Westjet 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 77

12. Share capital (continued)

(c) Stock option plan (continued)

The fair value of the options is expensed over the service period, with an offsetting entry to equity reserves. The fair value of

each option grant is estimated on the date of grant using the Black-Scholes option pricing model. Upon the exercise of stock

options, consideration received, together with amounts previously recorded in equity reserves, is recorded as an increase to

share capital.

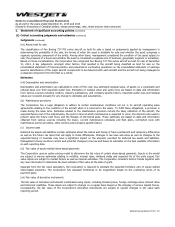

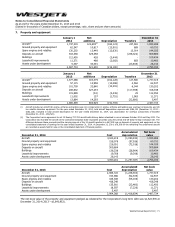

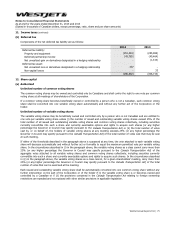

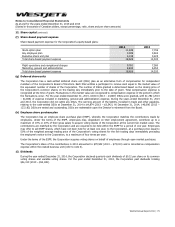

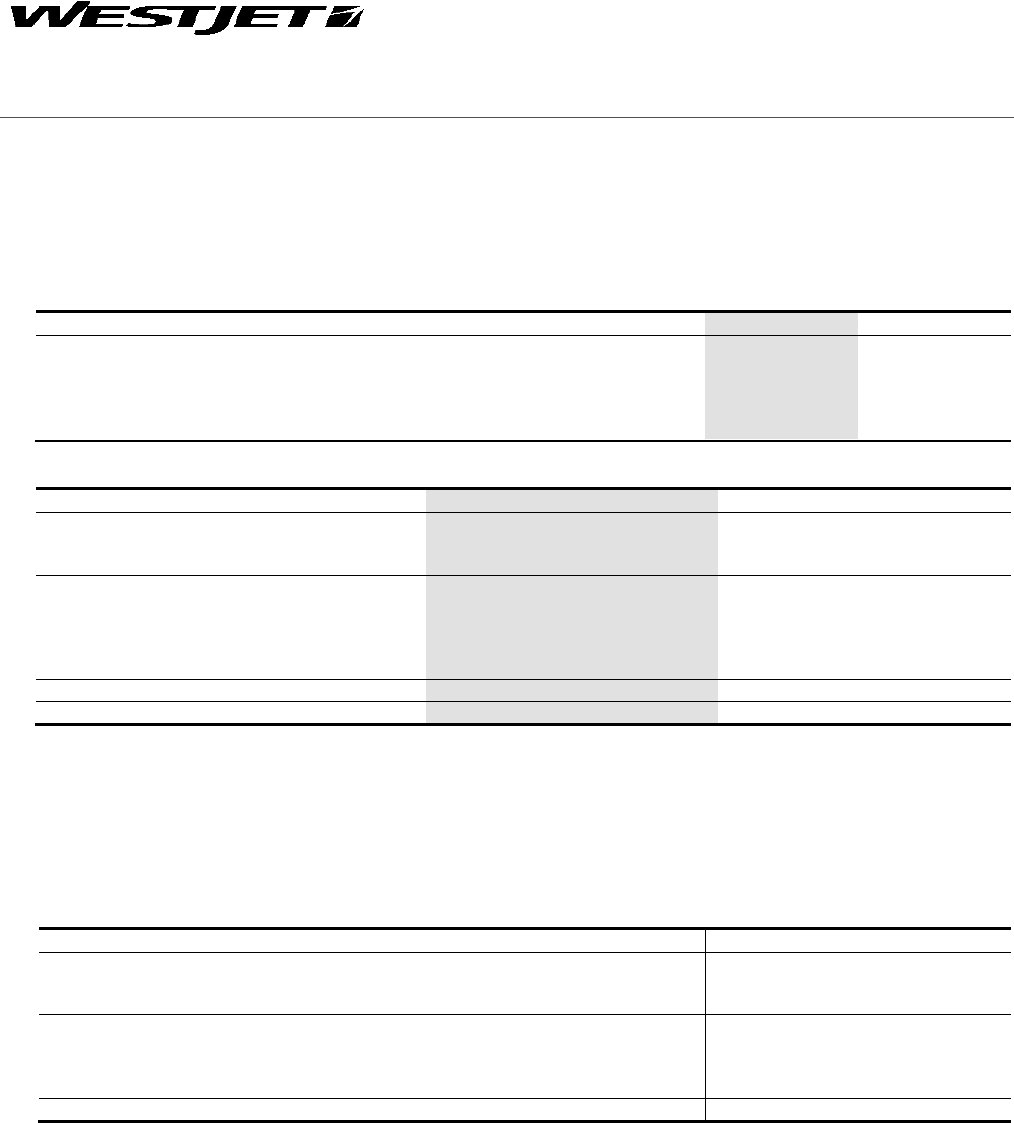

The fair value of options granted and the assumptions used in their determination:

2014 2013

Weighted average fair value per option

4.55

4.54

Weighted average risk-free interest rate 1.5% 1.3%

Weighted average expected volatility 27% 29%

Expected life of options (years)

3.8

3.9

Weighted average dividend yield 1.6% 1.6%

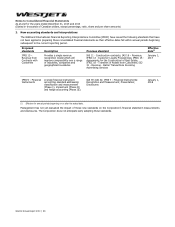

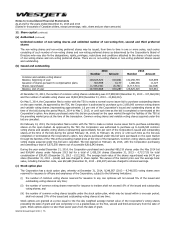

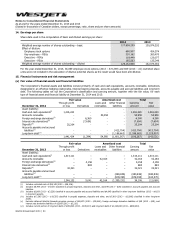

Changes in the number of options and their weighted average exercise price:

2014 2013

Number of

options

Weighted

average

exercise price Number of

options

Weighted

average

exercise price

Stock options outstanding, beginning of year 2,834,639 19.20 3,850,898 14.45

Granted 2,353,474 23.94 1,722,013 21.92

Exercised (1,447,250) 18.82 (2,668,440) 14.24

Forfeited

(2,149)

22.90

(67,796)

14.05

Expired - - (2,036) 13.55

Stock options outstanding, end of year

3,738,714

22.33

2,834,639

19.20

Exercisable, end of year 912,772 19.38 637,292 14.57

Under the terms of the Corporation's stock option plan, with the approval of the Corporation, option holders can either (i) elect

to receive shares by delivering cash to the Corporation in the amount of the exercise price of the options, or (ii) choose a

cashless settlement alternative, whereby they can elect to receive a number of shares equivalent to the market value of the

options over the exercise price. For the year ended December 31, 2014, option holders exercised 1,442,006 options (2013 –

2,660,717 options) on a cashless settlement basis and received 495,354 shares (2013 – 1,064,373 shares). For the year ended

December 31, 2014, 5,244 options were exercised on a cash basis and option holders received 5,244 shares (2013 – 7,723

options and 7,723 shares, respectively).

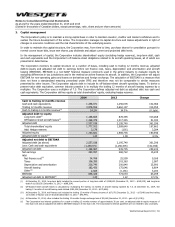

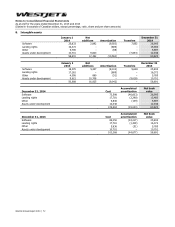

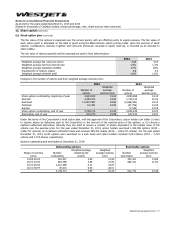

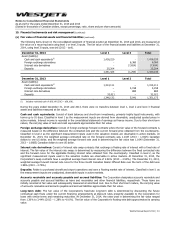

Options outstanding and exercisable at December 31, 2014:

Outstanding options Exercisable options

Range of exercise

prices Number

outstanding

Weighted average

remaining life

(years)

Weighted

average exercise

price Number

exercisable

Weighted

average exercise

price

13.85-20.00

502,547

2.99

14.94

330,361

14.89

20.01-23.00 883,768 3.66 21.92 582,411 21.92

23.01-26.00 2,312,389 4.12 23.87 - -

26.01-30.97

40,010

6.50

28.01

-

-

3,738,714 3.89 22.33 912,772 19.38