Aflac 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

03 04 05 06 07 08 09 10 11

12

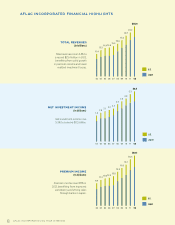

Net Earnings Per Diluted Share

Operating Earnings Per Diluted Share*

1.78

2.15

2.56

2.93

3.29

3.76

4.59

5.31

$6.59

5.91

EARNINGS PER DILUTED SHARE

Net and operating earnings per diluted share benefited

from record operating results. In 2012, we achieved our

primary financial target, growth in operating earnings

per diluted share, excluding a $.01 per share benefit

from the impact of the yen.

Operating earnings is an internal financial measure

we use to assess management’s performance. Aflac

defines operating earnings as the profits derived

from operations before realized investment gains

and losses from securities transactions, impairments,

and derivative and hedging activities, as well as

nonrecurring items.

*Excludes impact of the yen

Q

How do you perpetuate the success you’ve seen

with the Aflac Duck, and what has the Aflac brand

meant to your company?

AProtecting the Aflac brand is one of my most

important jobs, because our brand is everything to us,

and it’s more than just our commercials. Our brand is our

people and our culture. It is who we are. On the advertising

side of the brand, with technology that allows consumers to

bypass commercials, I believe businesses just starting out

and trying to develop a new brand from scratch with the

name recognition like ours face huge challenges, including

tremendous costs.

Q

How do you see Aflac being affected by the

adoption of the Patient Protection and Affordable

Health Care Act (PPACA) in the United States?

A

I think the opportunities before us are huge, and

I don’t think you can underestimate the value of

our brand. Businesses and individuals will gain clarity on

healthcare options following the implementation of PPACA.

I believe part of that clarity will be a better understanding

for the added layer of insurance protection our products

provide. I further believe both businesses and consumers

will want to turn to a brand they know and trust, and Aflac

can certainly be that brand. With more competitors in the

business, our ability to be the low-cost producer will also be

a key to our success.

Along with these opportunities, there

will undoubtedly be challenges. The U.S. insurance market

is changing much more rapidly than any time since

I’ve been affiliated with Aflac. As such, the competitive

landscape is shifting as well. We’ve always known Aflac

products are an attractive segment of the market, and

others are figuring that out too. We are going to have

to remain vigilant and agile. Our biggest challenge is

adapting to PPACA and the evolving marketplace. We’ll

also need to remain mindful of how these changes affect

our business.

Q

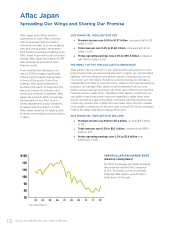

How do you view Aflac’s competition in Japan and

the United States?

A

In Japan, Aflac has been the number one seller of

cancer insurance since Aflac Japan entered the

market in 1974 and the leading seller of medical insurance

since we introduced EVER, our base medical policy, in 2002.

Over the last several years, competition has intensified,

which I think has actually broadened the market and made

the universe of potential customers bigger. In 2012, Aflac

Japan remained the leading seller of cancer and medical

insurance policies in Japan, and that tells the big story!

In the United States, we are number one in the voluntary

supplemental insurance market at the worksite, and I think

that speaks volumes too. While other companies are getting

into the voluntary space, I do want to point out one major

difference between Aflac and all the rest of the competing

U.S. companies: For Aflac, voluntary insurance sold at the

worksite represents virtually all of our focus, whereas our

competitors tend to offer voluntary products as a peripheral

line of business. We believe this discipline and focus gives us

an edge that has contributed to our market-leading position.

AFLAC INCORPORATED 2012 YEAR IN REVIEW 7