Abercrombie & Fitch 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

35

Amounts paid directly to taxing authorities were $122.0 million, $114.0

million and $113.0 million in Fiscal 2005, Fiscal 2004, and Fiscal 2003,

respectively.

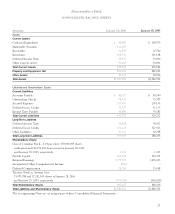

The effect of temporary differences which give rise to deferred

income tax assets (liabilities) was as follows (thousands):

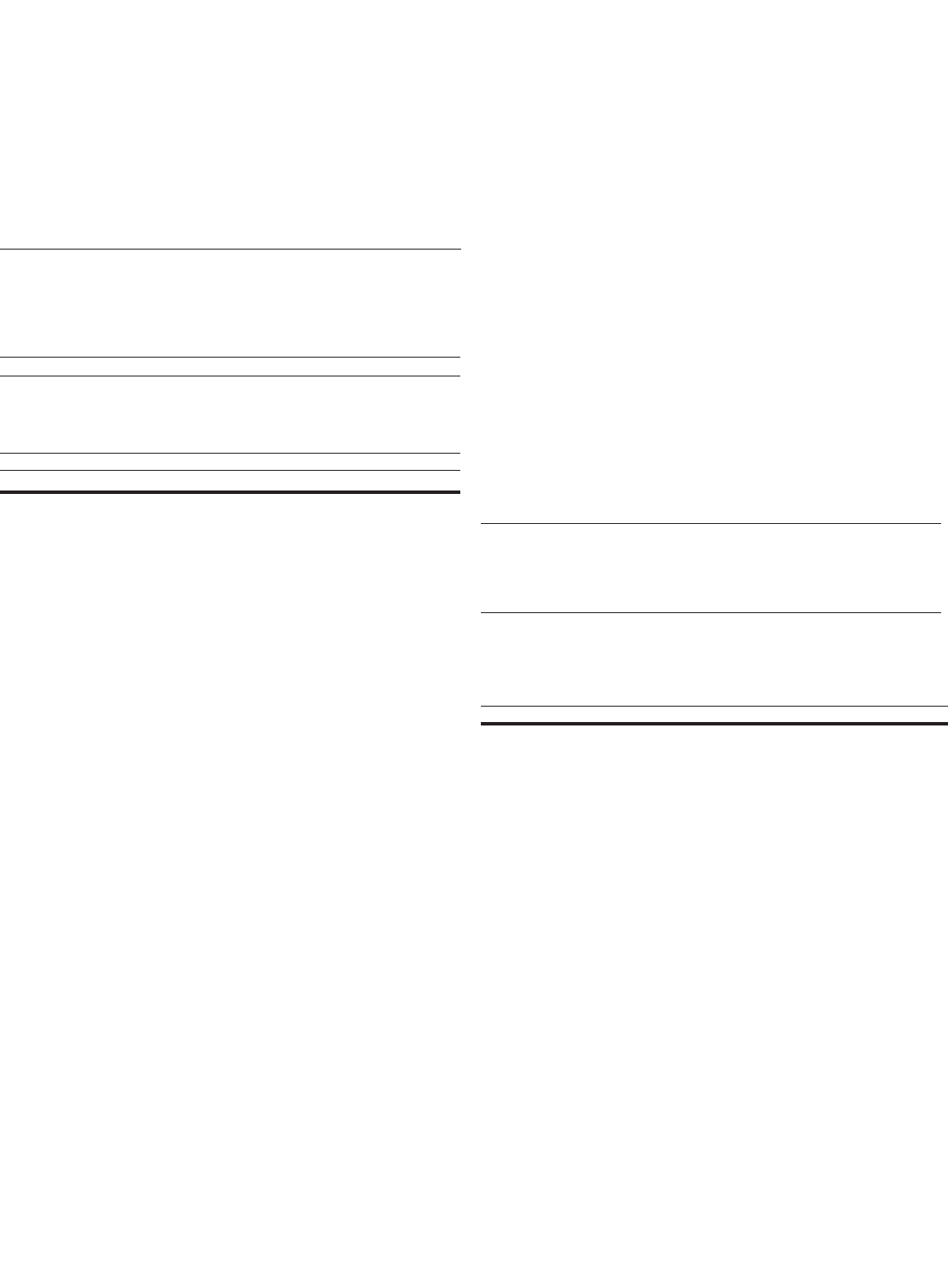

2005 2004

Deferred tax assets:

Deferred compensation $ 24,046 $ 16,205

Rent 88,399 98,793

Accrued expenses 11,340 7,194

Inventory 3,982 3,268

Legal expense 2,977 15,288

Total deferred tax assets $ 130,744 $ 140,748

Deferred tax liabilities:

Store supplies $ (10,851) $ (10,542)

Property and equipment (128,735) (141,147)

Total deferred tax liabilities $ (139,586) $ (151,689)

Net deferred income tax liabilities $ (8,842) $ (10,941)

No valuation allowance has been provided for deferred tax assets

because management believes the full amount of the net deferred tax

assets will be realized in the future.

9. LONG-TERM DEBT On December 15, 2004, the Company

entered into an amended and restated $250 million syndicated unse-

cured credit agreement (the “Amended Credit Agreement”). The

primary purposes of the Amended Credit Agreement are for trade,

stand-by letters of credit and working capital. The Credit Agreement

has several borrowing options, including an option where interest rates

are based on the agent bank’s “Alternate Base Rate,” and another using

the LIBO rate. The facility fees payable under the Amended Credit

Agreement are based on the Company’s leverage ratio of the sum of

total debt plus 600% of forward minimum rent commitments to con-

solidated EBITDAR for the trailing four-fiscal-quarter period. The

facility fees are projected to accrue between 0.15% and 0.175% on the

committed amounts per annum. The Amended Credit Agreement

contains limitations on indebtedness, liens, sale-leaseback transactions,

significant corporate changes including mergers and acquisitions with

third parties, investments, restricted payments (including dividends

and stock repurchases), hedging transactions and transactions with

affiliates. The Amended Credit Agreement will mature on December

15, 2009. Letters of credit totaling approximately $45.1 million and

$49.6 million were outstanding under the Amended Credit Agreement

at January 28, 2006 and January 29, 2005, respectively. No borrowings

were outstanding under the Amended Credit Agreement at January 28,

2006 and January 29, 2005.

10. RELATED PARTY TRANSACTIONS Shahid & Company,

Inc. has provided advertising and design services for the Company

since 1995. Sam N. Shahid, Jr., who served on A&F’s Board of

Directors until June 15, 2005, has been President and Creative Director

of Shahid & Company, Inc. since 1993. Fees paid to Shahid &

Company, Inc. for services provided during his tenure as a Director in

Fiscal 2005, Fiscal 2004 and Fiscal 2003 were approximately $863,000,

$2.1 million and $2.0 million, respectively. These amounts do not

include reimbursements to Shahid & Company, Inc. for expenses

incurred while performing these services.

11. STOCK OPTIONS AND RESTRICTED STOCK UNITS

Under the Company’s stock plans, associates and non-associate direc-

tors may be granted up to a total of 25.9 million restricted shares and

options to purchase A&F’s common stock at the market price on the

date of grant. In Fiscal 2005, associates of the Company were granted

options covering approximately 479,900 shares, with a vesting period of

four years. Options covering a total of 20,000 shares were granted to

non-associate directors in Fiscal 2005. Options granted to the non-

associate directors vest on the first anniversary of the grant date. All

options have a maximum term of ten years.

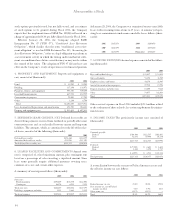

Options Outstanding Options Exercisable

at January 28, 2006 at January 28, 2006

Weighted–

Average Weighted– Weighted–

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercise

Prices Outstanding Life Price Exercisable Price

$ 8-$23 320,143 3.0 $15.06 233,393 $17.29

$23-$38 3,627,288 5.6 $27.43 2,612,387 $27.52

$38-$53 4,651,400 3.7 $44.04 3,435,750 $43.96

$53-$71 383,000 7.8 $57.80 2,500 $59.98

$71-$75 79,000 9.5 $71.10 ––

$ 8-$75 9,060,831 4.6 $37.18 6,284,030 $36.14