Westjet 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 81

15. Financial instruments and risk management (continued)

(a) Fair value of financial assets and financial liabilities (continued)

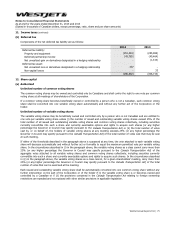

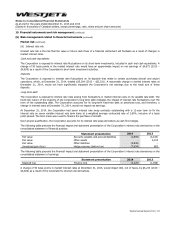

The following items shown in the consolidated statement of financial position at December 31, 2014 and 2013, are measured at

fair value on a recurring basis using level 1 or level 2 inputs. The fair value of the financial assets and liabilities at December 31,

2014, using level 3 inputs, was $nil (2013 − $nil).

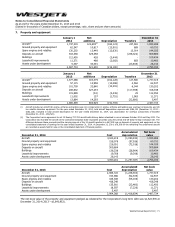

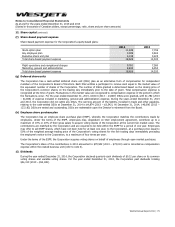

December 31, 2014 Level 1

Level 2

Total

Asset (liability):

Cash and cash equivalents

(i)

1,416,220 − 1,416,220

Foreign exchange derivatives − 6,360 6,360

Interest rate derivatives − (7,654) (7,654)

Deposits 25,204 − 25,204

1,441,424

(1,294)

1,440,130

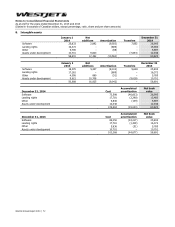

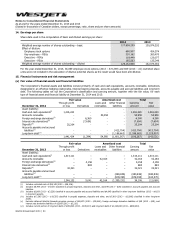

December 31, 2013 Level 1

Level 2

Total

Asset (liability):

Cash and cash equivalentsP

(i)

1,314,111 − 1,314,111

Foreign exchange derivatives − 4,158 4,158

Interest rate derivatives − 883 883

Deposits 32,021 − 32,021

1,346,132

5,041

1,351,173

(i) Includes restricted cash of $58,149 (2013 – $58,106).

During the years ended December 31, 2014 and 2013, there were no transfers between level 1, level 2 and level 3 financial

assets and liabilities measured at fair value.

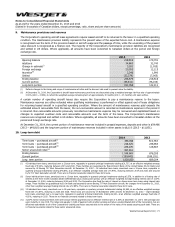

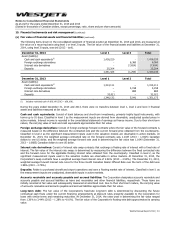

Cash and cash equivalents: Consist of bank balances and short-term investments, primarily highly liquid instruments, with

terms up to 91 days. Classified in level 1 as the measurement inputs are derived from observable, unadjusted quoted prices in

active markets. Interest income is recorded in the consolidated statement of earnings as finance income. Due to their short-term

nature, the carrying value of cash and cash equivalents approximates their fair value.

Foreign exchange derivatives: Consist of foreign exchange forward contracts where the fair value of the forward contracts is

measured based on the difference between the contracted rate and the current forward price obtained from the counterparty.

Classified in level 2 as the significant measurement inputs used in the valuation models are observable in active markets. At

December 31, 2014, the weighted average contracted rate on the forward contracts was 1.1187 (2013 – 1.0425) Canadian

dollars to one US dollar, and the weighted average forward rate used in determining the fair value was 1.1640 (December 31,

2013 – 1.0683) Canadian dollars to one US dollar.

Interest rate derivatives: Consist of interest rate swap contracts that exchange a floating rate of interest with a fixed rate of

interest. The fair value of the interest rate swaps is determined by measuring the difference between the fixed contracted rate

and the forward curve for the applicable floating interest rates obtained from the counterparty. Classified in level 2, as the

significant measurement inputs used in the valuation models are observable in active markets. At December 31, 2014, the

Corporation’s swap contracts have a weighted average fixed interest rate of 2.60% (2013 – 2.59%). The December 31, 2013,

weighted average forward interest rate curve for the three month Canadian Dealer Offered Rate over the term of the debt was

1.96% (2013 – 2.76%).

Deposits: Relate to purchased aircraft and airport operations and earn a floating market rate of interest. Classified in level 1 as

the measurement inputs are unadjusted, observable inputs in active markets.

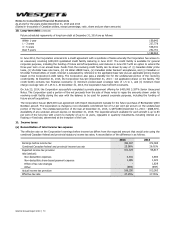

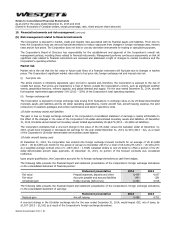

Accounts receivable and accounts payable and accrued liabilities: The Corporation designates accounts receivable and

accounts payable and accrued liabilities as loans and receivables and other financial liabilities, respectively. These items are

initially recorded at fair value and subsequently measured at amortized cost. Due to their short-term nature, the carrying value

of accounts receivable and accounts payable and accrued liabilities approximate their fair value.

Long-term debt: The fair value of the Corporation’s fixed-rate long-term debt is determined by discounting the future

contractual cash flows under the current financing arrangements at discount rates presently available to the Corporation for

loans with similar terms and remaining maturities. At December 31, 2014, the rates used in determining the fair value ranged

from 1.30% to 3.44% (2013 – 1.28% to 4.10%). The fair value of the Corporation’s floating-rate debt approximates its carrying

value.