Westjet 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2014│22

LIQUIDITY AND CAPITAL RESOURCES

Liquidity

As the airline industry has relatively high fixed costs, and as such is highly sensitive to unpredictable circumstances,

maintaining a strong financial position is imperative to an airline’s success. Our consistently strong financial results enable us

to maintain a healthy balance sheet. We completed 2014 with a cash and cash equivalents balance of $1,358.1 million,

compared to $1,256.0 million at December 31, 2013. The increase in our cash position was a result of cash flow from

operations of $571.6 million driven by strong earnings, and cash flow from financing activities of $175.0 million mainly driven

by our $400.0 million 3.287 per cent Senior Unsecured Notes issued in July 2014 partially offset by debt repayments,

described further under the

Financing

heading below. These inflows were partially offset by capital expenditures for aircraft

and other equipment of $665.1 million and a combined total of $100.7 million spent on our dividend and share buy-back

programs.

Part of our cash and cash equivalents balance relates to cash collected with respect to advance ticket sales, for which the

balance at December 31, 2014, was $575.8 million, an increase of 4.5 per cent from $551.0 million at December 31, 2013. We

have cash and cash equivalents on hand to have sufficient liquidity to meet these liabilities, under both normal and stressed

conditions. At December 31, 2014, we had cash on hand of 2.36 (2013 – 2.28) times our advance ticket sales balance.

We monitor capital on a number of measures, including cash to trailing 12 months (TTM) revenue ratio, adjusted debt-to-

equity ratio and adjusted net debt to EBITDAR ratio. As of December 31, 2014, our cash to TTM revenue ratio was 34.2 per

cent, compared to 34.3 per cent at December 31, 2013, relatively unchanged. This is in-line with our expectations and is the

result of an increase in cash and cash equivalents from strong earnings, an increase in our revenues and the issuance of our

Senior Unsecured Notes in July 2014. In addition to our cash and cash equivalents, as of December 31, 2014, we have

available the undrawn portion of our revolving credit facility which is $250.0 million and expires in June 2017. Our adjusted

debt-to-equity ratio of 1.44, and our adjusted net debt to EBITDAR ratio of 1.43 at December 31, 2014, have both increased

from 1.38 and 1.22, respectively, at December 31, 2013. Excluding the pre-tax $45.5 million non-cash loss, our adjusted net

debt to adjusted EBITDAR ratio is 1.36 at December 31, 2014. These increases are in line with our expectations and are due

to increased debt levels associated with the issuance of our Senior Unsecured Notes in July 2014.

Our current ratio, defined as current assets over current liabilities, was 1.29 at December 31, 2014 as compared to 1.09 at

December 31, 2013, an increase of 18.3 per cent due in large part to the cash received from the issuance of our Senior

Unsecured Notes in July 2014 and five aircraft classified as assets held for sale being included in current assets.

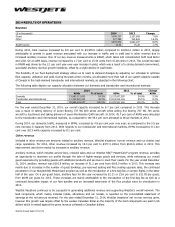

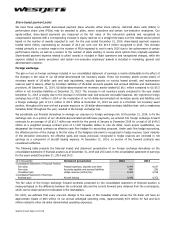

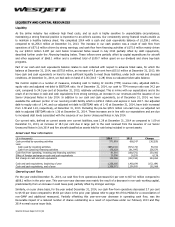

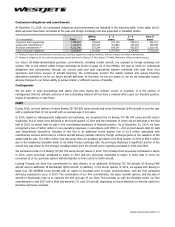

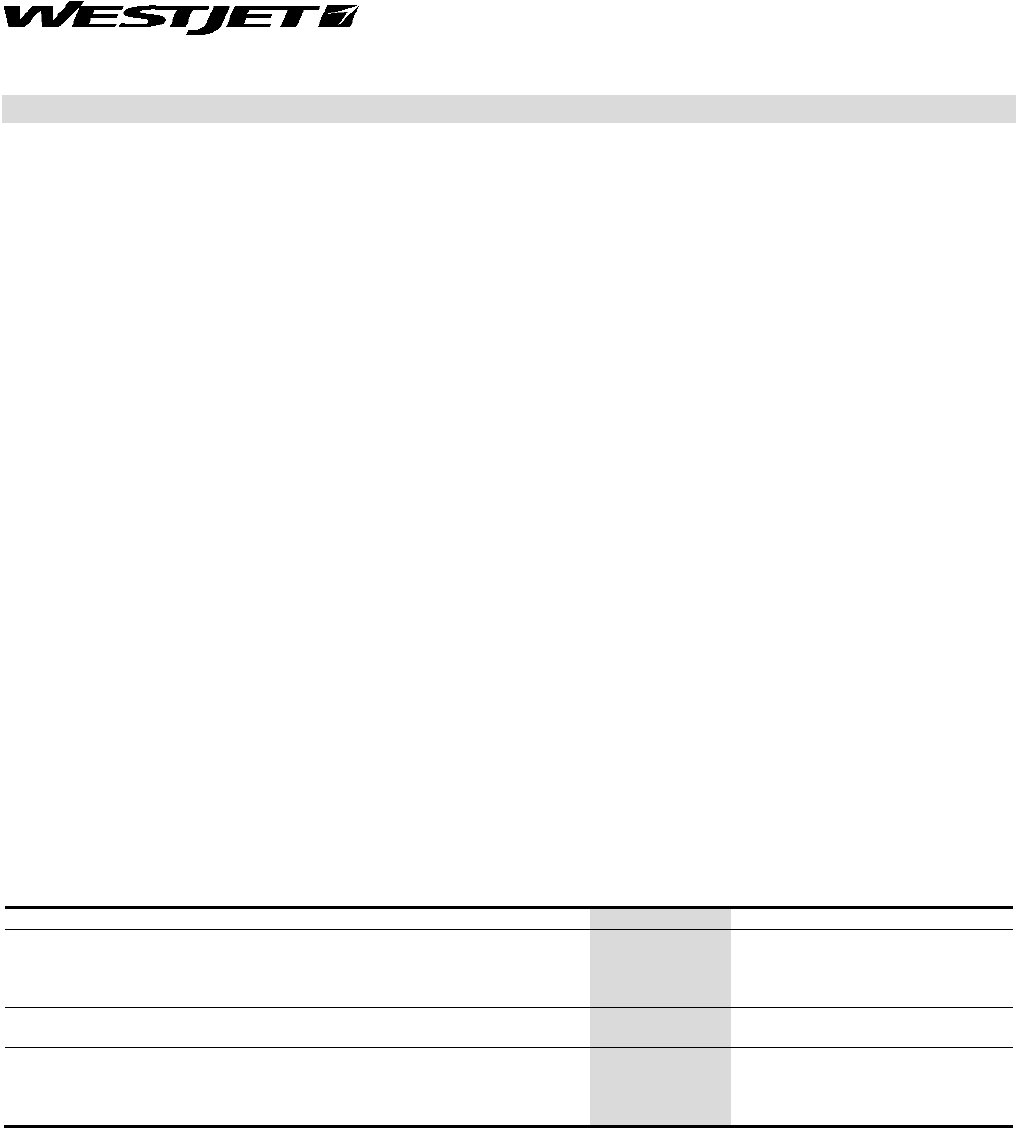

Select cash flow information

($ in thousands)

2014

2013

Change

Cash provided by operating activities

571,618

608,147

(36,529)

Less:

Cash used by investing activities (665,131) (715,172) 50,041

Cash from (used by) financing activities

175,023

(61,547)

236,570

Cash flow from operating, investing and financing activities 81,510 (168,572) 250,082

Effect of foreign exchange on cash and cash equivalents

20,556

16,378

4,178

Net change in cash and cash equivalents

102,066

(152,194)

254,260

Cash and cash equivalents, beginning of year 1,256,005 1,408,199 (152,194)

Cash and cash equivalents, end of year

1,358,071

1,256,005

102,066

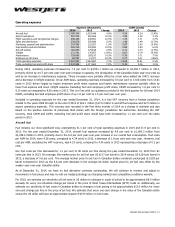

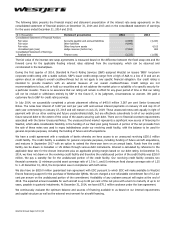

Operating cash flows

For the year ended December 31, 2014, our cash flow from operations decreased 6.0 per cent to $571.6 million compared to

$608.1 million in the prior year. This year-over-year decrease was mainly the result of a decrease in non-cash working capital,

predominantly from an increase in cash taxes paid, partially offset by stronger earnings.

Similarly, on a per share basis, for the year ended December 31, 2014, our cash flow from operations decreased 3.7 per cent

to $4.43 per share compared to $4.60 per share in the prior year (please refer to page 48 of this MD&A for a reconciliation of

non-GAAP and additional measures). Partially offsetting this year-over-year decrease in operating cash flow, was the

favourable impact of a reduced number of shares outstanding as a result of repurchase under our February 2013 and May

2014 normal course issuer bids.