Abercrombie & Fitch 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

36

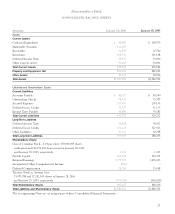

A summary of option activity for Fiscal 2005, Fiscal 2004 and

Fiscal 2003 follows:

Weighted–Average

2005 Shares Option Price

Outstanding at beginning of year 12,029,900 $32.44

Granted 499,900 59.67

Exercised (3,288,612) 23.16

Canceled (180,357) 32.63

Outstanding at end of year 9,060,831 $37.18

Options exercisable at year-end 6,284,030 $36.14

Weighted–Average

2004 Shares Option Price

Outstanding at beginning of year 14,839,900 $30.03

Granted 484,000 36.48

Exercised (2,556,000) 19.49

Canceled (738,000) 31.67

Outstanding at end of year 12,029,900 $32.44

Options exercisable at year-end 6,862,000 $31.09

Weighted–Average

2003 Shares Option Price

Outstanding at beginning of year 16,059,000 $28.31

Granted 640,000 27.89

Exercised (1,586,600) 12.39

Canceled (272,500) 27.04

Outstanding at end of year 14,839,900 $30.03

Options exercisable at year-end 6,191,000 $27.04

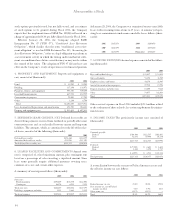

Approximately 627,100, 507,500 and 78,000 restricted shares were

granted in Fiscal 2005, Fiscal 2004 and Fiscal 2003, respectively, with a

total market value at grant date of $36.3 million, $16.0 million and $2.1

million, respectively. The restricted share grants primarily vest on a

graduated scale over four years for associates or over one year for non-

associate directors. The market value of restricted shares is amortized

as compensation expense over the vesting period. Compensation

expenses related to restricted share awards amounted to $24.1 million,

$10.4 million and $5.3 million in Fiscal 2005, Fiscal 2004 and Fiscal

2003, respectively.

12. RETIREMENT BENEFITS The Company maintains a quali-

fied defined contribution retirement plan and a nonqualified retirement

plan. Participation in the qualified plan is available to all associates who

have completed 1,000 or more hours of service with the Company dur-

ing certain 12-month periods and attained the age of 21. Participation

in the nonqualified plan is subject to service and compensation require-

ments. The Company’s contributions to these plans are based on a per-

centage of associates’ eligible annual compensation. The cost of these

plans was $10.5 million in Fiscal 2005, $9.9 million in Fiscal 2004 and

$7.0 million in Fiscal 2003.

Effective February 2, 2003, the Company established a Supplemental

Executive Retirement Plan (the “SERP”) to provide additional retire-

ment income to its Chairman. Subject to service requirements, the

Chairman will receive a monthly benefit equal to 50% of his final aver-

age compensation (as defined in the SERP) for life. The SERP has been

actuarially valued by an independent third party and the expense associ-

ated with the SERP is being accrued over the stated term of the

Amended and Restated Employment Agreement, dated as of August 15,

2005, between the Company and its Chairman.

13. CONTINGENCIES A&F is a defendant in lawsuits arising in the

ordinary course of business.

A&F is aware of 20 actions that have been filed against A&F and cer-

tain of its current and former officers and directors on behalf of a pur-

ported, but as yet uncertified, class of shareholders who purchased

A&F's Class A Common Stock between October 8, 1999 and October

13, 1999. These 20 actions have been filed in the United States District

Courts for the Southern District of New York and the Southern District

of Ohio, Eastern Division, alleging violations of the federal securities

laws and seeking unspecified damages. On April 12, 2000, the Judicial

Panel on Multidistrict Litigation issued a Transfer Order transferring

the 20 pending actions to the Southern District of New York for con-

solidated pretrial proceedings under the caption In re Abercrombie &

Fitch Securities Litigation. On November 16, 2000, the Court signed

an Order appointing the Hicks Group, a group of seven unrelated

investors in A&F’s Common Stock, as lead plaintiff, and appointing

lead counsel in the consolidated action. On December 14, 2000, plain-

tiffs filed a Consolidated Amended Class Action Complaint (the

“Amended Complaint”) in which they did not name as defendants

Lazard Freres & Co. and Todd Slater, who had formerly been named as

defendants in certain of the 20 complaints. On February 14, 2001, A&F

and the other defendants filed motions to dismiss the Amended

Complaint. On November 14, 2003, the motions to dismiss the

Amended Complaint were denied as to all defendants except Michelle

Donnan-Martin. On December 2, 2003, A&F and the other defendants

moved for reconsideration or reargument of the November 14, 2003

order denying the motions to dismiss. On February 23, 2004, the

motions for reconsideration or reargument were denied. On April 1,

2004, plaintiffs filed a motion for class certification. On April 8, 2005,

A&F and the other defendants filed their opposition to plaintiffs’

motion for class certification. The Court has yet to rule on the plain-

tiffs’ motion for class certification. The parties are currently conducting

merits discovery.

Five class actions have been filed against the Company involving

overtime compensation. In each action, the plaintiffs, on behalf of

their respective purported class, seek injunctive relief and unspecified

amounts of economic and liquidated damages. In Melissa Mitchell, et

al. v. Abercrombie & Fitch Co. and Abercrombie & Fitch Stores, Inc.,

which was filed on June 13, 2003 in the United States District Court for

the Southern District of Ohio, the plaintiffs allege that assistant man-

agers and store managers were not paid overtime compensation in vio-

lation of the Fair Labor Standards Act and Ohio law. The plaintiffs