Abercrombie & Fitch 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

30

1. BASIS OF PRESENTATION Abercrombie & Fitch Co. (“A&F”),

through its wholly-owned subsidiaries (collectively, A&F and its whol-

ly-owned subsidiaries are referred to as “Abercrombie & Fitch” or the

“Company”), is a specialty retailer of high quality, casual apparel for

men, women and kids with an active, youthful lifestyle. The business

was established in 1892.

The accompanying consolidated financial statements include the

historical financial statements of, and transactions applicable to, A&F

and its wholly-owned subsidiaries and reflect the assets, liabilities, results

of operations and cash flows on a historical cost basis.

FISCAL YEAR The Company’s fiscal year ends on the Saturday clos-

est to January 31. Fiscal years are designated in the financial statements

and notes by the calendar year in which the fiscal year commences. All

references herein to “Fiscal 2005” represent the results for the 52-week

fiscal year ended January 28, 2006; to “Fiscal 2004” represent the 52-

week fiscal year ended January 29, 2005; and to “Fiscal 2003” represent

the 52-week fiscal year ended January 31, 2004. In addition, references

herein to “Fiscal 2006” represent the 53-week fiscal year that will end on

February 3, 2007.

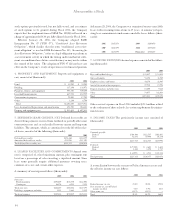

RECLASSIFICATIONS Certain amounts have been reclassified to

conform with the current year presentation. Amounts reclassified did

not have an effect on the Company’s results of operations or total

shareholders’ equity. On the Consolidated Balance Sheet for the year

ended January 29, 2005, the Company reclassified (a) deferred income

tax assets ($44.4 million) that were previously netted against income

tax payable to current assets; (b) the long-term portion of straight-line

rent ($32.9 million) from an accrued expense to other long-term liabil-

ities and the corresponding deferred income tax asset ($13.2 million)

from current to long-term deferred income taxes; (c) the long-term

portion of executive severance ($6.6 million) from accrued expense to

other long-term liabilities; (d) the portion of gift card liabilities ($10.4

million) that was previously classified in other long-term liabilities to

accrued expense; (e) a portion of store supplies ($20.6 million) from

current assets to other non-current assets and the corresponding

deferred income tax liability ($7.8 million) from current to long-term

deferred income taxes; (f) deferred compensation ($15.0 million) to be

shown as a separate component of shareholders’ equity; and (g) third-

party credit card receivables ($11.6 million) from cash equivalents to

receivables. On the Consolidated Statements of Cash Flows, the

reclassification of third-party credit card receivables during Fiscal 2004

and Fiscal 2003 decreased the ending cash balance and other assets and

liabilities by $11.6 million and $9.3 million, respectively. All other

reclassifications were within the operating activity section of the

Consolidated Statements of Cash Flows.

Beginning with the first quarter of the fiscal year ending January 28,

2006, the Company reclassified the condensed consolidated statements

of net income and comprehensive income. In prior periods, the

Company included buying and occupancy costs as well as certain home

office expenses as part of the gross profit calculation. The Company

believes that presenting gross profit as a function of sales reduced sole-

ly by cost of goods sold, as well as presenting stores and distribution

expense and marketing, general and administrative expense, as individ-

ual expense categories, provides a clearer and more transparent repre-

sentation of gross selling margin and operating expenses. Prior period

results have been reclassified accordingly.

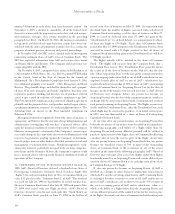

SEGMENT REPORTING In accordance with Statement of

Financial Accounting Standards (“SFAS”) No. 131, “Disclosures about

Segments of an Enterprise and Related Information,” the Company

determined its operating segments on the same basis that it uses inter-

nally to evaluate performance. The operating segments identified by

the Company, Abercrombie & Fitch, abercrombie, Hollister and

RUEHL, have been aggregated and are reported as one reportable

financial segment. The Company aggregates its operating segments

because they meet the aggregation criteria set forth in paragraph 17 of

SFAS No. 131. The Company believes its operating segments may

be aggregated for financial reporting purposes because they are simi-

lar in each of the following areas: class of consumer, economic char-

acteristics, nature of products, nature of production processes and dis-

tribution methods.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION The consolidated finan-

cial statements include the accounts of A&F and its subsidiaries. All

intercompany balances and transactions have been eliminated in con-

solidation.

CASH AND EQUIVALENTS Cash and equivalents include

amounts on deposit with financial institutions and investments with

original maturities of less than 90 days. Outstanding checks at year-end

are reclassified in the balance sheet from cash to accounts payable to

be reflected as liabilities.

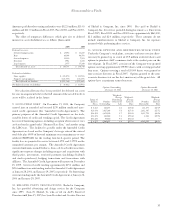

MARKETABLE SECURITIES Investments with original maturi-

ties greater than 90 days are accounted for in accordance with SFAS

No. 115, “Accounting for Certain Investments in Debt and Equity

Securities,” and are classified accordingly by the Company at the time

of purchase. At January 28, 2006, the Company’s investments in

marketable securities consisted primarily of investment grade municipal

notes and bonds and investment grade auction rate securities, all classified

as available-for-sale and reported at fair value, with maturities that could

range from three months to 40 years.

The Company began investing in municipal notes and bonds dur-

ing Fiscal 2005. These investments have early redemption provisions

at predetermined prices. For the fiscal year ended January 28, 2006,

there were no realized gains or losses and as of January 28, 2006, net

unrealized holding losses were $718,000.

For the Company’s investments in auction rate securities, the interest

rates reset through an auction process at predetermined periods ranging

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS