Abercrombie & Fitch 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

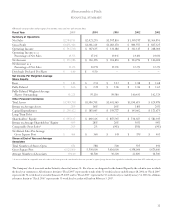

NET INCOME AND NET INCOME PER SHARE Net income

for Fiscal 2005 was $334.0 million versus $216.4 million in Fiscal 2004, an

increase of 54.3%. Net income included after-tax non-recurring charges

of $8.2 million in Fiscal 2005 related to a severance agreement of an exec-

utive officer and $25.6 million in Fiscal 2004 related to a legal settle-

ment. Net income per fully-diluted weighted-average share was $3.66 in

Fiscal 2005 versus $2.28 in Fiscal 2004, an increase of 60.5%. The per-

centage increase in net income per fully-diluted shares outstanding

was greater than the percentage increase in net income due to the

impact of the Company’s share repurchase program. In Fiscal 2005,

the Company repurchased 1.8 million shares.

FISCAL 2004 COMPARED TO FISCAL: 2003 FOURTH

QUARTER RESULTS: NET SALES Net sales for the fourth quar-

ter of Fiscal 2004 were $687.3 million, a 22.6% increase versus Fiscal 2003

fourth quarter net sales of $560.4 million. The net sales increase was

attributable to the net addition of 88 stores during Fiscal 2004, a com-

parable store sales increase of 9% for the quarter and an increase of $11.1

million in net sales (including shipping and handling revenue) for the

direct-to-consumer business versus the comparable period in Fiscal 2003.

By merchandise brand, comparable store sales for the quarter

were as follows: Abercrombie & Fitch increased 4% with men’s com-

parable store sales increasing by a high-single digit percentage and

women’s increasing by a low single-digit percentage. abercrombie,

the kids’ business, achieved a 16% increase in comparable store sales

with girls attaining a high-teen increase and boys increasing by a low

double-digit percentage. In Hollister, comparable store sales increased by

19% for the fourth quarter with bettys realizing an increase in the low-

twenties and dudes posting a high-teens increase.

On a regional basis, comparable store sales results across all three

brands were strongest in the Northeast and in the West and weakest in

the Midwest. However, all regions reported positive comparable store

sales for the quarter.

The Company committed to a strategy that included fewer pro-

motions in early Fiscal 2004, and maintained this strategy throughout

the fiscal year. As such, the Company did not anniversary the direct mail

promotions used during the fourth quarter of Fiscal 2003 to drive

business between Thanksgiving and Christmas.

In Abercrombie & Fitch, the men’s comparable store sales increase

for the quarter was driven by strong performances in graphic tees, jeans,

and woven shirts. Women’s comparable store sales growth was driven

by an increase in polos, jeans and fleece, offset by a decrease in sweaters.

In the abercrombie business, for the quarter, girls had comparable

store sales increases across most of the categories, especially polos,

jeans and graphic tees. Boys’ comparable store sales increases were

driven by graphic tees, jeans and fleece.

In Hollister, bettys achieved a slightly higher comparable store

sales increase than dudes. In bettys, polos, jeans and fleece had strong

comparable store sales increases. The increase in the dudes’ com-

parable store sales was the result of a strong performance in graphic

tees, jeans and woven shirts categories for the quarter.

Direct-to-consumer merchandise net sales through the Company’s

web sites and catalogue for the fourth quarter of Fiscal 2004 were $40.1

million, an increase of 29.4% versus Fiscal 2003 fourth quarter net sales

of $31.0 million. Shipping and handling revenue for the corresponding

periods was $5.5 million in Fiscal 2004 and $3.5 million in Fiscal 2003.

The direct-to-consumer business, including shipping and handling rev-

enue, accounted for 6.6% of net sales in the fourth quarter of Fiscal 2004

compared to 6.2% in the fourth quarter of Fiscal 2003.

GROSS PROFIT Gross profit for the fourth quarter of Fiscal 2004 was

$455.8 million compared to $355.4 million in the corresponding period in

Fiscal 2003. The gross profit rate for the fourth quarter of Fiscal 2004 was

66.3%, up 290 basis points from the Fiscal 2003 rate of 63.4%. The

increase in the gross profit rate resulted largely from lower markdowns

and an increase in IMU during the fourth quarter of Fiscal 2004 versus

the fourth quarter of Fiscal 2003, partially offset by the lower margin of

RUEHL. The improvement in IMU during the fourth quarter was a result

of higher average unit retail pricing in Abercrombie & Fitch, abercrombie

and Hollister. The three brands had IMU improvements compared to

the fourth quarter of Fiscal 2003 and operated at similar margins.

The Company ended the fourth quarter of Fiscal 2004 with inven-

tories, at cost, up 11% per gross square foot versus the fourth quarter of

Fiscal 2003. The inventory increase reflected a planned acceleration of

Spring and jeans merchandise deliveries.

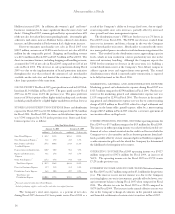

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for the fourth quarter of Fiscal 2004 was $223.8 million com-

pared to $164.0 million for the comparable period in Fiscal 2003. For the

fourth quarter of Fiscal 2004, the stores and distribution expense rate

was 32.6% compared to 29.3% in the fourth quarter of Fiscal 2003.

Stores and distribution expense was as follows:

Thirteen Weeks Ended

January 29, 2005 January 31, 2004

(millions) % of net sales (millions) % of net sales

Store Payroll Expense $ 74.6 10.9% $ 45.2 8.1%

Store Management Expense

(1)

7.7 1.1% 5.0 0.9%

Rent, Utilities and Other 57.5 8.4% 51.1 9.1%

Landlord Expense

Depreciation and Amortization 28.1 4.1% 21.8 3.9%

Repairs and Maintenance 8.3 1.2% 5.1 0.9%

Expense

Other Store Expenses

(2)

30.8 4.5% 22.4 4.0%

Total Stores Expense $207.0 30.1% $150.6 26.9%

Direct-to-Consumer Expense 10.6 1.5% 8.3 1.5%

Distribution Center Expense 6.2 0.9% 5.1 0.9%

Total Stores and

Distribution Expense $223.8 32.6% $164.0 29.3%

(1)

Previously reported within Store Payroll Expense.

(2)

Includes packaging, supplies, credit card fees and other store support functions.

Abercrombie &Fitch

17