Abercrombie & Fitch 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

6

CHAIRMAN’S LETTER

Fiscal 2005 was an outstanding year for Abercrombie & Fitch by almost every financial or operational measure.

Not only did we produce record sales and earnings, but we also strategically positioned ourselves for continued

success over the long-term. We like to think that our achievements during Fiscal 2005 are the result of our

ongoing and long-term commitment to protecting and enhancing the strength of our brands.

As we have often stated, to succeed in our business we must strike a balance between reporting near-term

profit growth and investing in the organization. Even as we were generating exceptional results during Fiscal

2005, we continued to make essential investments, initially focusing on the stores’ presentation and service,

which drastically improved the shopping experience of our customers. What was not so visible were the

changes made at the home office, including broadening our merchandising and design organization. These

actions, at the store level and to our infrastructure, will serve us well in the future.

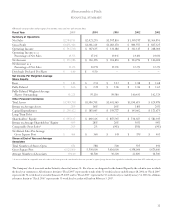

Even with these major investments, our results this year were outstanding. Net income per share rose to

$3.66, an increase of 61%, on net sales of $2.785 billion, up 38%. The gross margin rate reached an industry-

leading 66.5% of net sales. We also used our strong cash position to further enhance shareholder value by

repurchasing 1.8 million shares of common stock and paying dividends totaling $0.60 per share, an increase

of 20% over last year.

But, that was Fiscal 2005; what about the future?

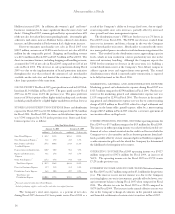

Our store investment program, which was initiated in late Fiscal 2004, is designed to enhance the shopping

experience of customers primarily by increasing on-floor staff coverage, but also by improving operational

efficiencies at the store level. Product replenishment and store presentation standards were enhanced through

a newly-developed merchandise filling system supported by the reengineering of our stock rooms.

The broadening of our merchandising and design groups resulted in greater expertise at the product

category level and these benefits are evident now. We also made investments in our information technology

infrastructure and established a Brand Protection Team, which focuses on defending our intellectual property

through an aggressive anti-counterfeit program.

Looking at the specific details for Fiscal 2005, you will find that each of our brands performed very well.

Hollister, one of our major growth vehicles, has only reached half of its maximum U.S. store potential. Over

the next few years, we expect Hollister’s iconic status to continue to strengthen. We opened our first Hollister

stores in Canada in late Fiscal 2005, with productivity at or above that of their average U.S. counterparts. The

results achieved at this brand during Fiscal 2005 demonstrate how solid this concept performs, achieving net

sales of approximately one billion dollars and $528 per square foot. For Fiscal 2005, net sales at Hollister

increased 72% with comparable store sales increasing 29%.

Our Abercrombie & Fitch brand achieved a comparable store sales increase of 18%, demonstrating excellent

growth for a relatively mature business. With limited opportunity to secure additional domestic mall locations,