Abercrombie & Fitch 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

OVERVIEW Beginning with the first quarter of Fiscal 2005, the

Company reclassified its condensed consolidated statements of net income

and comprehensive income. In prior periods, the Company included

buying and occupancy costs as well as certain home office expenses as part

of the gross profit calculation. The Company believes that presenting gross

profit as a function of sales reduced solely by cost of goods sold, as well as

presenting stores and distribution expense and marketing, general and

administrative expense as individual expense categories, provides a clearer

and more transparent representation of gross selling margin and operating

expenses. Prior period results have been reclassified accordingly.

The Company had net sales of $2.785 billion in Fiscal 2005, up

37.8% from $2.021 billion in Fiscal 2004. Operating income for Fiscal 2005

increased 56.1% to $542.7 million from $347.6 million for Fiscal 2004.

Operating income results in Fiscal 2005 and Fiscal 2004 included the

impact of non-recurring charges of $13.5 million related to a severance

agreement of an executive officer and $40.9 million related to a legal

settlement, respectively. Net income was $334.0 million in Fiscal 2005, up

54.3% from $216.4 million in Fiscal 2004. Net income per fully-diluted

weighted-average share was $3.66 for Fiscal 2005 compared to $2.28 in

Fiscal 2004, an increase of 60.5%. The non-recurring charges, net of the

related tax effect, reduced reported net income per fully-diluted share by

$0.09 and $0.27 in Fiscal 2005 and Fiscal 2004, respectively.

The Company generated cash from operations of $453.6 million in

Fiscal 2005 versus $423.8 million in Fiscal 2004, resulting primarily from

strong sales and income. During Fiscal 2005, the Company used cash from

operations to finance its growth strategy, opening 57 new Hollister stores,

15 new Abercrombie & Fitch stores, five new abercrombie stores and four

new RUEHL stores, as well as remodeling 14 Abercrombie & Fitch stores.

Further, the Company used excess cash to repurchase 1.8 million

shares of common stock for $103.3 million and pay dividends of $0.60 per

share for a total of $52.2 million. The Company believes that share

repurchases and dividends are an important way for the Company to

deliver shareholder value, but the Company’s first priority will be to

invest in the business to support its domestic and international growth

plans. The Company continues to be committed to maintaining sufficient

cash on the balance sheet to support the needs of the business and

withstand unanticipated business volatility.

The following data represent the Company’s consolidated statements of

net income for the last three fiscal years, expressed as a percentage of net sales:

2005 2004 2003

Net Sales 100.0% 100.0% 100.0%

Cost of Goods Sold 33.5 33.6 36.6

Gross Profit 66.5 66.4 63.4

Stores and Distribution Expense 35.9 36.5 35.0

Marketing, General and Administrative Expense 11.3(1) 12.9(2) 9.1

Other Operating Income, Net (0.2) (0.2) (0.1)

Operating Income 19.5 17.2 19.4

Interest Income, Net (0.2) (0.3) (0.2)

Income Before Income Taxes 19.7 17.5 19.6

Provision for Income Taxes 7.7 6.8 7.6

Net Income 12.0% 10.7% 12.0%

(1) Includes 0.5% related to a severance agreement.

(2) Includes 2.0% related to a legal settlement.

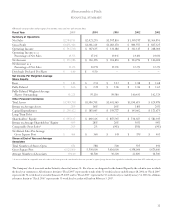

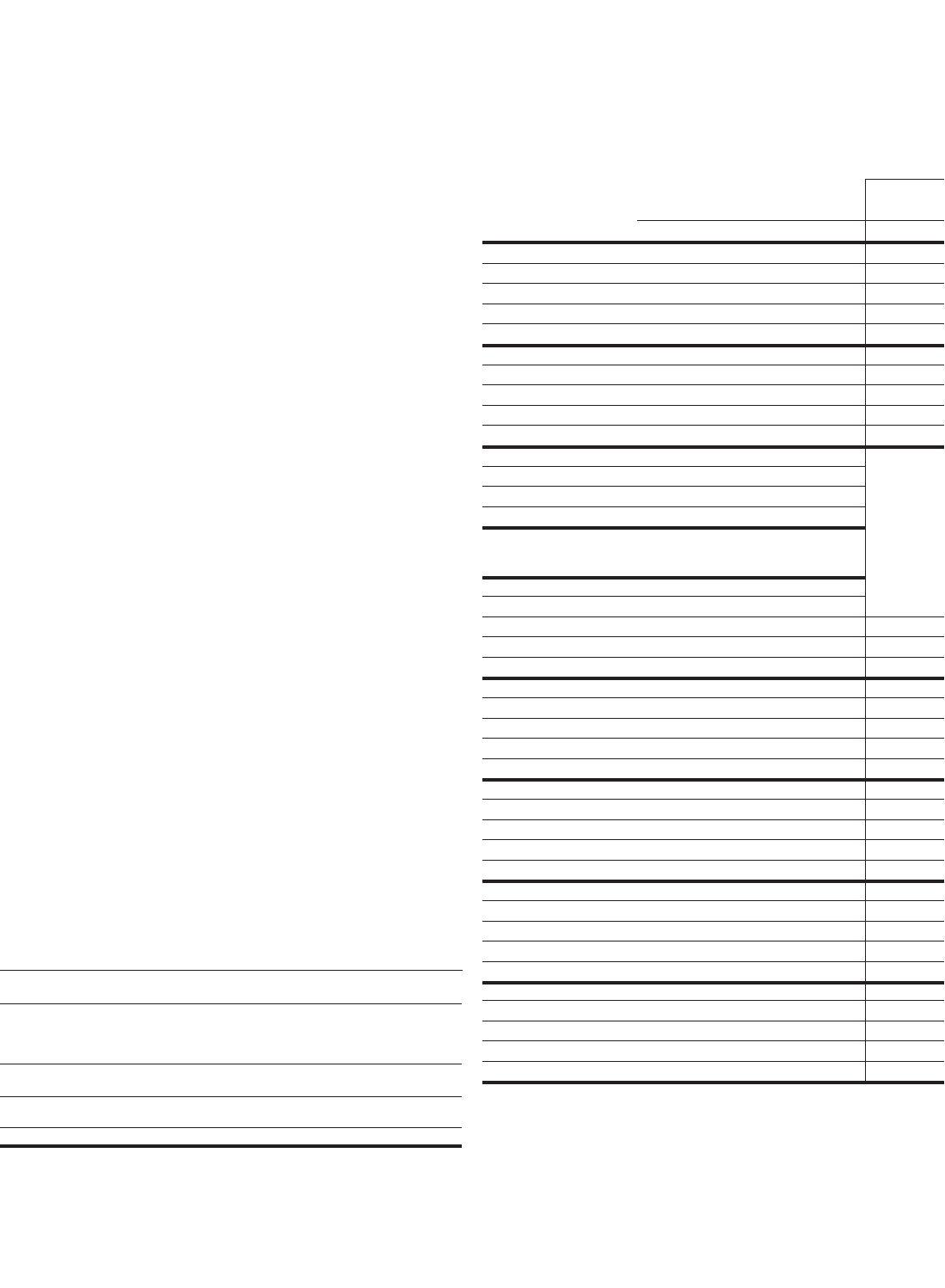

FINANCIAL SUMMARY The following summarized financial

and operational data compares Fiscal 2005 to Fiscal 2004 and Fiscal

2004 to Fiscal 2003:

% Change

2004- 2003-

2005 2004 2003 2005 2004

Net sales (thousands) $2,784,711 $2,021,253 $1,707,810 38% 18%

Net sales by brand (thousands)

Abercrombie & Fitch $1,424,013 $1,210,222 $1,180,646 18% 3%

abercrombie $ 344,938 $ 227,204 $ 212,276 52% 7%

Hollister $ 999,212 $ 579,687 $ 314,888 72% 84%

RUEHL* $ 16,548 $ 4,140 n / a 300% n /a

Net retail sales per average store (thousands)

Abercrombie & Fitch $ 3,784 $ 3,103 $ 3,184 22% (3)%

abercrombie $ 1,957 $ 1,241 $ 1,194 58% 4%

Hollister $ 3,442 $ 2,740 $ 2,594 26% 6%

RUEHL* $ 2,903 $ 1,255 n / a 131% n / a

Increase (decrease) in comparable store sales**

Abercrombie & Fitch 18% (1)% (11)%

abercrombie 54% 1% (6)%

Hollister 29% 13% 7%

Net sales increase attributable

to new and remodeled stores,

catalogue and web sites 12% 16% 16%

Net retail sales per average gross square foot

Abercrombie & Fitch $ 432 $ 352 $ 358 23% (2)%

abercrombie $ 446 $ 282 $ 270 58% 4%

Hollister $ 528 $ 423 $ 404 25% 5%

RUEHL* $ 315 $ 136 n / a 132% n / a

Transactions per average store

Abercrombie & Fitch 49,685 45,941 51,234 8% (10)%

abercrombie 30,356 21,740 22,128 40% (2)%

Hollister 64,913 56,687 57,593 15% (2)%

RUEHL* 26,215 12,913 n /a 103% n / a

Average transaction value

Abercrombie & Fitch $ 76.16 $ 67.54 $ 62.15 13% 9%

abercrombie $ 64.47 $ 57.10 $ 53.98 13% 6%

Hollister $ 53.03 $ 48.33 $ 45.04 10% 7%

RUEHL* $ 110.74 $ 97.16 n /a 14% n / a

Average units per transaction

Abercrombie & Fitch 2.18 2.22 2.24 (2)% 1%

abercrombie 2.66 2.68 2.68 (1)% nm

Hollister 2.21 2.18 2.14 1% 2%

RUEHL* 2.28 2.17 n / a 5% n / a

Average unit retail sold

Abercrombie & Fitch $ 34.94 $ 30.42 $ 27.75 15% 10%

abercrombie $ 24.24 $ 21.31 $ 20.14 14% 6%

Hollister $ 24.00 $ 22.17 $ 21.05 8% 5%

RUEHL* $ 48.57 $ 44.77 n /a 8% n /a

* Net sales for RUEHL during Fiscal 2004 and Fiscal 2005, and the related statistics, reflect the

activity of three stores opened in September 2004, one store opened in December 2004, and four stores

opened in 2005; as a result, year-to-year comparisons may not be meaningful.

** A store is included in comparable store sales when it has been open as the same brand at least one

year and its square footage has not been expanded or reduced by more than 20% within the past year.

12

MANAGEMENT’S DISCUSSION AND ANALYSIS