Westjet 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

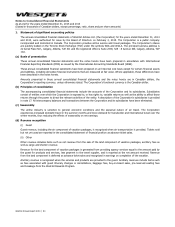

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2014 and 2013

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2014 │ 62

1. Statement of significant accounting policies (continued)

(e) Financial instruments (continued)

Other financial liabilities are measured at amortized cost using the effective interest method and include all liabilities other than

derivatives, which are designated as cash flow hedges.

The Corporation may, from time to time, use various financial derivatives to reduce market risk exposure from changes in

foreign exchange rates, interest rates and jet fuel prices. Derivatives are recorded at fair value on the consolidated statement of

financial position with changes in fair value recorded in net earnings unless designated as effective hedging instruments.

Similarly, embedded derivatives are recorded at fair value on the consolidated statement of financial position with the changes in

fair value recorded in the consolidated statement of earnings unless exempted from derivative treatment as a normal purchase

and sale or the host contract and derivative are deemed to be clearly and closely related. When financial assets and liabilities are

designated as part of a hedging relationship and qualify for hedge accounting, they are subject to measurement and

classification requirements as cash flow hedges. The Corporation’s policy is not to utilize derivative financial instruments for

trading or speculative purposes.

At each reporting period, the Corporation will assess whether there is any objective evidence that a financial asset, other than

those classified at fair value through profit or loss, is impaired.

The Corporation offsets qualifying transaction costs incurred in relation to the acquisition of financial assets and liabilities not

measured at fair value through profit or loss against those same financial assets and liabilities.

(f) Cash flow hedges

The Corporation uses various financial derivative instruments such as forwards and swaps to manage fluctuations in foreign

exchange rates and interest rates.

The Corporation’s derivatives that have been designated and qualify for hedge accounting are classified as cash flow hedges.

The Corporation formally documents all relationships between hedging instruments and hedged items as well as the risk-

management objective and strategy for undertaking the hedge transaction. This process includes linking all derivatives that are

designated in a cash flow hedging relationship to a specific firm commitment or forecasted transaction. The Corporation also

formally assesses, both at inception and at each reporting date, whether derivatives used in hedging transactions have been

highly effective in offsetting changes in cash flows of hedged items and whether those derivatives may be expected to remain

highly effective in future periods.

Under cash flow hedge accounting, the effective portion of the change in the fair value of the hedging instrument is recognized

in other comprehensive income (OCI) and presented within shareholders’ equity in hedge reserves. The ineffective portion of the

change in fair value is recognized in non-operating income (expense). Upon maturity of the financial derivative instrument, the

effective gains and losses previously accumulated in hedge reserves within shareholders’ equity are recorded in net earnings

under the same caption as the hedged item.

The Corporation excludes time value from the measurement of effectiveness; accordingly, changes in time value are recognized

in non-operating income (expense) during the period the change occurs.

If the hedging relationship ceases to qualify for cash flow hedge accounting, any change in fair value of the instrument from the

point it ceases to qualify is recorded in non-operating income (expense). Amounts previously accumulated in hedge reserves

within shareholders’ equity will remain in shareholders’ equity until settlement, at which time, the amount is recorded in net

earnings under the same caption as the hedged item. If the transaction is no longer expected to occur, amounts previously

accumulated in hedge reserves within shareholders’ equity will be reclassified to non-operating income (expense).

(g) Foreign currency

Monetary assets and liabilities, denominated in foreign currencies, are translated into Canadian dollars at the rate of exchange in

effect at the consolidated statement of financial position date, with any resulting gain or loss recognized in net earnings. Non-

monetary assets, non-monetary liabilities, revenue and expenses arising from transactions denominated in foreign currencies are

translated into Canadian dollars at the rates prevailing at the time of the transaction.

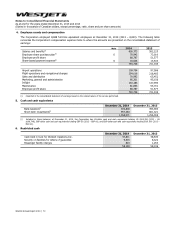

(h) Cash and cash equivalents

Cash and cash equivalents consist of cash and short-term investments that are highly liquid in nature and have maturity dates of

up to 91 days.