Westjet 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2014│50

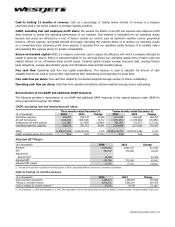

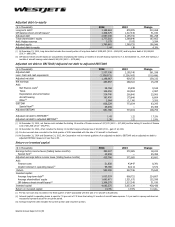

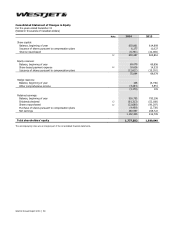

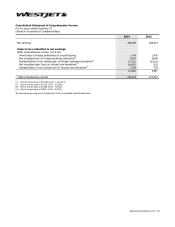

Adjusted debt-to-equity

($ in thousands)

2014

2013

Change

Long-term debt(i) 1,188,663 878,395 310,268

Off-balance-sheet aircraft leases

(ii)

1,368,375

1,317,345

51,030

Adjusted debt

2,557,038

2,195,740

361,298

Total shareholders’ equity 1,777,502 1,589,840 187,662

Add: Hedge reserves

3,179

(105)

3,284

Adjusted equity

1,780,681

1,589,735

190,946

Adjusted debt-to-equity 1.44 1.38 4.3%

(i) At December 31, 2014, long-term debt includes the current portion of long-term debt of $159,843 (2013 – $189,191) and long-term debt of $1,028,820

(2013 – $689,204).

(ii) Off-balance-sheet aircraft leases are calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. At December 31, 2014, the trailing 12

months of aircraft leasing costs totaled $182,450 (2013 – $175,646).

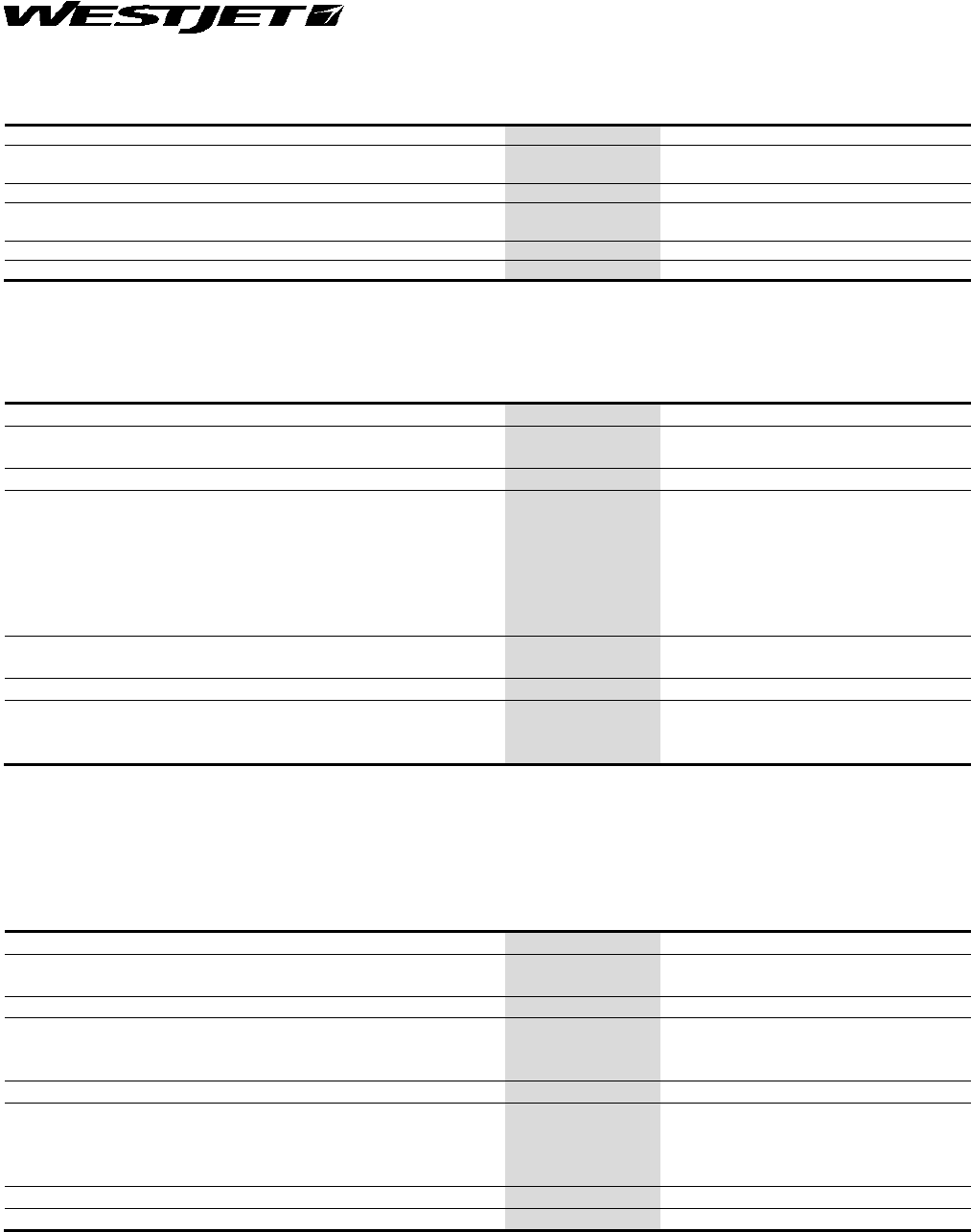

Adjusted net debt to EBITDAR/Adjusted net debt to adjusted EBITDAR

($ in thousands) 2014 2013 Change

Adjusted debt

2,557,038 2,195,740 361,298

Less: Cash and cash equivalents (1,358,071) (1,256,005) (102,066)

Adjusted net debt

1,198,967

939,735

259,232

Net earnings 283,957 268,722 15,235

Add:

Net finance costs(i)

34,768 25,599 9,169

Taxes 106,350 103,363 2,987

Depreciation and amortization 226,740 200,840 25,900

Aircraft leasing 182,450 175,646 6,804

Other(ii)

2,064 (1,136) 3,200

EBITDAR 836,329 773,034 63,295

Special item(iii)

45,459 ― 45,459

Adjusted EBITDAR 881,788 773,034 108,754

Adjusted net debt to EBITDAR(iv) 1.43 1.22 17.2%

Adjusted net debt to adjusted EBITDAR

(iv)

1.36 1.22 11.9%

(i) At December 31, 2014, net finance costs includes the trailing 12 months of finance income of $17,070 (2013 – $17,848) and the trailing 12 months of finance

cost of $51,838 (2013 – $43,447).

(ii) At December 31, 2014, other includes the trailing 12 months foreign exchange loss of $2,064 (2013 – gain of $1,136).

(iii) Pre-tax non-cash loss recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest.

(iv) At December 31, 2014 and December 31, 2013, the Corporation met its internal guideline of an adjusted net debt to EBITDAR and an adjusted net debt to

adjusted EBITDAR measure of less than 2.50.

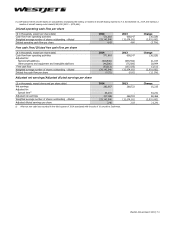

Return on invested capital

($ in thousands) 2014 2013 Change

Earnings before income taxes (trailing twelve months) 390,307 372,085 18,222

Special item(i)

45,459 ― 45,459

Adjusted earnings before income taxes (trailing twelve months)

435,766 372,085 63,681

Add:

Finance costs 51,838 43,447 8,391

Implicit interest in operating leases

(ii)

95,786

92,214

3,572

Return 583,390 507,746 75,644

Invested capital:

Average long-term debt(iii) 1,033,529 808,722 224,807

Average shareholders' equity 1,683,671 1,531,072 152,599

Off-balance-sheet aircraft leases(iv) 1,368,375 1,317,345 51,030

Invested capital 4,085,575 3,657,139 428,436

Return on invested capital 14.3% 13.9% 0.4 pts.

(i) Pre-tax non-cash loss recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest.

(ii) Interest implicit in operating leases is equal to 7.0 per cent of 7.5 times the trailing 12 months of aircraft lease expense. 7.0 per cent is a proxy and does not

necessarily represent actual for any given period.

(iii) Average long-term debt includes the current portion and long-term portion.