $17 in fiscal 2001, $17 in fiscal 2000 and $8 in

fiscal 1999.

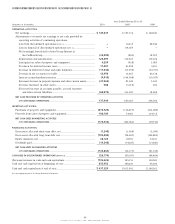

7. PENSION PLANS

The Company has a noncontributory defined benefit pension

plan covering the majority of full-time employees who are at

least age 21 and have completed one year of service. The cost of

the program is being funded currently. Plan benefits generally

are based on years of service and average compensation. Plan

assets consist primarily of equity securities and included 160,000

shares of Circuit City Group Common Stock at February 28,

2001, and February 29, 2000. Eligible employees of the Circuit

City Group participate in the Company’s plan. Pension costs for

these employees have been allocated to the Circuit City Group

based on its proportionate share of the projected benefit obligation.

63

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

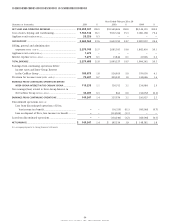

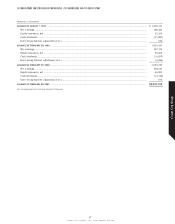

TABLE 1 2001 2000 1999

Weighted Average Weighted Average Weighted Average

(Shares in thousands) Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding at beginning of year................ 7,380 $25.07 8,894 $18.25 9,988 $16.00

Granted........................................................... 4,280 34.80 1,564 40.75 1,080 21.17

Exercised.......................................................... (1,526) 23.64 (2,864) 12.65 (2,008) 8.77

Cancelled.......................................................... (1,414) 34.25 (214) 22.06 (166) 16.80

Outstanding at end of year........................... 8,720 $28.60 7,380 $25.07 8,894 $18.25

Options exercisable at end of year .............. 3,158 $21.86 1,258 $13.89 2,966 $12.02

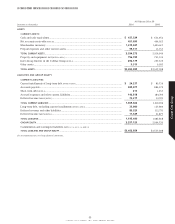

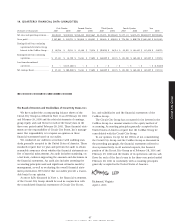

TABLE 2 Options Outstanding Options Exercisable

Weighted Average

(Shares in thousands) Number Remaining Weighted Average Number Weighted Average

Range of Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$ 9.09 to 14.75 ............................................. 1,344 3.8 $14.10 879 $13.93

15.18 to 18.00 ............................................. 1,067 3.0 17.24 876 17.23

18.43 to 25.28 ............................................. 864 4.1 21.11 212 20.78

29.50............................................................. 1,000 1.1 29.50 1,000 29.50

34.84 to 35.21 ............................................. 3,038 7.2 35.21 — —

35.22 to 47.53 ............................................. 1,407 5.4 40.72 191 40.81

Total ................................................................ 8,720 4.9 $28.60 3,158 $21.86