Aflac 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aflac U.S.

Delivering Our Promise in a Challenging Environment

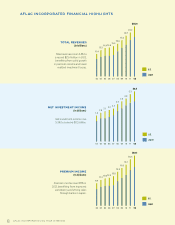

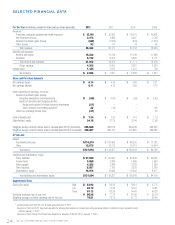

AFLAC U.S. 2012 FINANCIAL HIGHLIGHTS:

Premium income rose 5.4% to $5.0

billion, up from $4.7 billion in 2011.

Total revenues rose 5.4% to $5.6 billion,

increasing from $5.3 billion in 2011.

Pretax operating earnings rose by

10.3% to $997 million, compared with

$904 million in 2011.

The longstanding goal and vision of Aflac U.S. is

to be the leading provider of voluntary insurance

in the United States – a position we’ve held for

many years. In 2012, the economic landscape in

the U.S. continued to be challenging, especially

for the small business segment where more than

90% of our products are sold.

New annualized premium sales for Aflac U.S.

in 2012 were $1.5 billion, representing a slight

increase of .8% over prior year sales. Amid this

uncertain economic climate, particularly the

tenuous job market and ambiguity created

by health care reform options, we continue to

position our business for success in the evolving

environment.

During the year, we made structural changes to

our sales and marketing areas to improve our

future growth. By aligning sales and marketing,

we believe this integration enhances our ability

to deliver on the promises we make to our

customers, policyholders, shareholders and

employees.

A PRODUCT IS OUR PROMISE; A CLAIM IS OUR DELIVERY

Aflac voluntary products represent the promise that we’ll be there

for those we insure in their time of need. Our products provide

affordable insurance solutions to protect against income loss,

asset loss, and medical expenses. We are committed to evaluating

and enhancing our existing product lines, while also creating

new products to ensure our benefits are aligned with the needs

of consumers and businesses. To complement the individual

products we’ve offered for nearly six decades, we significantly

increased our competitive edge in 2009 with the addition of

group products to our portfolio. The addition of group products

has expanded our reach and enabled us to generate more sales

opportunities with larger employers for our brokers and traditional

sales agents. Our portfolio of group and individual products

provides consumers with outstanding value, while offering

businesses the opportunity to give their employees a more

valuable and comprehensive selection of benefit options.

In 2012, we revised several of our existing product offerings,

including a new cancer insurance product that incorporates

several benefits that were previously in the riders, including

wellness and initial diagnosis benefits. This allows us to provide

a simplified benefit structure that customers are better able to

understand and makes the sales process easier for our sales force.

We also introduced a revised vision product that offers more

benefits, including increased coverage for eye exams, glasses and

contact lenses. Additionally, in being cognizant of the economic

situation that many consumers face, we created policies with

various price points and corresponding benefit levels to address

the need for lower-priced product options.

AFLAC U.S. PRODUCTS

INCOME-LOSS

PROTECTION

ASSET-LOSS

PROTECTION

MEDICAL

Short-Term Disability

Life

• Term

• Whole

Accident

Cancer

Critical Illness

Hospital Intensive Care

Hospital Indemnity

Dental

Vision

18 AFLAC INCORPORATED 2012 YEAR IN REVIEW