Aflac 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

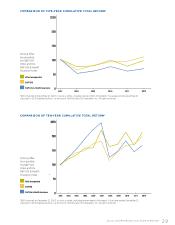

03 04 05 06 07 08 09 10 11 12

.30

.44

.55

.80

.96

1.12 1.14

1.23

$1.34

.38

Aflac has increased its

annual dividend for 30

consecutive years. Total

cash dividends paid in

2012 rose 8.9% over 2011.

AFLAC’S TOTAL RETURN TO

SHAREHOLDERS

In 2012, Aflac Incorporated

marked the 30th consecutive year

the company increased its annual

dividend. Including reinvested cash

dividends, Aflac’s total return to

shareholders increased 26.4% in

2012. Aflac’s share price increased

22.8% from the 2011 year-end price

of $43.26 to the 2012 year-end price

of $53.12. This compares with a total

shareholder return of 14.6% for the

S&P Life & Health Index, 16.0% for

the S&P 500, and 10.2% for the

Dow Jones Industrial Average.

• Overthelastveyears,Aac’s

total return to shareholders,

including reinvested dividends,

was down 3.3%.

• Overthelast10years,Aac’stotal

return to shareholders, including

reinvested dividends, was 112.7%.

AFL SHAREHOLDER MIX*

Number of registered shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . 87,200

Percentage of outstanding AFL shares owned by institutional investors . . . . . . 64%

Percentage of outstanding AFL shares owned by individual investors. . . . . . . . 36%

(includes director, employee and sales force ownership of approximately 4%)

*Approximate, as of 12/31/12

FIRST SHAREHOLDERS

Cost of 100 shares purchased in 1955 when Aflac was founded . . . . . . . . . . . $1,110

Number of shares those 100 shares grew into

(after 28 stock dividends and splits) . . . . . . . . . . . . . . . . . . . 187,980 shares

Value at 12/31/12 (excluding reinvested dividends). . . . . . . . . . . . . . . $10.0 million

Dividends paid in 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$251,893

AFLAC FINANCIAL STRENGTH*

Standard & Poor’s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . AA-

Moody’s Investors Service. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Aa3

A.M. Best . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A+ (Superior)

Rating & Investment Information Inc. (R&I) . . . . . . . . . . . . . . . . . . . . . . . . AA-

*Ratings as of 3/1/13

Visit aflac.com and click on Investors to access the following:

• YourAFLshareholderaccount

• Aac’snancialinformation

• Acalendarofevents

• Dividendreinvestmentplan(DRIP)information

INVESTOR FACTS

ANNUAL CASH DIVIDENDS PAID PER SHARE

28 AFLAC INCORPORATED 2012 YEAR IN REVIEW