Abercrombie & Fitch 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

addition to those listed above, that may cause actual results to differ

materially from those contained in the forward-looking statements.

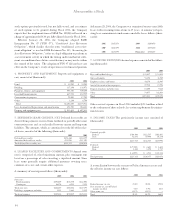

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK The Company maintains its cash equiv-

alents in financial instruments with original maturities of 90 days or

less. The Company also holds investments in marketable securities,

which consist primarily of investment grade municipal notes and

bonds and investment grade auction rate securities, all classified as

available-for-sale and could have maturities ranging from three months

to 40 years. These securities are consistent with the investment objec-

tives contained within the investment policy established by the

Company’s Board of Directors. The basic objectives of the investment

policy are the preservation of capital, maintaining sufficient liquidity

to meet operating requirements and maximizing net after-tax yield.

Investments in municipal notes and bonds have early redemp-

tion provisions at predetermined prices. Taking these provisions into

account none of these investments extend beyond five years. The

Company believes that a significant increase in interest rates could

result in a material loss if the Company sells the investment prior to

the early redemption provision. For Fiscal 2005, there were no real-

ized gains or losses, and as of January 28, 2006, net unrealized hold-

ing losses were $718,000.

Despite the underlying long-term maturity of auction rate secu-

rities, from the investor’s perspective, such securities are priced and

subsequently traded as short-term investments because of the inter-

est rate reset feature. Interest rates are reset through an auction

process at predetermined periods ranging from one to 49 days. Failed

auctions rarely occur. As of January 28, 2006, the Company held

approximately $411.2 million in marketable securities.

The Company does not enter into financial instruments for

trading purposes.

As of January 28, 2006, the Company had no long-term debt

outstanding. Future borrowings would bear interest at negotiated

rates and would be subject to interest rate risk.

The Company’s market risk profile as of January 28, 2006 has

not significantly changed since January 29, 2005.

25

Abercrombie &Fitch