Aflac 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

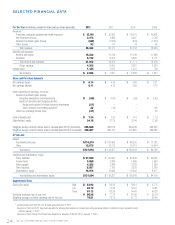

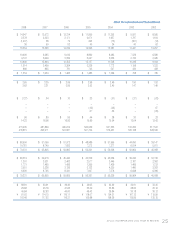

AFLAC INCORPORATED INVESTMENT SUMMARY

During 2012, Aflac’s Global Investment Division made significant progress in building out our investment capability,

while also improving the overall quality, liquidity and diversification of our global investment portfolio. The buildout

of the Investment Division included the opening of a new office in New York City, hiring key investment personnel both

in Japan and New York, completing a strategic business review, and implementing a strategic asset allocation study to

invest our sizeable cash flows at more attractive returns through a more diversified and high-quality portfolio.

INVESTMENT PORTFOLIO BACKGROUND

Our investment portfolio fortifies the most important promise Aflac makes to policyholders – to protect them when they

need us most by paying claims fairly and promptly.

We primarily invest for the long term, and the strong cash flows from our persistent book of business give us the ability

to continue to invest from this perspective. We have defined our investment objectives as maximizing risk-adjusted

performance subject to our liability profile and capital requirements.

• InJapan,ourproductsareyen-denominated,long-dated,andhavehighpersistency,thusyieldinglong

duration liabilities.

• OurU.S.policyliabilitieshaveashorterdurationthaninJapan,andourinvestmentapproachistailored

accordingly.

CHANGING GLOBAL INVESTMENT ENVIRONMENT

Because the vast majority of our policies are in Japan, we’re predominantly invested in yen-denominated assets around

the world, including Europe. Virtually all of our investments in Europe are yen-denominated. Following the 2008 financial

crisis, our primary focus has been on investment risk management, while investing our significant cash flows in assets of

relatively higher quality and liquidity.

ENHANCING PORTFOLIO QUALITY

One way we’ve adapted over the last several years has been through reducing our exposure to financials in Europe and

sovereign investments in the peripheral Eurozone countries of Portugal, Italy, Ireland, Greece, and Spain. During 2012

we continued to identify investment opportunities to further reduce European and financial holdings that improved the

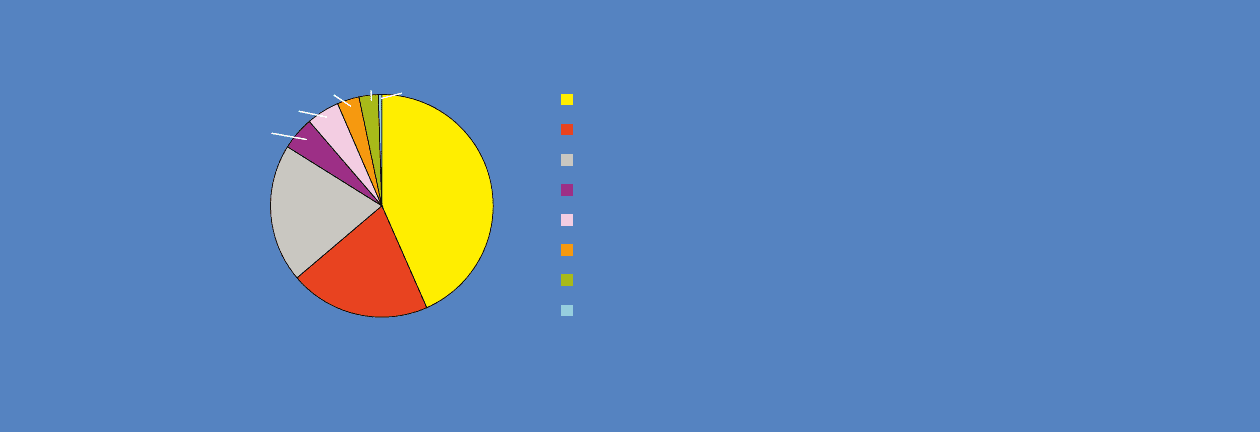

quality of our investment portfolio. Our total exposure to European assets declined from 29.1% of total investment and

cash at the end of 2011 to 20.0% at year-end 2012.

Total Debt and Perpetual Securities - $112.1 Billion

Japan

Europe

U.S.

Asia, excl. Japan

Americas, excl. U.S.

Middle East & Africa

Australasia

All Others

2012 Composition of Portfolio - Geographic Region

2.8% .5%

3.2%

4.8%

4.8%

20.1%

20.4%

43.4%

(At Amortized Cost)

26 AFLAC INCORPORATED 2012 YEAR IN REVIEW