Abercrombie & Fitch 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

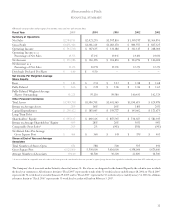

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for Fiscal 2004 was $738.2 million compared to $597.4 million

for Fiscal 2003. For Fiscal 2004, the stores and distribution expense rate

was 36.5% compared to 35.0% in Fiscal 2003. Stores and distribution

expense was as follows:

Fifty-Two Weeks Ended

January 29, 2005 January 31, 2004

(millions) % of net sales (millions) % of net sales

Store Payroll Expense $218.4 10.8% $158.5 9.3%

Store Management Expense

(1)

26.7 1.3% 18.5 1.1%

Rent, Utilities and Other 224.4 11.1% 197.5 11.6%

Landlord Expense

Depreciation and Amortization 96.1 4.8% 78.1 4.6%

Repairs and Maintenance 34.7 1.7% 25.6 1.5%

Expense

Other Store Expenses

(2)

84.3 4.2% 66.0 3.9%

Total Stores Expense $684.6 33.9% $544.2 31.9%

Direct-to-Consumer Expense 33.1 1.6% 34.8 2.0%

Distribution Center Expense 20.5 1.0% 18.4 1.1%

Total Stores and

Distribution Expense $738.2 36.5% $597.4 35.0%

(1)

Previously reported within Store Payroll Expense.

(2)

Includes packaging, supplies, credit card fees and other store support functions.

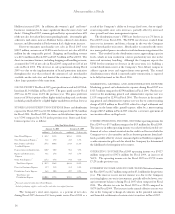

The Company’s total store expense for Fiscal 2004, as a percent of

net sales, increased versus Fiscal 2003 as a result of the Company

beginning to implement its store investment program during the

fourth quarter of Fiscal 2004, offset by leverage of rent, utilities and

other landlord expense as a result of the increase in comparable store

sales. In Fiscal 2004, the distribution center’s UPH increased 10%

over the Fiscal 2003 results.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during Fiscal 2004

was $259.8 million compared to $155.6 million during Fiscal 2003.

For Fiscal 2004, the marketing, general and administrative expense

rate was 12.9% compared to 9.1% in Fiscal 2003. The increase in the

marketing, general and administrative expense rate was due to a non-

recurring charge of $40.9 million in Fiscal 2004, which represented

0.9% of net sales, related to a legal settlement and higher incentive

compensation accruals resulting from the improved financial per-

formance during the fiscal year.

OTHER OPERATING INCOME, NET Other operating income

for Fiscal 2004 was $4.5 million compared to $979,000 for Fiscal

2003. The increase was related to the amount of the gift card liability

recognized as other income for gift cards for which the Company has

determined the likelihood of redemption to be remote.

OPERATING INCOME For Fiscal 2004, operating income was

$347.6 million compared to $331.2 million for Fiscal 2003. The operat-

ing income rate for Fiscal 2004 was 17.2% versus 19.4% in Fiscal 2003.

INTEREST INCOME AND INCOME TAXES Net interest

income for Fiscal 2004 was $5.2 million compared to $3.7 million in

Fiscal 2003. The increase in net interest income was due to an

increase in interest rates and average cash balances for Fiscal 2004

when compared to Fiscal 2003. Beginning in January 2005, the

Company began investing in taxable money market investments; prior

thereto, the Company invested in tax-free securities. The effective tax

rate for Fiscal 2004 was 38.7% compared to 38.8% for Fiscal 2003.

NET INCOME AND NET INCOME PER SHARE Net income for

Fiscal 2004 was $216.4 million versus $204.8 million for Fiscal 2003, an

increase of 5.7%. Net income for Fiscal 2004 included the after-tax

impact of the legal settlement of $25.6 million. Net income per fully-

diluted weighted-average share was $2.28 in Fiscal 2004 versus $2.06 in

Fiscal 2003, an increase of 10.7%. The percentage increase in net income

per fully-diluted share was greater than the percentage increase in net

income due to the Company’s repurchase program in Fiscal 2004. The

Company repurchased 11.2 million shares in Fiscal 2004.

FINANCIAL CONDITION Continued growth in net income

resulted in higher cash provided by operating activities. A more detailed

discussion of liquidity, capital resources and capital requirements follows.

LIQUIDITY AND CAPITAL RESOURCES The Company

believes cash provided by operating activities and cash on hand will

continue to provide adequate resources to support operations, including

projected growth, seasonal requirements and capital expenditures.

Furthermore, the Company expects that cash from operating activities

will fund dividends currently being paid at a rate of $0.175 per share

per quarter. The Board of Directors will review the Company’s cash

position and results of operations and approve the appropriateness of

future dividend amounts.

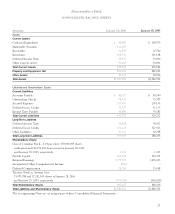

A summary of the Company’s working capital (current assets less

current liabilities) position and capitalization for the last three fiscal

years follows (thousands):

2005 2004 2003

Working capital $455,530 $241,572 $466,970

Capitalization:

Shareholders’ equity $995,117 $669,326 $857,765

The increase in working capital in Fiscal 2005 versus Fiscal 2004 was

the result of higher cash and marketable securities resulting primarily from

the Company’s net sales increase and the increase in inventory, partially

offset by an increase in income taxes payable. The decrease in working

capital in Fiscal 2004 versus Fiscal 2003 was the result of lower cash and

marketable securities resulting primarily from the Company’s repur-

chase of 11.2 million shares of common stock at a cost of $434.7 million.

Abercrombie &Fitch

19