Westjet 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

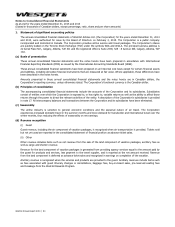

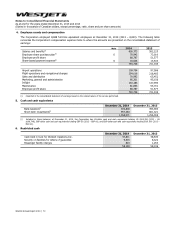

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 67

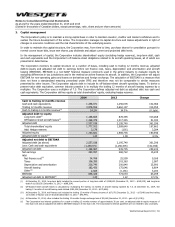

1. Statement of significant accounting policies (continued)

(t) Critical accounting judgments and estimates (continued)

Judgments (continued)

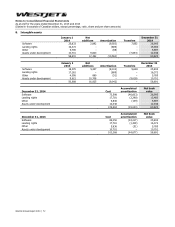

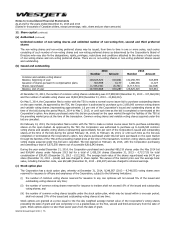

(vii) Assets held for sale

The classification of five Boeing 737-700 series aircraft as held for sale is based on judgements applied by management in

determining the probability of the sale, the timing of when the asset is available for sale and whether the asset comprises a

separate operating component of the entity. Among other items, management considered the condition of the asset subject to

sale, the presence of a buyer and whether the asset is considered a separate line of business, geographic segment or subsidiary.

Based on these considerations, the Corporation has recognized five Boeing 737-700 series aircraft as held for sale at December

31, 2014. A key judgement, amongst other factors, that resulted in the aircraft being classified as held for sale on the

consolidated statement of financial position and presented in continuting operations on the consolidated statement of earnings

was the identification of the major aircraft components to be delivered with each aircraft and the aircraft not being managed as

a separate component from the fleet as a whole.

Estimates

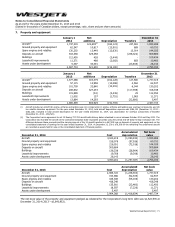

(viii) Depreciation and amortization

Depreciation and amortization are calculated to write-off the cost, less estimated residual value, of assets on a systematic and

rational basis over their expected useful lives. Estimates of residual value and useful lives are based on data and information

from various sources including vendors, industry publications, and company-specific history. Expected useful lives and residual

values are reviewed annually for any change to estimates and assumptions.

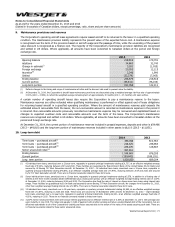

(ix) Maintenance provisions

The Corporation has a legal obligation to adhere to certain maintenance conditions set out in its aircraft operating lease

agreements relating to the condition of the aircraft when it is returned to the lessor. To fulfill these obligations, a provision is

made during the lease term. Estimates related to the maintenance provision include the likely utilization of the aircraft, the

expected future cost of the maintenance, the point in time at which maintenance is expected to occur, the discount rate used to

present value the future cash flows and the lifespan of life-limited parts. These estimates are based on data and information

obtained from various sources including the lessor, current maintenance schedules and fleet plans, contracted costs with

maintenance service providers, other vendors and company-specific history.

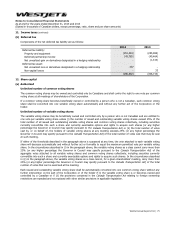

(x) Income taxes

Deferred tax assets and liabilities contain estimates about the nature and timing of future permanent and temporary differences

as well as the future tax rates that will apply to those differences. Changes in tax laws and rates as well as changes to the

expected timing of reversals may have a significant impact on the amounts recorded for deferred tax assets and liabilities.

Management closely monitors current and potential changes to tax law and bases its estimates on the best available information

at each reporting date.

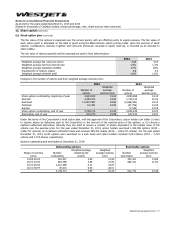

(xi) Fair value of equity-settled share-based payments

The Corporation uses an option pricing model to determine the fair value of certain share-based payments. Inputs to the model

are subject to various estimates relating to volatility, interest rates, dividend yields and expected life of the units issued. Fair

value inputs are subject to market factors as well as internal estimates. The Corporation considers historic trends together with

any new information to determine the best estimate of fair value at the date of grant.

Separate from the fair value calculation, the Corporation is required to estimate the expected forfeiture rate of equity-settled

share-based payments. The Corporation has assessed forfeitures to be insignificant based on the underlying terms of its

payment plans.

(xii) Fair value of derivative instruments

The fair value of derivative instruments is estimated using inputs, including forward prices, foreign exchange rates, interest rates

and historical volatilities. These inputs are subject to change on a regular basis based on the interplay of various market forces.

Consequently, the fair value of the Corporation’s derivative instruments are subject to regular changes in fair value each

reporting period.