Abercrombie & Fitch 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

34

stock options previously issued, but not fully vested, and an estimate

of stock options to be granted during Fiscal 2006, the Company

expects that the implementation of SFAS No. 123(R) will result in a

charge of approximately $0.10 per fully-diluted share for Fiscal 2006.

Effective January 28, 2006, the Company adopted FASB

Interpretation No. 47 (“FIN 47”), “Conditional Asset Retirement

Obligations”, which clarifies that the term “conditional asset retire-

ment obligation” as used in FASB Statement No. 143, “Accounting for

Asset Retirement Obligations,” refers to a legal obligation to perform an

asset retirement activity in which the timing and/or method of settle-

ment are conditional on a future event that may or may not be within

the control of the entity. The adoption of FIN 47 did not have any

effect on the Company’s results of operations or its financial position.

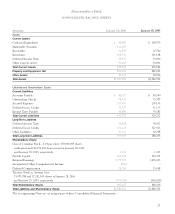

4. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2005 2004

Land $ 15,985 $ 15,985

Building 117,398 110,971

Furniture, fixtures and equipment 444,540 509,349

Leasehold improvements 625,732 402,535

Construction in progress 79,480 27,782

Other 3,248 6,790

Total $1,286,383 $1,073,412

Less: Accumulated depreciation and amortization 472,780 386,401

Property and equipment, net $ 813,603 $ 687,011

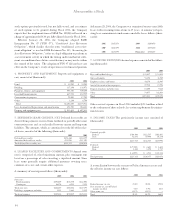

5. DEFERRED LEASE CREDITS, NET Deferred lease credits are

derived from payments received from landlords to partially offset store

construction costs and are reclassified between current and long-term

liabilities. The amounts, which are amortized over the life of the relat-

ed leases, consisted of the following (thousands):

2005 2004

Deferred lease credits $376,460 $334,175

Amortized deferred lease credits (153,508) (125,117)

Total deferred lease credits, net $222,952 $209,058

6. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount. Store

lease terms generally require additional payments covering taxes,

common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2005 2004 2003

Store rent:

Fixed minimum $170,009 $141,450 $122,001

Contingent 16,178 6,932 5,194

Total store rent $186,187 $148,382 $127,195

Buildings, equipment and other 3,241 1,663 1,219

Total rent expense $189,428 $150,045 $128,414

At January 28, 2006, the Company was committed to non-cancelable

leases with remaining terms of one to 15 years. A summary of oper-

ating lease commitments under non-cancelable leases follows (thou-

sands):

2006 $187,674 2009 $169,856

2007 $187,397 2010 $155,670

2008 $178,595 Thereafter $538,635

7. ACCRUED EXPENSES Accrued expenses consisted of the follow-

ing (thousands):

2005 2004

Rent and landlord charges $ 23,847 $ 13,843

Gift card liability 53,150 41,707

Employee salaries and bonus 30,250 21,985

Accrual for construction in progress 19,510 15,756

Property, franchise and other taxes 13,600 9,228

Other 74,677 102,634

Total $215,034 $205,153

Other accrued expenses in Fiscal 2004 included $49.1 million related

to the settlement of three related class action employment discrimina-

tion lawsuits.

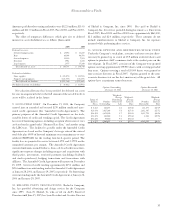

8. INCOME TAXES The provision for income taxes consisted of

(thousands):

2005 2004 2003

Currently payable:

Federal $184,884 $112,537 $101,692

State 32,641 19,998 18,248

$217,525 $132,535 $119,940

Deferred:

Federal $ (5,980) $ 2,684 $ 8,601

State 3,881 1,258 1,517

$ (2,099) $ 3,942)$ 10,118

Total provision $215,426 $136,477 $130,058

A reconciliation between the statuatory Federal income tax rate and

the effective income tax rate follows:

2005 2004 2003

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 4.3% 3.9% 3.8%

Other items, net (0.1%) (0.2%) –

Total 39.2% 38.7% 38.8%