Abercrombie & Fitch 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

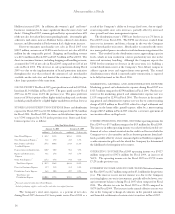

ending inventory valuation at cost as well as the resulting gross mar-

gins. Management believes that this inventory valuation method

is appropriate since it preserves the cost-to-retail relationship in end-

ing inventory.

Property and Equipment - Depreciation and amortization of

property and equipment are computed for financial reporting pur-

poses on a straight-line basis, using service lives ranging principally

from 30 years for buildings, the lesser of ten years or the life of the

lease for leasehold improvements and three to ten years for other

property and equipment. The cost of assets sold or retired and the

related accumulated depreciation or amortizations are removed from

the accounts with any resulting gain or loss included in net income.

Maintenance and repairs are charged to expense as incurred. Major

remodels and improvements that extend service lives of the assets are

capitalized. Long-lived assets are reviewed at the store level at least

annually for impairment or whenever events or changes in circum-

stances indicate that full recoverability is questionable. Factors used

in the evaluation include, but are not limited to, management's

plans for future operations, recent results of operations and project-

ed cash flows.

Income Taxes - Income taxes are calculated in accordance with

SFAS No. 109, “Accounting for Income Taxes,” which requires the use

of the asset and liability method. Deferred tax assets and liabilities

are recognized based on the difference between the financial state-

ment carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured

using current enacted tax rates in effect in the years in which those

temporary differences are expected to reverse. Inherent in the meas-

urement of deferred balances are certain judgments and interpretations

of enacted tax law and published guidance with respect to applica-

bility to the Company’s operations. No valuation allowance has been

provided for deferred tax assets because management believes the

full amount of the net deferred tax assets will be realized in the

future. The effective tax rate utilized by the Company reflects man-

agement’s judgment of the expected tax liabilities within the various

taxing jurisdictions.

Contingencies - In the normal course of business, the Company

must make continuing estimates of potential future legal obligations

and liabilities, which requires the use of management’s judgment on

the outcome of various issues. Management may also use outside

legal advice to assist in the estimating process. However, the ultimate

outcome of various legal issues could be different than management

estimates, and adjustments may be required.

Equity Compensation Expense - The Company reports stock-

based compensation through the disclosure-only requirements of

SFAS No. 123, “Accounting for Stock-Based Compensation,” as

amended by SFAS No. 148, “Accounting for Stock-Based

Compensation–Transition and Disclosure–an Amendment of FASB

Statement No. 123,” but elects to measure compensation expense

using the intrinsic value method in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock Issued to

the time the customer takes possession of the merchandise and pur-

chases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer receipt

of merchandise. Amounts relating to shipping and handling billed

to customers in a sale transaction are classified as revenue and the

related direct shipping costs are classified as stores and distribution

expense. Employee discounts are classified as a reduction of rev-

enue. The Company reserves for sales returns through estimates

based on historical experience and various other assumptions that

management believes to be reasonable. The Company’s gift cards

do not expire or lose value over periods of inactivity. The Company

accounts for gift cards by recognizing a liability at the time a gift card

is sold. The liability remains on the Company’s books until the ear-

lier of redemption (recognized as revenue) or when the Company

determines the likelihood of redemption is remote (recognized as

other operating income). The Company considers the probability of

the gift card being redeemed to be remote for 50% of the balance of

gift cards at 24 months after the date of issuance and remote for the

remaining balance at 36 months after the date of issuance and at that

time recognizes the remaining balance as other operating income.

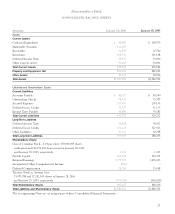

At January 28, 2006 and January 29, 2005, the gift card liability on

the Company’s Consolidated Balance Sheet was $53.2 million and

$41.7 million, respectively.

The Company is not required by law to escheat the value of

unredeemed gift cards to the states in which it operates. During

Fiscal 2005 and Fiscal 2004, the Company recognized other operat-

ing income for adjustments to the gift card liability of $2.4 million

and $4.3 million, respectively. No income for adjustments to the gift

card liability was recognized during Fiscal 2003.

Inventory Valuation - Inventories are principally valued at the

lower of average cost or market utilizing the retail method. The

retail method of inventory valuation is an averaging technique

applied to different categories of inventory. At the Company, the

averaging is determined at the stock keeping unit (“SKU”) level by

averaging all costs for each SKU. An initial markup is applied to

inventory at cost in order to establish a cost-to-retail ratio.

Permanent markdowns, when taken, reduce both the retail and cost

components of inventory on hand so as to maintain the already

established cost-to-retail relationship. The use of the retail method

and the recording of markdowns effectively values inventory at the

lower of cost or market. At the end of the first and third fiscal quar-

ters, the Company reduces inventory value by recording a mark-

down reserve that represents the estimated future anticipated selling

price decreases necessary to sell-through the current season inventory.

Additionally, as part of inventory valuation, an inventory

shrinkage estimate is made each period that reduces the value of

inventory for lost or stolen items. The Company performs physical

inventories throughout the year and adjusts the shrink reserve

accordingly. Inherent in the retail method calculation are certain

significant judgments and estimates including, among others, IMU,

markdowns and shrinkage, which could significantly impact the

Abercrombie &Fitch

23