Westjet 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2014│ 33

There is no guarantee that our fuel cost initiatives and revenue management practices will be effective in offsetting volatile or

increasing fuel prices. If we are unable to mitigate volatile or increasing fuel prices, this would have an adverse effect on our

earnings and our low cost operation, which significantly contributes to our growth strategy. In turn, this could affect the

timing and nature of our growth strategy and initiatives and could also result in the curtailment of scheduled service.

The airline industry is labour intensive and subject to increasing labour costs and potential unionization.

The labour intensive nature of the airline industry places additional emphasis on our human resource policies such as hiring,

retention, working environment and compensation policies. Given the competitive nature of the airline industry we are

constantly balancing the interests of our business and the interests of our employees. We have developed strong

compensation policies that have both fixed and variable components, a mix of full-time, part-time and contract labour and a

share ownership and profit sharing program that align the interests of our employees with the interests of our business. These

policies allow our business and our employees to be rewarded in strong operating environments, but also protect and sustain

our business and our employees in weaker operating environments. Should our labour costs not be able to suitably respond to

changes in the economic and competitive environment, our operations and earnings could be negatively impacted.

We have a non-union workforce that we believe gives us a competitive advantage and helps foster our unique corporate

culture. From time to time, certain groups of our employees have been subjected to unionization drives and may be subjected

to further unionization drives in the future that could result in these classes of employees having a collective voice to bargain

terms and conditions of employment outside of the scope of our existing employee association. While no application for

certification has been filed with the Canada Industrial Relations Board, the Canada Labour Code provides that a union can be

automatically certified where more than 50 per cent of a group of employees sign membership cards. In the event an

employee group were to unionize, we would be required to bargain in good faith with the trade union regarding the

implementation of a collective agreement. Depending on the ability to reach a collective agreement and the final terms of that

agreement, we are subject to potential disruption in scheduled service, changes to our current work rules and processes and

increases to our labour costs. Unionization could also fundamentally change the dynamic of our relationship with our

employees and may diminish our employee-friendly corporate culture and reputation, which could ultimately have a negative

impact on our earnings.

We believe our employee association has played a key role in balancing the interests of the business with the interests of

WestJetters through a pro-active approach to identifying and resolving issues that have important implications for our

business, our employees and our culture. In December 2014, we announced that our pilots voted in favour of a new

agreement that will expire on April 20, 2019. We are currently in the process of negotiations with our flight attendant

employee group working towards a mutually-beneficially agreement that will best serve the interests of the business and

WestJetters alike. Should these negotiations not result in a definitive agreement, we may be subject to further unionization

drives, operational disruptions and negative impacts to our corporate culture and reputation, which in turn, could negatively

impact our earnings.

Inability to retain key personnel could harm our business.

Our success will depend, in part, on the retention of management and key personnel. If any of these individuals become

unable to continue in their present role, we may have difficulty replacing these individuals, which could adversely affect our

business.

Our business is labour intensive and requires large numbers of pilots, flight attendants, mechanics, guest service and other

personnel. Our growth and general turnover requires us to locate, hire, train and retain a significant number of new

employees each year. There can be no assurance that we will be able to locate, hire, train and retain the qualified employees

that we need to meet our growth plans or replace departing employees. Our business would be adversely affected if we are

unable to hire and retain qualified employees at a reasonable cost.

Our maintenance costs will increase as our fleet ages.

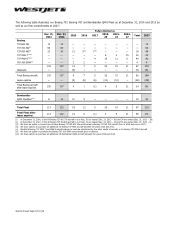

The average age of our fleet at December 31, 2014, was 6.8 years. Our maintenance costs will increase as our fleet ages and

our aircraft warranties expire. Since we began acquiring our Boeing 737 NG and Bombardier Q400 NextGen aircraft, 86

aircraft have come off warranty, with an additional 6 coming off warranty in 2015. Our repair and maintenance programs

include larger overhauls to engines, landing gear and airframes in addition to smaller ongoing maintenance requirements.

Overhaul costs on owned components are separately capitalized and amortized over the period until the next overhaul