Westjet 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

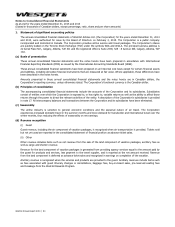

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 63

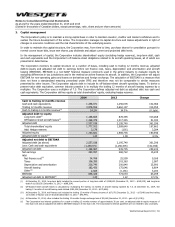

1. Statement of significant accounting policies (continued)

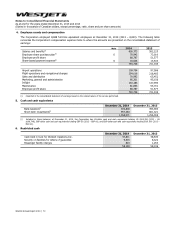

(i) Inventory

Inventories are valued at the lower of cost and net realizable value, with cost being determined on a first-in, first-out basis and a

specific item basis depending on the nature of the inventory. The Corporation’s inventory balance consists of aircraft fuel, de-

icing fluid, retail merchandise and aircraft expendables.

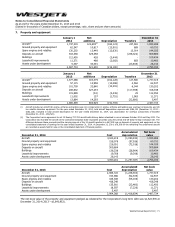

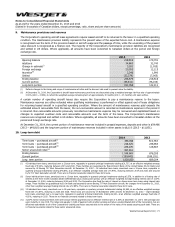

(j) Property and equipment

Property and equipment is stated at cost and depreciated to its estimated residual value. Expected useful lives and depreciation

methods are reviewed annually.

Asset class

Basis

Rate

Aircraft, net of estimated residual value

Straight-line

15 to 20 years

Engine, airframe and landing gear overhaul Straight-line 5 to 15 years

Ground property and equipment Straight-line 3 to 25 years

Spare engines and rotables, net of estimated residual value

Straight-line

15 to 20 years

Buildings Straight-line 40 years

Leasehold improvements Straight-line 5 years/Term of lease

Estimated residual values of the Corporation’s aircraft range between $2,500 and $6,000 per aircraft. Spare engines have an

estimated residual value equal to 10% of the original purchase price. Residual values, where applicable, are reviewed annually

against prevailing market rates at the consolidated statement of financial position date.

Major overhaul expenditures are capitalized and depreciated over the expected life between overhauls. All other costs relating to

the maintenance of fleet assets are charged to the consolidated statement of earnings on consumption or as incurred.

Rotable parts are purchased, depreciated and disposed of, on a pooled basis. When parts are purchased, the cost is added to

the pool and depreciated over its useful life of 15 to 20 years. The cost to repair rotable parts is recognized in maintenance

expense as incurred.

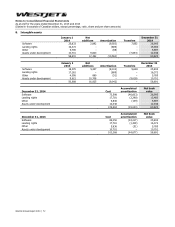

(k) Assets held for sale

The Corporation classifies a non-current asset as held for sale if the carrying amount of the asset will be recovered principally

through a sale transaction instead of through continuing use. The Corporation measures any asset held for sale at the lower of:

(i) its carrying amount, or (ii) fair value less costs to sell. Assets held for sale are not depreciated or amortized and are classified

as a current asset on the consolidated statement of financial position until the sale is complete. If the asset is considered a

separate component of the Corporation, then the operating results of this component will be classified as discontinued

operations on the consolidated statement of earnings. If the asset is not considered a separate component, then the operating

results continue to be included in earnings from continuing operations until the time of sale. Any subsequent changes to the fair

value less costs to sell after classication as held for sale are recognized in profit or loss, not to exceed the original carrying

amount of the assets held for sale.

At December 31, 2014, the Corporation has recognized five aircraft as held for sale. These aircraft form part of a transaction for

the sale of 10 Boeing 737-700 series aircraft. The Boeing 737-700 series aircraft were not assessed to be a separate component

of the entity as they are not managed separately from the entire fleet and therefore, the operating results of these aircraft

continue to be included in earnings from continuing operations on the consolidated statement of earnings until such time that

they are delivered. The five undelivered 737-700 series aircraft are classified as current assets on the consolidated statement of

financial position at the contracted purchase price with the buyer less costs to sell. The difference between the carrying amounts

and contracted purchase price was recorded as a loss on disposal of property and equipment. The Corporation has recorded the

aircraft at the contracted Canadian dollar equivalent proceeds using the period end US-dollar foreign exchange rate.