Aflac 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

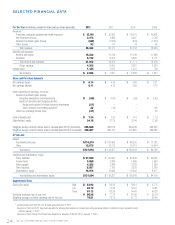

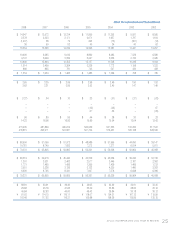

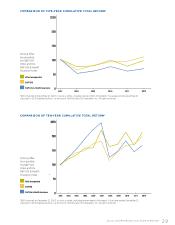

Our overall portfolio is dominated by fixed-maturity securities. The majority of our total investments fall into the senior

debt category. The percentage of our senior debt holdings increased from 86.2% at the end of 2011 to 91.9% at the end

of 2012. At year-end 2011, 94.4% of our portfolio was investment grade, and that increased to 95.3% at the end of 2012.

SHAREHOLDERS’ EQUITY

In 2012, net after-tax realized investment losses from securities transactions and impairments, excluding derivatives,

were $326 million, which is a significant improvement from after-tax realized investment losses of $850 million in 2011.

It’s worth noting that while we have been actively and successfully reducing the risk in our portfolio, we have grown our

shareholders’ equity from $8.8 billion at year-end 2007 to $16.0 billion at December 31, 2012.

ENHANCING LIQUIDITY AND INVESTMENT RETURNS

In the second half of 2012, our objective was to invest roughly two-thirds of our investment cash flow in U.S. dollar-

denominated, publicly traded corporate bonds for Aflac Japan’s portfolio. Our enhanced investment strategies provide

the benefit of liquidity, portfolio flexibility, and diversification. This investment program was successful and enabled us

to surpass our budgeted new money yield for 2012. In addition to achieving our objective of having our assets primarily

denominated in yen, we employed a currency hedging strategy, which serves to ensure our dollar investments in this

program are hedged back to yen. At December 31, this program represented 6.2% of our total portfolio.

GEOGRAPHIC INVESTMENT EXPOSURE

We diversify our large, fixed-income portfolio by geography and industry. The vast majority of our investments in Japan

are in Japanese Government Bonds (JGBs). In addition, we seek investment opportunities around the world. The United

States is our second-largest region along with diversification from around the rest of the world. As an insurance company,

we are mindful of the changing investment landscape and will seek investments around the globe to achieve the best

long-term value.

INVESTMENT OUTLOOK

As we look ahead, our goal is to continue to enhance the quality of our portfolio by expanding our portfolio’s diversity

and ultimately improving our returns while reducing risks to certain market cycles. Our ability to continue to implement

new strategies is based on the evolving capabilities of the Aflac Global Investment Division. To support investments in

newer asset classes, we will continue to invest in our human capital and technology, while assessing which investment

opportunities represent the best value based on market conditions in the future. We believe this dynamic approach is

in the best interest of all our stakeholders, especially our policyholders, bondholders and shareholders.

Total Debt and Perpetual Securities - $112.1 Billion

JGBs

Industrials

Banks/Financials

Utilities

Sovereign & Supranationals

Municipalities

Other

2012 Composition of Portfolio - Sector

(At Amortized Cost)

39.3%

18.0%

23.9%

11.4%

4.5% 1.4% 1.5%

AFLAC INCORPORATED 2012 YEAR IN REVIEW 27