Abercrombie & Fitch 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

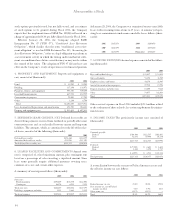

Employees.” Accordingly, no compensation expense for options has

been recognized because all options are granted at fair market value

on the grant date. The Company recognizes compensation expense

related to restricted stock unit awards to associates and non-associ-

ate directors.

For the disclosure requirement of SFAS No. 123, the

Company’s equity compensation expense related to stock options is

estimated using the Black-Scholes option-pricing model to deter-

mine the fair value of the stock option grants, which requires the

Company to estimate the expected term of the stock option grants

and expected future stock price volatility over the term. The

Company uses the vesting period of the stock option as a proxy for

the term of the option. Estimates of expected future stock price

volatility are based on the historic volatility of the Company’s stock

for the period equal to the expected term of the stock option. The

Company calculates the historic volatility as the annualized stan-

dard deviation of the differences in the natural logarithms of the

weekly stock closing price, adjusted for dividends and stock splits.

The fair market value calculation under the Black-Scholes val-

uation model is particularly sensitive to changes in the term and

volatility assumptions. Increases in term or volatility will result in a

higher fair market valuation of stock option grants. Assuming all

other assumptions disclosed in Note 2 of the Notes to Consolidated

Financial Statements, “Summary of Significant Accounting Policies

- Stock Based Compensation,” being equal, a 10% increase in term

will yield a 4% increase in the Black-Scholes valuation, while a 10%

increase in volatility will yield a 8% increase in the Black-Scholes

valuation. The Company believes that changes in term and volatil-

ity will not have a material effect on the Company’s results since the

number of stock options granted during the period was not material.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2004, the Financial Accounting Standards Board

(“FASB”) issued SFAS No. 123(R). This standard is a revision of SFAS

No. 123 and requires all share-based payments to employees, includ-

ing grants of employee stock options and similar awards, to be

recognized in the financial statements based on their fair values meas-

ured at the grant date.

In April 2005, the Security And Exchange Commission delayed

the effective date of SFAS No. 123(R) to annual periods beginning

after June 15, 2005 for public companies. Based on stock options

previously issued, but not fully vested, and an estimate of stock

options to be granted during Fiscal 2006, the Company expects that

the implementation of SFAS No. 123(R) will result in a charge of

approximately $0.10 per fully-diluted share for Fiscal 2006.

Effective January 28, 2006, the Company adopted FASB

Interpretation No. 47 (“FIN 47,”) “Conditional Asset Retirement

Obligations,” which clarifies that the term “conditional asset retire-

ment obligation” as used in FASB Statement No. 143, “Accounting

for Asset Retirement Obligations”, refers to a legal obligation to per-

form an asset retirement activity in which the timing and/or method

of settlement are conditional on a future event that may or may not

be within the control of the entity. The adoption of FIN 47 did not

have any effect on the Company’s results of operations or its finan-

cial position.

IMPACT OF INFLATION The Company’s results of operations

and financial condition are presented based upon historical cost.

While it is difficult to accurately measure the impact of inflation due

to the imprecise nature of the estimates required, the Company

believes that the effects of inflation, if any, on its results of operations

and financial condition have been minor.

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

The Company cautions that any forward-looking statements (as such

term is defined in the Private Securities Litigation Reform Act of

1995) contained in this Form 10-K or made by management involve

risks and uncertainties and are subject to change based on various

important factors, many of which may be beyond its control. Words

such as “estimate,” “project,” “plan,” “believe,” “expect,” “antici-

pate,” “intend,” and similar expressions may identify forward-looking

statements. The following factors in some cases have affected and in

the future could affect the Company’s financial performance and

could cause actual results to differ materially from those expressed or

implied in any of the forward-looking statements included in this

report or otherwise made by management:

■changes in consumer spending patterns and consumer pref-

erences;

■the impact of competition and pricing;

■disruptive weather conditions;

■availability and market prices of key raw materials;

■currency and exchange risks and changes in existing or potential

duties, tariffs or quotas;

■availability of suitable store locations on appropriate terms;

■ability to develop new merchandise;

■ability to hire, train and retain associates; and

■the effects of political and economic events and conditions

domestically and in foreign jurisdictions in which the

Company operates, including, but not limited to, acts of terror-

ism or war.

Future economic and industry trends that could potentially

impact net sales and profitability are difficult to predict. Therefore,

there can be no assurance that the forward-looking statements includ-

ed in this report will prove to be accurate and the inclusion of such

information should not be regarded as a representation by the Company,

or any other person, that its objectives will be achieved. Except as may

be required by applicable law, the Company assumes no obligation to

publicly update or revise its forward-looking statements.

Because forward-looking statements involve risks and uncer-

tainties, the Company cautions that there are important factors, in

24

Abercrombie &Fitch