CarMax 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

Circuit City Stores, Inc.

receivables in the public market. The program had a capacity of

$655 million at the end of fiscal 2001. Securitized receivables

under all CarMax programs totaled $1.28 billion at the end of

fiscal 2001.

The receivables are sold to unaffiliated third parties with

the servicing rights retained. We expect that securitization

programs can be expanded to accommodate future growth for

both businesses.

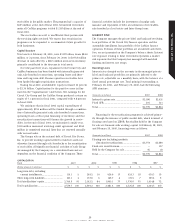

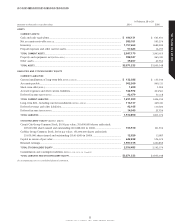

Capital Structure

Total assets at February 28, 2001, were $3.87 billion, down $84.0

million, or 2 percent, since February 29, 2000. A $197.8 million

decrease in cash offset by a $68.5 million increase in inventory

primarily contributed to the decrease in total assets.

Over the past three years, expansion for the Circuit City and

CarMax businesses has been funded with internally generated

cash, sale-leaseback transactions, operating leases and short-

term and long-term debt. Finance operation receivables have

been funded through securitization transactions.

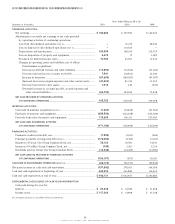

During fiscal 2001, stockholders’ equity increased 10 percent

to $2.36 billion. Capitalization for the past five years is illus-

trated in the “Capitalization” table below. Net earnings for the

Circuit City Group and the CarMax Group produced a return on

equity of 7.1 percent in fiscal 2001, compared with 9.8 percent

in fiscal 2000.

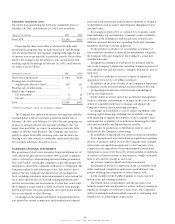

We anticipate that in fiscal 2002 capital expenditures of

approximately $295 million will be funded through a combina-

tion of internally generated cash, sale-leaseback transactions,

operating leases or floor plan financing of inventory and that

securitization transactions will finance the growth in receiv-

ables. At the end of fiscal 2001, we maintained a multi-year,

$150 million unsecured revolving credit agreement and $360

million in committed seasonal lines that are renewed annually

with various banks.

The Groups rely on the external debt of Circuit City Stores,

Inc. to provide working capital needed to fund net assets not

otherwise financed through sale-leasebacks or the securitization

of receivables. All significant financial activities of each Group

are managed by the Company on a centralized basis and are

dependent on the financial condition of the Company. These

financial activities include the investment of surplus cash,

issuance and repayment of debt, securitization of receivables,

sale-leasebacks of real estate and Inter-Group loans.

MARKET RISK

The Company manages the private-label and bankcard revolving

loan portfolios of the Circuit City finance operation and the

automobile installment loan portfolio of the CarMax finance

operation. Portions of these portfolios are securitized and, there-

fore, are not presented on the Company’s balance sheets. Interest

rate exposure relating to these receivables represents a market

risk exposure that the Company has managed with matched

funding and interest rate swaps.

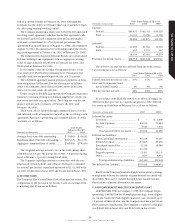

Revolving Loans

Interest rates charged on the accounts in the managed private-

label and bankcard portfolios are primarily indexed to the

prime rate, adjustable on a monthly basis, with the balance at a

fixed annual percentage rate. Total principal outstanding at

February 28, 2001, and February 29, 2000, had the following

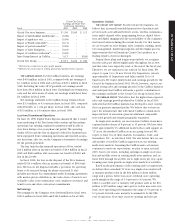

APR structure:

(Amounts in millions) 2001 2000

Indexed to prime rate .......................................... $2,596 $2,631

Fixed APR.............................................................. 203 213

Total........................................................................ $2,799 $2,844

Financing for the securitization programs is achieved primar-

ily through the issuance of public market debt, which is issued at

floating rates based on LIBOR. Receivables held by the Company

for sale are financed with working capital. At February 28, 2001,

and February 29, 2000, financings were as follows:

(Amounts in millions) 2001 2000

Floating-rate (including synthetic

alteration) securitizations.............................. $2,754 $2,689

Fixed-rate securitizations.................................... — 137

Held by the Company for sale ........................... 45 18

Total........................................................................ $2,799 $2,844

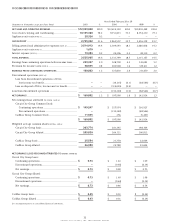

CAPITALIZATION

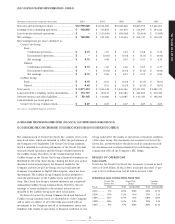

Fiscal 2001 2000 1999 1998 1997

(Dollar amounts in millions) $ % $% $% $ % $ %

Long-term debt, excluding

current installments................................... 116.1 5 249.2 10 426.6 17 424.3 18 430.3 19

Other long-term liabilities .............................. 107.1 4 157.8 6 149.7 6 171.5 7 199.4 9

Total stockholders’ equity............................... 2,356.5 91 2,142.2 84 1,905.1 77 1,730.0 75 1,614.8 72

Total capitalization .......................................... 2,579.7 100 2,549.2 100 2,481.4 100 2,325.8 100 2,244.5 100