Abercrombie & Fitch 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

The Company considers the following to be measures of its liquidity and

capital resources for the last three fiscal years:

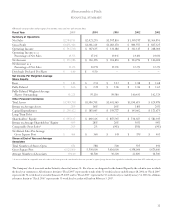

2005 2004 2003

Current ratio

(current assets divided by current liabilities) 1.93 1.56 2.63

Net cash provided by

operating activities (in thousands) $453,590 $423,784 $340,814

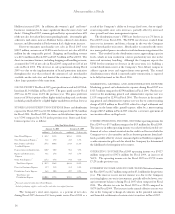

OPERATING ACTIVITIES Net cash provided by operating activ-

ities, the Company’s primary source of liquidity, increased to $453.6

million for Fiscal 2005 from $423.8 million in Fiscal 2004 primarily due

to increases in net income, income taxes payable and tax benefit of

stock option exercises, partially offset by an increase in inventory and a

decrease in accounts payable and accrued expenses. The increase in

net income and income taxes payable was a result of the net sales

growth during Fiscal 2005. The increase in tax benefit of stock option

exercises was the result of approximately 3.3 million stock options

exercised during Fiscal 2005. The Company ended Fiscal 2005 with

higher inventory levels in key product categories to ensure size, color

and style integrity. The decrease in accounts payable and accrued

expenses was due to payment of a legal settlement in Fiscal 2005 that

was settled and accrued for in Fiscal 2004.

The increase in cash provided by operating activities in Fiscal

2004 compared to Fiscal 2003 was primarily driven by an increase in

accounts payable and accrued expenses. The increase in accrued

expenses was primarily due to the accrual for the settlement of three

related class action employment discrimination lawsuits and the

increase in accounts payable was due to the purchase of inventory.

Inventories increased from the net addition of 103 stores representing

an increase of 658,000 gross square feet in Fiscal 2003. Inventories at

fiscal year-end were 3% higher on a per gross square foot basis than at

the end of the 2002 fiscal year.

The Company’s operations are seasonal in nature and typically

peak during the Back-to-School and Holiday selling periods.

Accordingly, cash requirements for inventory expenditures are highest

in the second and third fiscal quarters as the Company builds inven-

tory in anticipation of these selling periods.

INVESTING ACTIVITIES Cash outflows for Fiscal 2005 and

Fiscal 2003 were primarily for purchases of marketable securities and

capital expenditures. Cash inflows for Fiscal 2004 were primarily the

result of proceeds from sales of marketable securities, offset by capital

expenditures. See “Capital Expenditures and Lessor Construction

Allowances” for additional information. As of January 28, 2006, the

Company held $411.2 million of marketable securities with original

maturities of greater than 90 days; as of January 29, 2005, all invest-

ments had original maturities of less than 90 days and accordingly

were classified as cash equivalents. As of January 31, 2004, the

Company held $464.7 million of marketable securities with original

maturities of greater than 90 days.

FINANCING ACTIVITIES Cash outflows related to financing

activities consisted primarily of the repurchase of the Company’s Class

A Common Stock in Fiscal 2005, Fiscal 2004 and Fiscal 2003 and the

payment of dividends in Fiscal 2005 and Fiscal 2004. Cash inflows

consisted of stock option exercises, restricted stock issuances and the

change in overdrafts. The overdrafts are outstanding checks reclassi-

fied from cash to accounts payable.

The Company repurchased 1,765,000 shares, 11,150,500 shares

and 4,401,000 shares of its Class A Common Stock pursuant to previ-

ously authorized stock repurchase programs in Fiscal 2005, Fiscal 2004

and Fiscal 2003, respectively. As of January 28, 2006, the Company had

5,683,500 shares remaining available to repurchase under the 6,000,000

shares authorized by the Board of Directors in August 2005.

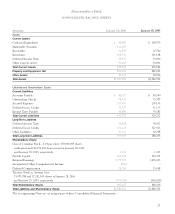

Effective December 15, 2004, the Company entered into an

amended and restated $250 million syndicated unsecured credit agree-

ment (the “Amended Credit Agreement”). The Amended Credit

Agreement will expire on December 15, 2009. The primary purpose of

the Amended Credit Agreement is to support letters of credit (trade and

standby) and finance working capital. The Amended Credit

Agreement has several borrowing options, including an option where

interest rates are based on the agent bank’s “Alternate Base Rate,” and

another using the LIBO rate. The facility fees payable under the

Amended Credit Agreement are based on the Company’s leverage ratio

of the sum of total debt plus 600% of forward minimum rent commit-

ments to consolidated EBITDAR for the trailing four-fiscal-quarter

period. The facility fees are projected to accrue between 0.15% and

0.175% on the committed amounts per annum.

Letters of credit totaling approximately $45.1 million and $49.6

million were outstanding under the Amended Credit Agreement at

January 28, 2006 and January 29, 2005, respectively. No borrowings

were outstanding under the Amended Credit Agreement at January 28,

2006 or January 29, 2005.

The Company has standby letters of credit in the amount of $4.5

million that are set to expire during the fourth quarter of Fiscal 2006.

The beneficiary, a merchandise supplier, has the right to draw upon the

standby letters of credit if the Company authorizes or files a voluntary

petition in bankruptcy. To date, the beneficiary has not drawn upon

the standby letters of credit.

20