Westjet 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 84

15. Financial instruments and risk management (continued)

(b) Risk management related to financial instruments (continued)

Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge

an obligation. At December 31, 2014, the Corporation’s credit exposure consists primarily of the carrying amounts of cash and

cash equivalents, restricted cash, accounts receivable, deposits and the fair value of derivative financial assets.

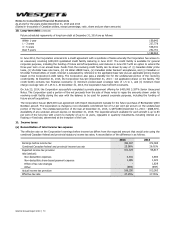

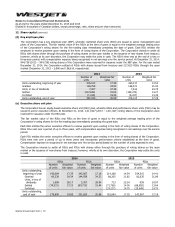

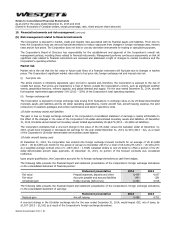

The Corporation’s maximum exposure to credit risk is represented by the balances in the aforementioned accounts:

2014 2013

Cash and cash equivalents(i)

1,358,071 1,256,005

Restricted cash(i)

58,149 58,106

Accounts receivable

(ii)

54,950 42,164

Deposits

(iii)

25,204 32,021

Derivative financial assets

(iv)

6,409 11,568

(i) Consist of bank balances and short-term investments with terms of up to 91 days. Credit risk associated with cash and cash equivalents and restricted

cash is minimized substantially by ensuring that these financial assets are invested primarily in debt instruments with highly rated financial institutions,

some with provincial-government-backed guarantees. The Corporation manages its exposure by assessing the financial strength of its counterparties

and by limiting the total exposure to any one individual counterparty.

(ii) All significant counterparties, both current and new, are reviewed and approved for credit on a regular basis under the Corporation’s credit management

policies. The Corporation does not hold any collateral as security, however, in some cases the Corporation requires guaranteed letters of credit with

certain of its counterparties. Trade receivables are generally settled within 30 to 60 days. Industry receivables are generally settled in less than 30 days.

(iii) The Corporation is not exposed to counterparty credit risk on its deposits that relate to purchased aircraft, as the funds are held in a security trust

separate from the assets of the financial institution. While the Corporation is exposed to counterparty credit risk on its deposit relating to airport

operations, it considers this risk to be remote because of the nature and size of the counterparty.

(iv) Derivative financial assets consist of foreign exchange forward contracts and interest rate swap contracts. The Corporation reviews the size and credit

rating of both current and any new counterparties in addition to limiting the total exposure to any one counterparty.

There were no new bad debts recorded for the year ended December 31, 2014 (2013 - $69). For the year ended December 31,

2014, the Corporation revised its estimate for its allowance for doubtful accounts relating to value-added tax (VAT) in a foreign

jurisdiction. The effect of recording this change in estimate for the year ended December 31, 2014, is a reduction to

Aircraft fuel

and

Airport operations

expense on the consolidated statement of earnings by $20,234 and $2,869, respectively. The

Corporation’s change in estimate is based on the successful outcome of filed VAT returns. The Corporation has no remaining

VAT amounts recorded in its allowance for doubtful accounts.

Liquidity risk

Liquidity risk is the risk that the Corporation will encounter difficulty in meeting obligations associated with financial liabilities.

The Corporation maintains a strong liquidity position and sufficient financial resources to meet its obligations as they fall due.

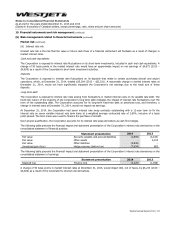

The table below presents a maturity analysis of the Corporation’s undiscounted contractual cash flows for its non-derivative and

derivative financial liabilities at December 31, 2014. The analysis is based on foreign exchange and interest rates in effect at the

consolidated statement of financial position date, and includes both principal and interest cash flows for long-term debt.

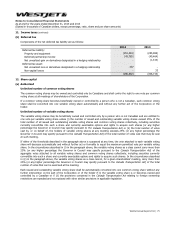

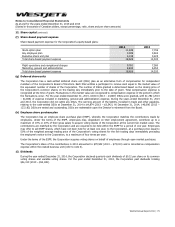

Total Within 1 year 1–3 years 3–5 years Over 5 years

Accounts payable and accrued liabilities

(i)

412,704 412,704 − − −

Derivative financial liabilities

(ii)

7,703 2,858 4,845 − −

Long-term debt 1,363,817 205,626 307,446 588,961 261,784

1,784,224 621,188 312,291 588,961 261,784

(i) Excludes deferred WestJet Rewards liability of $86,870, foreign exchange derivative liabilities of $49 and interest rate derivative liabilities of $2,809.

(ii) Derivative financial liabilities consist of foreign exchange forward contracts of $49 and interest rate derivative contracts of $7,654. The Corporation

reports long-term interest rate derivatives at their net position. At December 31, 2014, net long-term interest rate derivative liabilities were $4,845.

A portion of the Corporation’s cash and cash equivalents balance relates to cash collected with respect to advance ticket sales,

for which the balance at December 31, 2014, was $575,781 (2013 – $551,022). The Corporation has cash and cash equivalents

on hand to have sufficient liquidity to meet its liabilities, when due, under both normal and stressed conditions. At December 31,

2014, the Corporation had cash and cash equivalents on hand of 2.36 times (2013 – 2.28) the advance ticket sales balance.

The Corporation aims to maintain a current ratio, defined as current assets over current liabilities, of at least 1.00. At December

31, 2014, the Corporation’s current ratio was 1.29 (2013 – 1.09). At December 31, 2014, the Corporation has not been required

to post collateral with respect to any of its outstanding derivative contracts.