Abercrombie & Fitch 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

to the business combination or sale (or in certain circumstances, an

affiliate) which at the time of such transaction will have a market

value of twice the exercise price of the Right.

The Rights will expire on July 16, 2008, unless earlier exchanged or

redeemed. A&F may redeem all of the Rights at a price of $.01 per

whole Right at any time before any person becomes an Acquiring

Person.

Rights holders have no rights as a shareholder of A&F, including

the right to vote and to receive dividends.

15. COMPREHENSIVE INCOME Comprehensive income con-

sists of cumulative foreign currency translation adjustments and unre-

alized gains and losses on marketable securities.

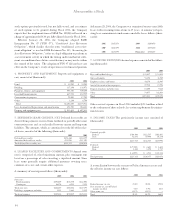

16. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly financial results for Fiscal 2005 and Fiscal

2004 follow (thousands except per share amounts):

Fiscal 2005 Quarter First Second Third Fourth

Net sales $546,810 $571,591 $704,918 $961,392

Gross profit $357,252 $389,660 $465,086 $639,418

Operating income $ 68,289 $ 91,087 $115,874 $267,488

Net income $ 40,359 $ 57,401 $ 71,600 $164,626

Net income per basic share $0.47 $0.66 $0.81 $1.88

Net income per fully-diluted share $0.45 $0.63 $0.79 $1.80

Fiscal 2004 Quarter First Second Third Fourth

Net sales $411,930 $401,346 $520,724 $687,254

Gross profit $267,924 $280,917 $336,617 $455,767

Operating income $ 46,722 $ 68,762 $ 61,978 $170,175

Net income $ 29,317 $ 42,888 $ 39,911 $104,260

Net income per basic share $0.31 $0.45 $0.43 $1.19

Net income per fully-diluted share $0.30 $0.44 $0.42 $1.15

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING The management of the

Company is responsible for establishing and maintaining adequate

internal control over financial reporting. The Company’s internal con-

trol over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f)

under the Exchange Act, is a process designed to provide reasonable

assurance regarding the reliability of financial reporting and the prepa-

ration of financial statements for external purposes and in accordance

with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial

reporting may not prevent or detect misstatements. Also, projections of

any evaluation of effectiveness to future periods are subject to the risk

that controls may become inadequate because of changes in condi-

tions, or that the degree of compliance with the policies or procedures

may deteriorate.

39

Management evaluated the effectiveness of the Company’s internal

control over financial reporting as of January 28, 2006 using criteria

established in Internal Control-Intergrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission

(COSO). Based on the assessment of the Company’s internal control

over financial reporting, management has concluded that, as of

January 28, 2006, the Company’s internal control over financial report-

ing was effective.

The Company’s independent registered public accounting firm,

PricewaterhouseCoopers LLP, has audited management’s assessment

of the effectiveness of the Company’s internal control over financial

reporting as of January 28, 2006 as stated in their report, which is

included herein.

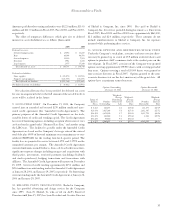

MARKET FOR REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PUR-

CHASES OF EQUITY SECURITIES A&F’s Class A Common

Stock (the “Common Stock”) is traded on the New York Stock

Exchange under the symbol “ANF.” The table below sets forth the high

and low sales prices of A&F’s Common Stock on the New York Stock

Exchange for Fiscal 2005 and Fiscal 2004:

Sales Price

High Low

Fiscal 2005

4th Quarter $68.25 $50.25

3rd Quarter $72.66 $44.17

2nd Quarter $74.10 $52.51

1st Quarter $59.98 $49.74

Fiscal 2004

4th Quarter $53.03 $38.51

3rd Quarter $39.94 $27.42

2nd Quarter $39.46 $30.93

1st Quarter $36.38 $25.53

Beginning in Fiscal 2004, the Board of Directors voted to initiate a

cash dividend, at an annual rate of $0.50 per share. A quarterly divi-

dend, of $0.125 per share, was paid in March, June, September and

December 2004. A quarterly dividend, of $0.125 per share, was paid in

March and June 2005. In August 2005, the Board of Directors

increased the quarterly dividend to $0.175 per share, which was paid

in September and December of Fiscal 2005. The Company expects to

continue to pay a dividend, subject to Board of Directors review of the

Company’s cash position and results of operations.

As of April 1, 2006, there were approximately 5,340 shareholders

of record. However, when including investors holding shares in bro-

ker accounts under street name, active associates who participate in

A&F’s stock purchase plan and associates who own shares through

A&F-sponsored retirement plans, A&F estimates that there are

approximately 60,150 shareholders.