Westjet 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2014│18

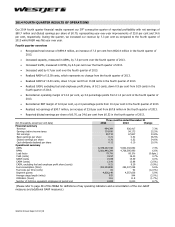

2014 FOURTH QUARTER RESULTS OF OPERATIONS

Our 2014 fourth quarter financial results represent our 39th consecutive quarter of reported profitability with net earnings of

$90.7 million and diluted earnings per share of $0.70, representing year-over-year improvements of 33.8 per cent and 34.6

per cent, respectively. During the quarter, we increased our revenue by 7.3 per cent as compared to the fourth quarter of

2013 while RASM was flat year over year.

Fourth quarter overview

• Recognized total revenue of $994.4 million, an increase of 7.3 per cent from $926.4 million in the fourth quarter of

2013.

• Increased capacity, measured in ASMs, by 7.3 per cent over the fourth quarter of 2013.

• Increased traffic, measured in RPMs, by 6.6 per cent over the fourth quarter of 2013.

• Increased yield by 0.7 per cent over the fourth quarter of 2013.

• Realized RASM of 15.59 cents, which represents no change from the fourth quarter of 2013.

• Realized CASM of 13.40 cents, down 3.5 per cent from 13.88 cents in the fourth quarter of 2013.

• Realized CASM, excluding fuel and employee profit share, of 9.21 cents, down 0.9 per cent from 9.29 cents in the

fourth quarter of 2013.

• Recorded an operating margin of 14.0 per cent, up 3.0 percentage points from 11.0 per cent in the fourth quarter of

2013.

• Recorded an EBT margin of 12.6 per cent, up 2.4 percentage points from 10.2 per cent in the fourth quarter of 2013.

• Realized net earnings of $90.7 million, an increase of 33.8 per cent from $67.8 million in the fourth quarter of 2013.

• Reported diluted earnings per share of $0.70, up 34.6 per cent from $0.52 in the fourth quarter of 2013.

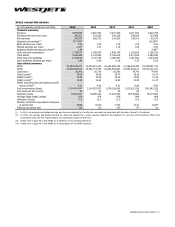

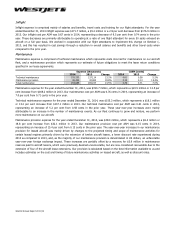

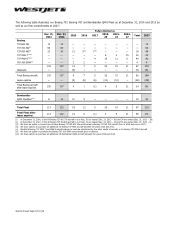

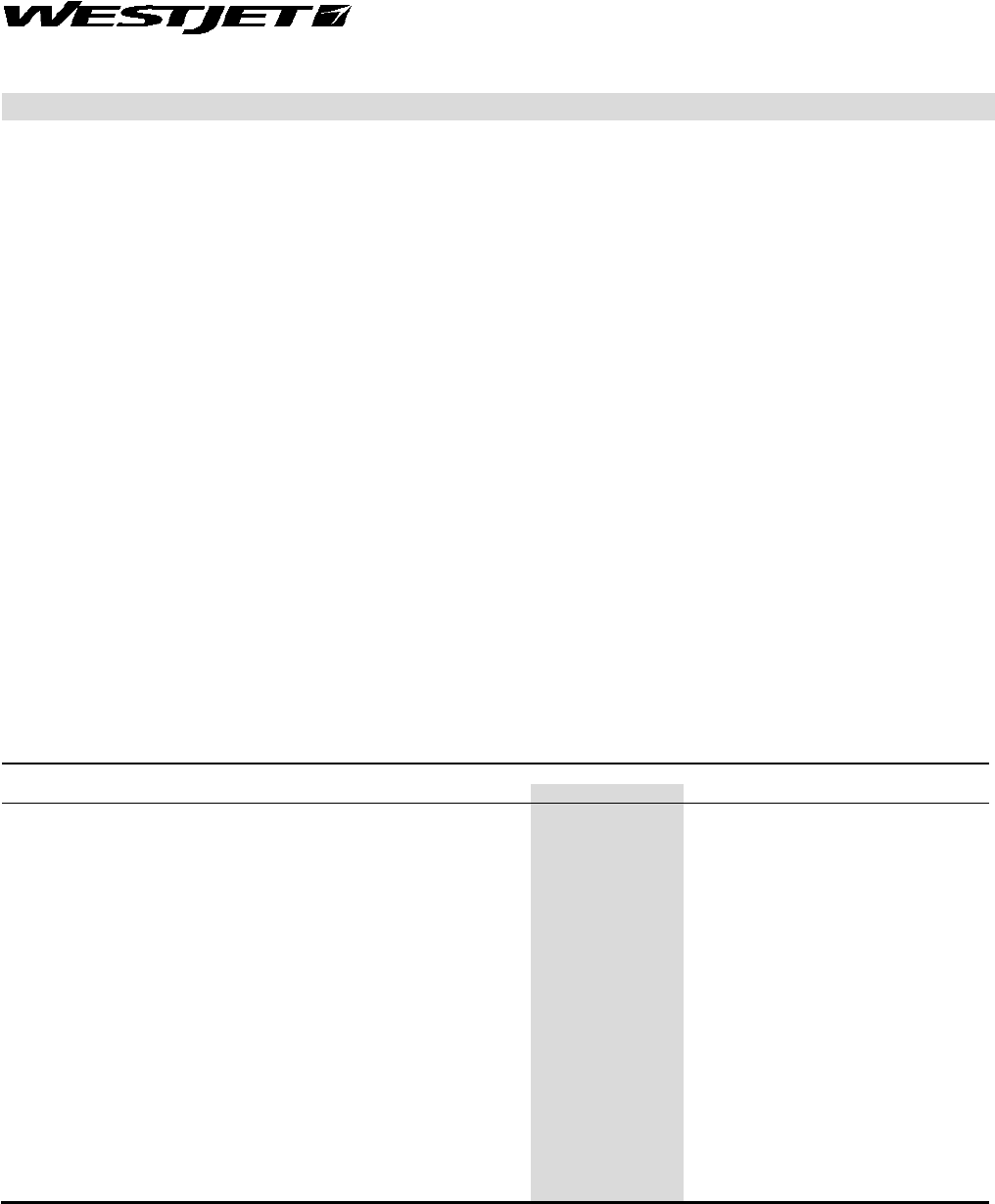

Three months ended December 31

($in thousands, except per unit data) 2014 2013 Change

Financial summary

Revenue 994,394 926,417 7.3%

Earnings before income taxes

124,816

94,173

32.5%

Net earnings

90,713

67,807

33.8%

Basic earnings per share 0.71 0.52 36.5%

Diluted earnings per share

0.70

0.52

34.6%

Cash dividends declared per share 0.12 0.10 20.0%

Operational summary

ASMs

6,378,247,018

5,942,032,692

7.3%

RPMs

5,081,440,294

4,768,595,990

6.6%

Load factor 79.7% 80.3% (0.6pts.)

Yield (cents)

19.57

19.43

0.7%

RASM (cents 15.59 15.59 0.0%

CASM (cents)

13.40 13.88 (3.5%)

CASM, excluding fuel and employee profit share (cents)

9.21

9.29

(0.9%)

Fuel consumption (litres) 300,254,948 284,337,058 5.6%

Fuel costs per litre (cents) 81 92 (12.0%)

Segment guests

4,826,149

4,557,606

5.9%

Average stage length (miles) 925 944 (2.0%)

Utilization (hours) 11.6 11.8 (1.7%)

Number of full-time equivalent employees at period end

8,698

8,000

8.7%

(Please refer to page 48 of this MD&A for definitions of key operating indicators and a reconciliation of the non-GAAP

measures and additional GAAP measures.)