Abercrombie & Fitch 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

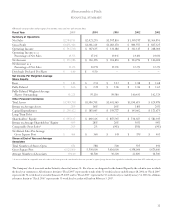

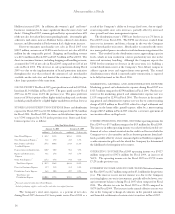

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for the fourth quarter of Fiscal 2005 was $293.5 million com-

pared to $223.8 million for the comparable period in Fiscal 2004. The

stores and distribution expense rate (stores and distribution expense

divided by net sales) for the fourth quarter of Fiscal 2005 was 30.5%

compared to 32.6% in the fourth quarter of Fiscal 2004. Stores and

distribution expense was as follows:

Thirteen Weeks Ended

January 28, 2006 January 29, 2005

(millions) % of net sales (millions) % of net sales

Store Payroll Expense $101.5 10.6% $ 74.6 10.9%

Store Management Expense

(1)

12.4 1.3% 7.7 1.1%

Rent, Utilities and Other 75.0 7.8% 57.5 8.4%

Landlord Expense

Depreciation and Amortization 29.4 3.1% 28.1 4.1%

Repairs and Maintenance 8.5 0.9% 8.3 1.2%

Expense

Other Store Expenses

(2)

45.9 4.8% 30.8 4.5%

Total Stores Expense $272.7 28.4% $207.0 30.1%

Direct-to-Consumer Expense 13.1 1.4% 10.6 1.5%

Distribution Center Expense 7.7 0.8% 6.2 0.9%

Total Stores and

Distribution Expense $293.5 30.5% $223.8 32.6%

(1)

Previously reported within Store Payroll Expense.

(2)

Includes packaging, supplies, credit card fees and other store support functions.

The Company’s total store expense, as a percent of net sales, dur-

ing the fourth quarter of Fiscal 2005 decreased 170 basis points versus

the comparable period during Fiscal 2004 as a result of the Company’s

ability to leverage fixed costs due to significant comparable store sales

increases partially offset by increases in store management and loss pre-

vention programs during Fiscal 2005. The Company believes that the

increases in store management and loss prevention programs were key

in driving sales and reducing shrink levels during the quarter, which

had a favorable impact on the Company’s gross profit rate.

The distribution center productivity level, measured in units

processed per labor hour (“UPH”), was 20% lower in the fourth

quarter of Fiscal 2005 versus the fourth quarter of Fiscal 2004. The

UPH rate decrease resulted from increases in inventory and from a

change in the way the Company flowed merchandise to its stores.

Merchandise was routed to the stores in a more gradual process in

order to avoid stockroom congestion at the stores. This resulted in

the distribution center approaching capacity levels, which in turn

resulted in a lower productivity rate due to the increased inventory

handling. Although the Company expects the UPH level to continue

to decrease in the near term, it is building a second distribution cen-

ter at the Company’s New Albany campus to address capacity issues

and support future store growth. The second distribution center,

which is currently under construction, is expected to be fully func-

tional in late Fiscal 2006.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during the fourth quarter

of Fiscal 2005 was $80.8 million compared to $66.1 million during the

same period in Fiscal 2004. For the fourth quarter of Fiscal 2005, the

marketing, general and administrative expense rate (marketing, general

and administrative expense divided by net sales) was 8.4% compared to

9.6% in the fourth quarter of Fiscal 2004. The decrease in the marketing,

general and administrative expense rate was due to the Company’s

ability to leverage home office payroll, a reduction in sample expenses

and marketing expenses due to timing of photo shoots, offset by increases

in outside services mostly due to legal costs.

OTHER OPERATING INCOME, NET Fourth quarter other oper-

ating income for Fiscal 2005 was $2.3 million compared to $4.3 million for

the fourth quarter of Fiscal 2004. The decrease was related to the amount

of the gift card liability recognized as other income for gift cards for which

the Company has determined the likelihood of redemption to be remote.

OPERATING INCOME Operating income during the fourth quar-

ter of Fiscal 2005 increased to $267.5 million from $170.2 million in

Fiscal 2004, an increase of 57.2%. The operating income rate (operating

income divided by net sales) for the fourth quarter of Fiscal 2005 was

27.8% compared to 24.8% for the fourth quarter of Fiscal 2004.

INTEREST INCOME AND INCOME TAXES Fourth quarter

net interest income was $2.4 million in Fiscal 2005 compared to $1.3

million during the comparable period in Fiscal 2004. The increase in

net interest income was due to higher rates on investments, partially

offset by lower average investment balances during the fourth quarter

of Fiscal 2005 when compared to the same period in Fiscal 2004. The

Company continued to invest in investment grade municipal notes

and bonds and investment grade auction rate securities. The effective

tax rate for the fourth quarter of Fiscal 2005 was 39.0% compared to

39.2% for the Fiscal 2004 comparable period.

NET INCOME AND NET INCOME PER SHARE Net income for

the fourth quarter of Fiscal 2005 was $164.6 million versus $104.3 mil-

lion for the fourth quarter of Fiscal 2004, an increase of 57.8%. Net

income per fully-diluted weighted-average share outstanding for the

fourth quarter of Fiscal 2005 was $1.80 versus $1.15 for the same period

last year, an increase of 56.5%.

FISCAL 2005 RESULTS: NET SALES Net sales for Fiscal 2005

were $2.785 billion, an increase of 37.8% versus Fiscal 2004 net sales

of $2.021 billion. The net sales increase was attributable to an

increase in comparable stores sales of 26% for the year, the net addi-

tion of 63 stores during Fiscal 2005 and a $13.9 million increase in net

sales (including shipping and handling revenue) for the direct-to-

consumer business.

For the fiscal year, comparable store sales by brand were as follows:

Abercrombie & Fitch increased 18%; abercrombie increased 54%;

Abercrombie &Fitch

15