Abercrombie & Fitch 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

33

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receivables,

marketable securities and accounts payable, approximate fair value due

to the short maturity and because the average interest rate approxi-

mates current market origination rates.

STOCK-BASED COMPENSATION The Company reports stock-

based compensation through the disclosure-only requirements of

SFAS No. 123, “Accounting for Stock-Based Compensation,” as amended

by SFAS No. 148, “Accounting for Stock-Based Compensation–Transition

and Disclosure–an Amendment of FASB No. 123,” but elects to measure

compensation expense using the intrinsic value method in accordance

with Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees.” Accordingly, no compensation expense for

options has been recognized because all options are granted at fair

market value on the grant date. The Company recognizes compensa-

tion expense related to restricted share awards. If compensation

expense related to options had been determined based on the estimat-

ed fair value of options granted in Fiscal 2005, Fiscal 2004 and Fiscal

2003, consistent with the methodology in SFAS 123, the pro forma

effect on net income and net income per basic and fully-diluted share

would have been as follows:

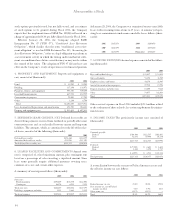

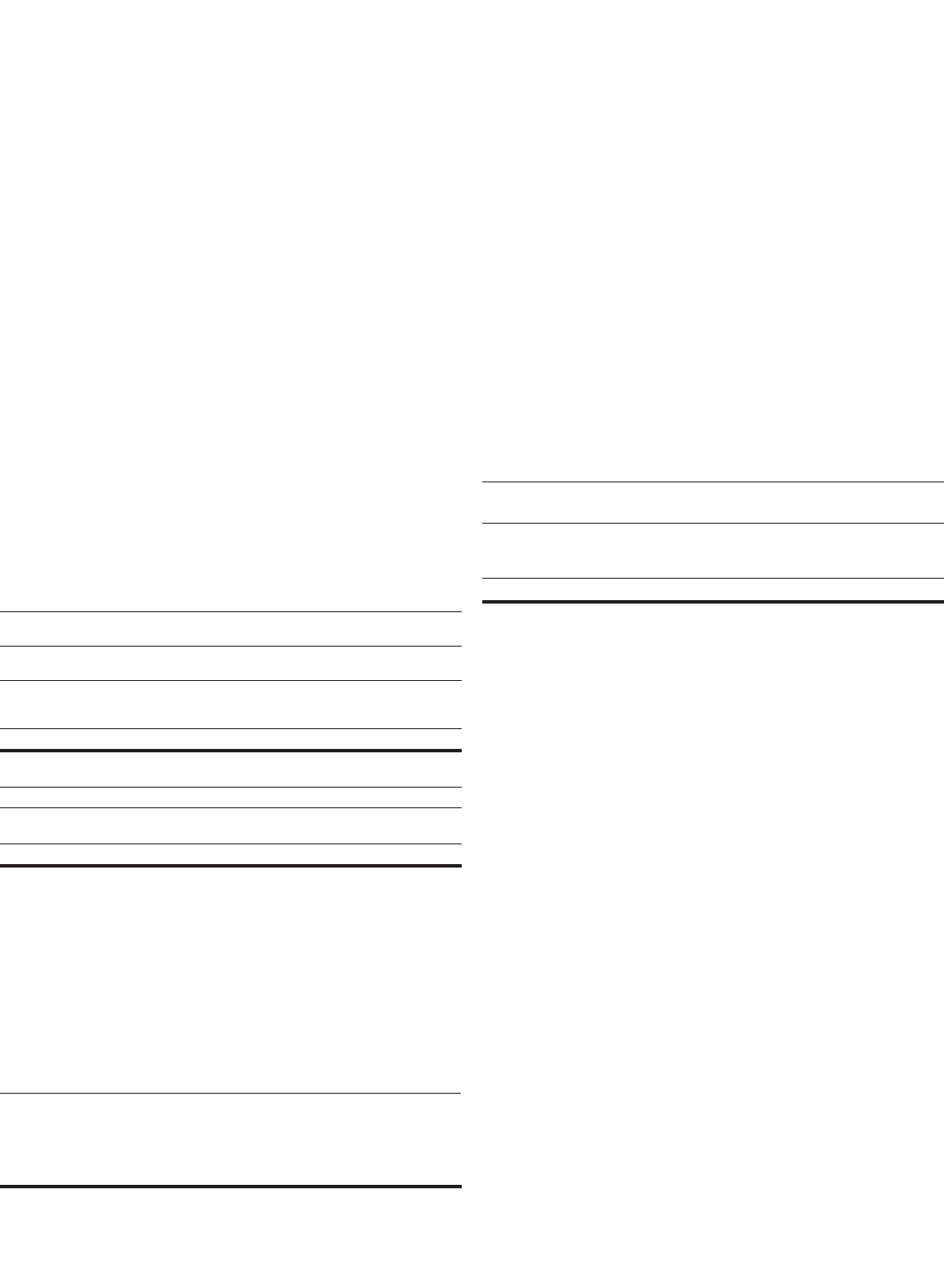

(Thousands except per share amounts) 2005 2004 2003

Net Income:

As reported $333,986 $216,376 $204,830

Stock-based compensation expense

included in reported net income, net of tax(1) 14,716 6,358 3,250

Stock-based compensation expense

determined under fair value based method,

net of tax (36,689) (27,720) (27,274)

Pro forma $312,013 $195,014 $180,806

Basic net income per share:

As reported $3.83 $2.33 $2.12

Pro forma $3.58 $2.10 $1.87

Fully-diluted net income per share:

As reported $3.66 $2.28 $2.06

Pro forma $3.38 $2.05 $1.83

(1) Includes stock-based compensation expense related to restricted share awards actually

recognized in earnings in each period presented using the intrinsic value method.

The average weighted-average fair value of options were $23.01,

$15.05 and $14.18 for Fiscal 2005, Fiscal 2004 and Fiscal 2003, respective-

ly. The fair value of each option was estimated using the Black-Scholes

option-pricing model, which is included in the pro forma results above.

For purposes of the valuation, the following weighted-average assump-

tions were used:

2005 2004 2003

Dividend yield 1.1% 1.3% –

Price volatility 47% 56% 63%

Risk-free interest rate 4.0% 3.2% 3.0%

Annual forfeiture rate 5.7% 6.4% 5.3%

Expected life (years) 4 4 4

For options granted to non-associate directors during Fiscal 2005, the

weighted-average fair value of the options was $8.42. The fair value of

each option was estimated using the Black-Scholes option-pricing

model, which is included in the pro forma results above. For purposes

of the valuation, the following weighted-average assumptions were

used: a 1.23% dividend yield; stock price volatility over the expected

term of 37%; risk-free interest rate of 3.33%; annual forfeiture rate of

9%; and expected term of one year.

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net income per

basic share is computed based on the weighted-average number of

outstanding shares of common stock. Net income per fully-diluted

share includes the weighted-average effect of dilutive stock options

and restricted shares.

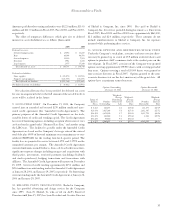

Weighted–Average Shares Outstanding (thousands):

2005 2004 2003

Shares of Class A Common Stock issued 103,300 103,300 103,300

Treasury shares oustanding (16,139) (10,523) (6,467)

Basic shares outstanding 87,161 92,777 96,833

Dilutive effect of options and

restricted shares 4,060 2,333 2,747

Fully-diluted shares outstanding 91,221 95,110 99,580

Options to purchase 150,500, 5,213,000 and 6,151,000 shares of Class A

Common Stock were outstanding at the end of Fiscal 2005, Fiscal 2004

and Fiscal 2003, respectively, but were not included in the computation of

net income per fully-diluted share because the options’ exercise prices

were greater than the average market price of the underlying shares.

USE OF ESTIMATES IN THE PREPARATION OF FINAN-

CIAL STATEMENTS The preparation of financial statements in

conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities as

of the date of the financial statements and the reported amounts of rev-

enues and expenses during the reporting period. Since actual results

may differ from those estimates, the Company revises its estimates and

assumptions as new information becomes available.

3. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2004, the Financial Accounting Standards Board

(“FASB”) issued SFAS No. 123 (Revised 2004), “Share-Based

Payment.” This standard is a revision of SFAS No. 123 and requires all

share-based payments to employees, including grants of employee

stock options and similar awards, to be recognized in the financial

statements based on their fair values measured at the grant date.

In April 2005, the Securities and Exchange Commission delayed

the effective date of SFAS No. 123(R) to annual periods beginning

after June 15, 2005 for public companies. The Company adopted

SFAS 123(R) at the beginning of the first quarter of Fiscal 2006 using

the modified prospective application transition method. Based on