Westjet 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2014│24

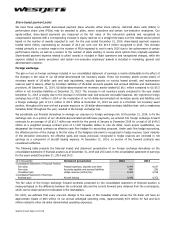

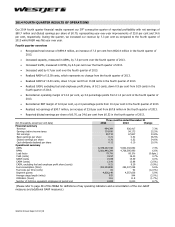

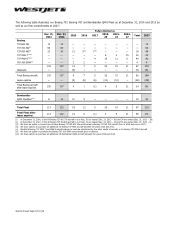

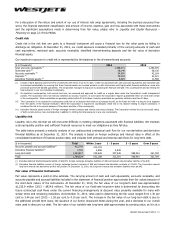

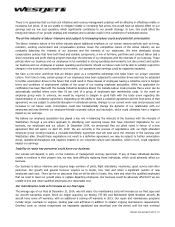

The following table presents the financial impact and statement presentation of the interest rate swap agreements on the

consolidated statement of financial position at December 31, 2014 and 2013 and on the consolidated statement of earnings

for the years ended December 31, 2014 and 2013.

($ in thousands)

Statement presentation

2014

2013

Consolidated Statement of Financial Position:

Fair value Accounts payable and accrued liabilities (2,809) (3,220)

Fair value Other liabilities (4,845) −

Fair value

Other long-term assets

−

4,103

Unrealized gain (loss)

Hedge reserves (before tax)

(7,654)

883

Consolidated Statement of Earnings:

Realized loss Finance costs (3,225) (1,058)

The fair value of the interest rate swap agreements is measured based on the difference between the fixed swap rate and the

forward curve for the applicable floating interest rates obtained from the counterparty, which can be observed and

corroborated in the marketplace.

During the first quarter of 2014, Standard & Poor’s Rating Services (S&P) assigned WestJet an issuers 'BBB-' long-term

corporate credit rating with a stable outlook. S&P’s issuer credit ratings range from a high of AAA to a low of D and are an

opinion about an obligor’s overall creditworthiness but do not apply to any specific financial obligation. Our credit rating is

intended to provide investors with an external measure of our overall creditworthiness. Credit ratings are not

recommendations to buy, sell or hold our securities and do not address the market price or suitability of a specific security for

a particular investor. There is no assurance that our rating will remain in effect for any given period of time or that our rating

will not be revised or withdrawn entirely by S&P in the future if, in its judgment, circumstances so warrant. We paid a

customary fee to S&P for credit rating services.

In July 2014, we successfully completed a private placement offering of $400.0 million 3.287 per cent Senior Unsecured

Notes. The notes bear interest of 3.287 per cent per year with semi-annual interest payments on January 23 and July 23 of

each year commencing on January 23, 2015 and will mature on July 23, 2019. These unsecured notes rank equally in right of

payment with all our other existing and future unsubordinated debt, but are effectively subordinate to all of our existing and

future secured debt to the extent of the value of the assets securing such debt. There are no financial covenant requirements

associated with the Senior Unsecured Notes. The unsecured bond market represents a significant new source of financing for

WestJet, which adds considerable flexibility in the funding of our fleet plan going forward. A portion of the net proceeds from

the sale of these notes was used to repay indebtedness under our revolving credit facility, with the balance to be used for

general corporate purposes, including the funding of future aircraft acquisitions.

We have a credit agreement with a syndicate of banks whereby we have access to an unsecured revolving $250.0 million

credit facility. The credit facility is available for general corporate purposes, including funding of future aircraft acquisitions,

and matures in September 2017 with an option to extend the three-year term on an annual basis. Funds from the credit

facility can be drawn in Canadian or US dollars through various debt instruments. Interest is calculated by reference to the

applicable base rate for the chosen instrument plus an applicable pricing margin based on our debt rating. At December 31,

2014, we have not drawn on the revolving credit facility and therefore the undisbursed portion of the credit facility was $250.0

million. We pay a standby fee for the undisbursed portion of the credit facility. Our revolving credit facility contains two

financial covenants: (i) minimum pooled asset coverage ratio of 1.5 to 1, and (ii) minimum fixed charge coverage ratio of 1.25

to 1. At December 31, 2014, the Corporation was in compliance with both ratios.

We also have an $820.0 million guaranteed loan agreement with EDC pursuant to which EDC will make available to WestJet

Encore financing support for the purchase of Bombardier Q400s. We are charged a non-refundable commitment fee of 0.2 per

cent per annum on the undisbursed portion of the commitment. Availability of any undrawn amount will expire at the end of

2018. The expected amount available for each aircraft is up to 80 per cent of the net price with a term to maturity of up to 12

years, payable in quarterly instalments. At December 31, 2014, we have $575.1 million undrawn under the loan agreement.

We continuously evaluate the optimum balance and sources of financing available to us based on our internal requirements

and capital structure as well as the external environment for aircraft financing.