Aflac 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

when they need us most by paying claims promptly. We continue

to review our investments to ensure that they best represent the

interests of our policyholders and all of our stakeholders.

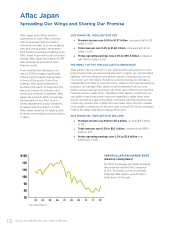

As we evaluate investment opportunities, it is a challenge to

invest large cash flows in a low-interest-rate environment. For

example, in Japan alone, we invested, on average, $77 million each

business day in 2012. In particular, our history of generating very

strong cash flows was magnified in 2012 due to tremendously

strong sales of WAYS, our hybrid whole-life product in Japan. We

primarily invest for the long term, and the strong cash flows from

our persistent book of business give us the ability to continue to

invest from this perspective. Clearly, the world, and particularly

Europe, presents a very dynamic macro-environment, and we

expect continued volatility in the future. To effectively respond to

this environment, we have embarked on a global transformation of

our investment function. We’ve also adapted over the last several

years through reducing our exposure to financial holdings and

investments in Europe. Additionally, in the second half of 2012, we

began employing a U.S. corporate bond program for Aflac Japan’s

portfolio. This program has been an effective means for diversifying

our risk and enhancing portfolio liquidity, while also improving new

money yields in Japan. With the success of this program in 2012, we

intend to continue it into 2013.

We made a significant financial business commitment to build out

the investment function in 2012. I believe the enhancements we’re

making to our investment team, processes and infrastructure will

better position us to invest our sizeable cash flows at more attractive

returns through a more diversified and high-quality portfolio.

CONTINUED GROWTH AND MORE PROMISES TO KEEP

While we are proud of our past accomplishments, we are equally

excited about Aflac’s future. With our firm commitment to

continually evaluate our strengths and weaknesses, and to make

quick and appropriate changes when necessary, I am convinced

that the U.S. and Japanese markets are excellent platforms for

future growth.

At Aflac, we do not just sell voluntary supplemental insurance

products. We sell a promise to be there for our policyholders in

their time of need – a promise we don’t take lightly. Tens of millions

of consumers have placed their trust in us. They expect us to

manage our business in such a way that we will deliver exceptional

service and always fulfill our obligations, and we are privileged to

have the opportunity to deliver on their expectations.

Ever since our company was founded nearly six decades ago, we

put the customer first by reminding ourselves each day about the

promises we make to the people who rely on us – and positioning

our business to fulfill those promises.

I want to personally thank you, our shareholders, for supporting

Aflac and helping establish and maintain a strong foundation for

our company.

Daniel P. Amos

Chairman and

Chief Executive Officer

“We sell a promise to be there

for our policyholders in their

time of need – a promise we

don’t take lightly.”

AFLAC INCORPORATED 2012 YEAR IN REVIEW 5