Westjet 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Executing on our strategies

WestJet Annual Report 2014

Table of contents

-

Page 1

Executing on our strategies WestJet Annual Report 2014 -

Page 2

... to execute on our profitable growth strategies throughout the year, including the continued expansion of WestJet Encore, the further evolution of our fare bundles product, the expansion of our code-share and interline partnerships, the introduction of WestJet Rewards tiers, and the extremely... -

Page 3

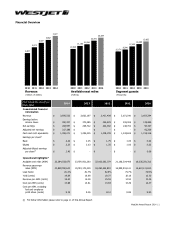

...,041 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 Revenue (millions of dollars) Available seat miles (millions) Segment guests (thousands) ($ in thousands, except per share data) Consolidated financial information Revenue Earnings before income taxes... -

Page 4

... guests access to over 150 destinations via WestJet. During 2014, we grew the total number of airline partnerships to 46 through new interline relationships and new code-share agreements with Qantas Airways and China Airlines. In 2014 we launched our most successful new destination ever with service... -

Page 5

...travel reward card according to an annual review and ranking of credit cards in the September 2014 issue of Money Sense magazine. Our guests confirmed that ranking when the WestJet RBC World Elite MasterCard and the WestJet RBC MasterCard were ranked Canada's number one and number two travel rewards... -

Page 6

...revenue generation and cost-saving strategies. With a focus on continued profitable growth in the coming years, we anticipate the further expansion of WestJet Encore, increased transatlantic service, and the deployment of wide body aircraft into our network, ushering in a new era of long-haul travel... -

Page 7

...-body service with initial flights planned between Alberta and Hawaii in late 2015 and beginning in 2016 our plans to expand our network into additional overseas markets; the continued growth of WestJet Encore, including into the United States; our expectations that the first checked bag fee will... -

Page 8

Management's Discussion and Analysis of Financial Results 2014 -

Page 9

... and the pricing environment), labour matters, government regulations, stock market volatility, the ability to access sufficient capital from internal and external sources, and additional risk factors discussed in other documents we file from time to time with securities regulatory authorities... -

Page 10

... our guests' overall experience. We launched a new WestJet Rewards tiers program and we introduced a price-drop guarantee on flights and vacation packages. We also introduced a fee for the first checked bag on Econo fares, we were successful at expanding our sources of financing through a new credit... -

Page 11

..., Nova Scotia to Glasgow, on May 29, 2015, with direct (same-aircraft) service from Toronto, to be operated with our Boeing 737 NG 700 series aircraft. The expansion of our transatlantic flights provides a great opportunity for us to bring our brand and guest experience to new routes and new markets... -

Page 12

... in December 2014, WestJet RBC® World Elite MasterCard± and WestJet RBC® MasterCard± were once again voted as Canada's top travel rewards credit cards in the airline category, according to RewardsCanada.ca. ®Registered trademarks of Royal Bank of Canada. RBC and Royal Bank are registered... -

Page 13

...) CASM, excluding fuel and employee profit share (cents)(iv) Fuel consumption (litres) Fuel costs per litre (cents) Segment guests Average stage length (miles) Utilization (hours) Number of full-time equivalent employees at period end Fleet size at period end (i) (ii) (iii) (iv) 2014 3,976,552 390... -

Page 14

... in 2013. This increase was mainly due to increases in the number of guest bookings, pre-reserved seating and Plus seating upgrade sales, the continued penetration of our WestJet RBC MasterCard program as well as the introduction of a first bag fee on certain flights in the latter half of the year... -

Page 15

...Airport operations Flight operations and navigational charges Sales and distribution Marketing, general and administration Depreciation and amortization Aircraft leasing Inflight Maintenance Employee profit share Total operating expenses Total, excluding fuel and profit share During 2014, operating... -

Page 16

...at a ratio of one flight attendant for every 50 seats onboard an aircraft on a full year basis. We worked in cooperation with our flight attendants to implement this change on October 1, 2013, and this has resulted in cost savings through a reduction in overall salaries and benefits and other travel... -

Page 17

... WestJet, which creates a personal vested interest in our financial results and operational accomplishments. ($ in thousands) Salaries and benefits Employee share purchase plan Employee profit share Share-based payment plans Presentation on the Consolidated Statement of Earnings: Airport operations... -

Page 18

... to vest in early 2015 due to the achievement of certain performance criteria, as well as a revision to the number of pilots electing to receive stock options than originally expected. Share-based payment expense related to pilots' awards is included in flight operations and navigational charges... -

Page 19

... and New Brunswick increased their general corporate income tax rates to 11 per cent and 12 percent, respectively, in the third quarter of 2013. For 2015, we anticipate that our annual effective tax rate will remain in the range of approximately 27 to 28 per cent. WestJet Annual Report 2014â", 17 -

Page 20

... guests Average stage length (miles) Utilization (hours) Number of full-time equivalent employees at period end (Please refer to page 48 of this MD&A for definitions of key operating indicators and a reconciliation of the non-GAAP measures and additional GAAP measures.) WestJet Annual Report 2014... -

Page 21

... Aircraft fuel Airport operations Flight operations and navigational charges Sales and distribution Marketing, general and administration Depreciation and amortization Aircraft leasing Inflight Maintenance Employee profit share Total operating expenses Total, excluding fuel and profit share Change... -

Page 22

...as certain airport rates and fees are denominated in US dollars. Flight operations and navigational charges Flight operations and navigational charges are comprised mainly of salaries and benefits, costs related to flight delays and cancellations and related accommodations for displaced guests. For... -

Page 23

... of the prior year we experienced severe winter weather events at Calgary International Airport and Toronto Pearson International Airport, which we did not experience in the fourth quarter of the current year. This impacted both the annual and quarterly on-time performance ratio compared to the... -

Page 24

... liquidity to meet these liabilities, under both normal and stressed conditions. At December 31, 2014, we had cash on hand of 2.36 (2013 - 2.28) times our advance ticket sales balance. We monitor capital on a number of measures, including cash to trailing 12 months (TTM) revenue ratio, adjusted debt... -

Page 25

... of Boeing 737 NG and Bombardier Q400 aircraft. Our seven Bombardier Q400 aircraft deliveries during 2014 were financed by secured term loans with EDC for approximately 80 per cent of the purchase price of the aircraft. We also took delivery of seven Boeing 737 NG 800 series aircraft during 2014... -

Page 26

... 31, 2014, the Corporation was in compliance with both ratios. We also have an $820.0 million guaranteed loan agreement with EDC pursuant to which EDC will make available to WestJet Encore financing support for the purchase of Bombardier Q400s. We are charged a non-refundable commitment fee of... -

Page 27

... upon our financial position, results of operations or cash flows. FLEET During 2014, we took delivery of seven Boeing 737 NG 800 series aircraft and seven Bombardier Q400 aircraft to end the year with a registered fleet of 122 aircraft with an average age of 6.8 years. In 2014, based on management... -

Page 28

... for the other model of aircraft, or for Boeing 737 MAX 9 aircraft We have an option to purchase the Boeing 767 300 ERW series aircraft prior to delivery. We have options to purchase an additional 15 Bombardier Q400 aircraft between the years 2015 and 2018. WestJet Annual Report 2014â",26 -

Page 29

... 31, 2014 (2013 - US $590.6 million) which we expect to fund through cash from operations. Although the current obligations related to our aircraft operating lease agreements are not recognized on our consolidated statement of financial position, we include an amount equal to 7.5 times our annual... -

Page 30

...there are 1,519,690 shares remaining for purchase under the May 2014 bid. A shareholder of WestJet may obtain a copy of the notice filed with the TSX in relation to the bid, free of charge, by contacting the Corporate Secretary of WestJet, at 22 Aerial Place N.E., Calgary, Alberta T2E 3J1 (telephone... -

Page 31

... Canadian dollar to US dollar exchange rate and changes to our aircraft delivery schedule. For the first quarter of 2015, we expect our net capital expenditures to be between $160 million and $170 million. The first quarter and full-year 2015 expected CASM, excluding fuel and employee profit share... -

Page 32

... management policies, including those related to financial instruments. Management performs continuous assessments so that all significant risks related to financial instruments are reviewed and addressed in light of changes to market conditions and our operating activities. Fuel risk The airline... -

Page 33

... derivative contracts of $7,654. The Corporation reports long-term interest rate derivatives at their net position. At December 31, 2014, net long-term interest rate derivative liabilities were $4,845. Fair value of financial instruments Fair value represents a point-in-time estimate. The carrying... -

Page 34

..., mainly aircraft fuel, aircraft leasing expense, certain maintenance costs, a portion of airport operation costs, certain IT and computer reservation system fees, and the land components associated with our WestJet Vacation packages. Since our revenues are received primarily in Canadian dollars, we... -

Page 35

... to meet our growth plans or replace departing employees. Our business would be adversely affected if we are unable to hire and retain qualified employees at a reasonable cost. Our m aintenance costs w ill increase as our fleet ages. The average age of our fleet at December 31, 2014, was 6.8 years... -

Page 36

...and airport operations at Toronto's Pearson International Airport, Calgary International Airport and Vancouver International Airport. A significant change in the demand environment in these markets, a significant change to airport rates and fees or significant operational disturbances due to weather... -

Page 37

... or more credit card acceptance programs. The inability to process one or more credit card brands could have a material adverse impact on our guest bookings and could harm our business. We may occasionally experience system interruptions and delays that make our website and services unavailable or... -

Page 38

... reputation or the demand for the products and services of WestJet Vacations. A significant change in our unique corporate culture, guest experience or brand could have adverse operational and financial consequences. Our corporate culture and brand recognition are key competitive advantages for us... -

Page 39

...any adverse regulatory or government imposed changes, would negatively impact our ability to service our existing fixed obligations as well as obtain new sources of financing on reasonable terms. In turn, this could have adverse effects on our future operations and financial condition and prevent us... -

Page 40

... and filing data with, or otherwise reporting data to, government agencies may adversely impact our business. The increase in security measures and clearance times required for guest travel could have a material adverse effect on guest demand and the number of guests travelling on our flights and... -

Page 41

...increased fuel consumption by flying through or avoiding such weather, which adversely affects our costs and potentially our on-time performance and guest experience. Work stoppages or strikes by airport workers, baggage handlers, air traffic controllers and other third party workers not employed by... -

Page 42

... judgement, amongst other factors, that resulted in the timing of aircraft being classified as held for sale on the consolidated statement of financial position and presented in continuing operations on the consolidated statement of earnings was the identification of WestJet Annual Report 2014â",40 -

Page 43

...current maintenance schedules and fleet plans, contracted costs with maintenance service providers, other vendors and company-specific history and experience. We recognize maintenance expense in the consolidated statement of earnings based on aircraft usage and the passage of time as well as changes... -

Page 44

... respective department's operating expense line item with a corresponding increase to equity reserves over the related service period. (v) Fair value of derivative instruments We use various financial derivative instruments such as forwards and swaps to manage fluctuations in foreign exchange rates... -

Page 45

... Description A new standard on revenue recognition that contains a single model that applies to contracts with customers and two approaches to recognizing revenue; at a point in time or over time. A single financial instrument accounting standard addressing: classification and measurement (Phase... -

Page 46

... to provide reasonable assurance that all relevant information is gathered and reported to management, including the chief executive officer (CEO) and the chief financial officer (CFO), on a timely basis so that appropriate decisions can be made regarding public disclosure. An evaluation of our DC... -

Page 47

...expansion on page 9; that our guests will be able to use their own personal electronic device to receive live and stored content streamed wirelessly from a server on board each Boeing 737 NG aircraft, that we will install USB/110 volt power outlets in new, slimmer seats on our Boeing 737 NG aircraft... -

Page 48

...the growth of our regional Bombardier Q400 fleet, our narrow body Boeing 737 fleet and, for the first time in 2015, the addition of wide body Boeing 767-300 ERW aircraft, referred to under the heading Risks relating to the business on page 32; that we do not anticipate early adopting the new revenue... -

Page 49

... network plans and aircraft deliveries; Our anticipation that our 2015 full-year CASM, excluding fuel and employee profit share, will be up 2.5 to 3.5 per cent, and first-quarter 2015 CASM, excluding fuel and employee profit share, will be up 1.0 to 1.5 per cent compared to the first quarter of 2014... -

Page 50

... seat miles. Cycle: One flight, counted by the aircraft leaving the ground and landing. Utilization: Operating hours per day per operating aircraft. NON-GAAP AND ADDITIONAL GAAP MEASURES The following non-GAAP and additional GAAP measures are used to monitor our financial performance: Adjusted... -

Page 51

... months of revenue is a measure commonly used in the airline industry to compare liquidity positions. CASM, excluding fuel and employee profit share: We exclude the effects of aircraft fuel expense and employee profit share expense to assess the operating performance of our business. Fuel expense is... -

Page 52

... the third quarter of 2014 associated with the sale of 10 aircraft to Southwest. (iv) At December 31, 2014 and December 31, 2013, the Corporation met its internal guideline of an adjusted net debt to EBITDAR and an adjusted net debt to adjusted EBITDAR measure of less than 2.50. Return on invested... -

Page 53

... earnings per share (i) 2014 283,957 33,231 317,188 129,142,940 2.46 2013 268,722 268,722 132,074,002 2.03 Change 15,235 33,231 48,466 (2,931,062) 21.2% After-tax non-cash loss recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest. WestJet Annual Report 2014... -

Page 54

Consolidated Financial Statements and Notes For the years ended December 31, 2014 and 2013 -

Page 55

... governance of the Corporation, including ensuring management fulfills its responsibilities for financial reporting and internal control, and reviewing and approving the consolidated financial statements. The Board carries out these responsibilities principally through its Audit Committee. The Audit... -

Page 56

... financial position of WestJet Airlines Ltd. at December 31, 2014 and December 31, 2013, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with International Financial Reporting Standards. Chartered Accountants February 2, 2015 Calgary... -

Page 57

Consolidated Statement of Earnings For the years ended December 31 (Stated in thousands of Canadian dollars, except per share amounts) Note 2014 2013 Revenue: Guest Other Operating expenses: Aircraft fuel Airport operations Flight operations and navigational charges Sales and distribution ... -

Page 58

... assets: Property and equipment Intangible assets Other assets Total assets Liabilities and shareholders' equity Current liabilities: Accounts payable and accrued liabilities Advance ticket sales Non-refundable guest credits Current portion of maintenance provisions Current portion of long-term... -

Page 59

... of Canadian dollars) Note 2014 2013 Operating activities: Net earnings Items not involving cash: Depreciation and amortization Change in maintenance provisions Change in other liabilities Amortization of hedge settlements Loss on disposal of property and equipment Share-based payment expense... -

Page 60

... of Canadian dollars) Note 2014 2013 Share capital: Balance, beginning of year Issuance of shares pursuant to compensation plans Shares repurchased 12 603,861 6,177 (6,751) 603,287 614,899 11,027 (22,065) 603,861 Equity reserves: Balance, beginning of year Share-based payment expense Issuance... -

Page 61

... of of of of income income income income taxes taxes taxes taxes of of of of $(3,048) (2013 - $(2,347)). $2,475 (2013 - $1,238). $3,065 (2013 - $(183)). $(841) (2013 - $(275)). The accompanying notes are an integral part of the consolidated financial statements. WestJet Annual Report 2014 â", 59 -

Page 62

... company incorporated and domiciled in Canada. The Corporation provides airline service and travel packages. The Corporation's shares are publicly traded on the Toronto Stock Exchange (TSX) under the symbols WJA and WJA.A. The principal business address is 22 Aerial Place N.E., Calgary, Alberta... -

Page 63

... accounting policies (continued) (d) Revenue recognition (continued) (iii) WestJet Rewards Program The Corporation has a rewards program that allows guests to accumulate credits based on their WestJet travel spend to be used towards future flights and vacation packages. Revenue received in relation... -

Page 64

...and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 1. Statement of significant accounting policies (continued) (e) Financial instruments (continued) Other financial liabilities are measured at amortized... -

Page 65

... statement of earnings until such time that they are delivered. The five undelivered 737-700 series aircraft are classified as current assets on the consolidated statement of financial position at the contracted purchase price with the buyer less costs to sell. The difference between the carrying... -

Page 66

... to provide the lessor with collateral should an aircraft be returned in an operating condition that does not meet the requirements stipulated in the lease agreement. Maintenance reserves are refunded to the Corporation when qualifying maintenance is performed, or if not refunded, act to reduce the... -

Page 67

Notes to Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 1. Statement of significant accounting policies (continued) (o) Leases The determination of whether an... -

Page 68

... on management's judgement that resource allocation decisions and performance assessments are done at a consolidated company and fleet level with a view that the Corporation manages an integrated network of markets with a consolidated fleet of different sized aircraft. WestJet Annual Report 2014... -

Page 69

... publications, and company-specific history. Expected useful lives and residual values are reviewed annually for any change to estimates and assumptions. (ix) Maintenance provisions The Corporation has a legal obligation to adhere to certain maintenance conditions set out in its aircraft operating... -

Page 70

... Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 2. New accounting standards and interpretations The IASB and International Financial Reporting Interpretations... -

Page 71

...future development of the airline. The Corporation manages its capital structure and makes adjustments in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain the capital structure, the Corporation may, from time to time, purchase shares... -

Page 72

... 721,345 Airport operations Flight operations and navigational charges Sales and distribution Marketing, general and administration Inflight Maintenance Employee profit share (i) Classified in the consolidated statement of earnings based on the related nature of the service performed. 5. Cash and... -

Page 73

...of $63,892 (December 31, 2013 - $56,523). The Corporation has an agreement to sell 10 Boeing 737-700 aircraft with delivery dates scheduled to occur between October 2014 and May 2015. The Corporation has recorded the aircraft at the contracted Canadian dollar equivalent proceeds using the period end... -

Page 74

Notes to Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 8. Intangible assets January 1 2014 25,833 16,372 5,785 10,701 58,691 January 1 2013 18,970 17,261 4,... -

Page 75

... at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 9. Maintenance provisions and reserves The Corporation's operating aircraft lease agreements require leased aircraft to be returned to the lessor in... -

Page 76

... to Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 10. Long-term debt (continued) Future scheduled repayments of long-term debt at December 31, 2014 are as... -

Page 77

Notes to Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 11. Income taxes (continued) (b) Deferred tax Components of the net deferred tax liability are as ... -

Page 78

... of the TSX at the prevailing market price at the time of the transaction. Common voting shares and variable voting shares acquired under this bid are cancelled. On February 14, 2013, the Corporation filed a notice with the TSX to make a normal course issuer bid to purchase outstanding shares on the... -

Page 79

... Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 12. Share capital (continued) (c) Stock option plan (continued) The fair value of the options is expensed over the service... -

Page 80

... Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 12. Share capital (continued) (d) Key employee plan The Corporation has a key employee plan (KEP), whereby restricted share... -

Page 81

...four times per year. Under the terms of the ESPP, the Corporation acquires voting shares on behalf of employees through open market purchases. The Corporation's share of the contributions in 2014 amounted to $79,942 (2013 - $73,010) and is recorded as compensation expense within the related business... -

Page 82

..., 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 14. Earnings per share Share data used in the computation of basic and diluted earnings per share: Weighted average number of shares outstanding - basic Effect of dilution: Employee stock... -

Page 83

... 2013, weighted average forward interest rate curve for the three month Canadian Dealer Offered Rate over the term of the debt was 1.96% (2013 - 2.76%). Deposits: Relate to purchased aircraft and airport operations and earn a floating market rate of interest. Classified in level 1 as the measurement... -

Page 84

... the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 15. Financial instruments and risk management (continued) (b) Risk management related to financial instruments The Corporation is exposed to market, credit and... -

Page 85

... purchased aircraft and airport operations, which, at December 31, 2014, totaled $25,204 (2013 - $32,021). A reasonable change in market interest rates at December 31, 2014, would not have significantly impacted the Corporation's net earnings due to the small size of these deposits. Long-term... -

Page 86

... for the year ended December 31, 2014, is a reduction to Aircraft fuel and Airport operations expense on the consolidated statement of earnings by $20,234 and $2,869, respectively. The Corporation's change in estimate is based on the successful outcome of filed VAT returns. The Corporation has no... -

Page 87

... to Consolidated Financial Statements As at and for the years ended December 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 16. Commitments (a) Purchased aircraft and spare engines At December 31, 2014, the Corporation is committed... -

Page 88

... 31, 2014 and 2013 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 17. Related parties (a) Interests in subsidiaries The consolidated financial statements of WestJet Airlines Ltd., the parent company, include the accounts of the Corporation and its... -

Page 89

...Fuel Aircraft expendables De-icing fluid Other Other Assets: Aircraft deposits(iv) Maintenance reserves - long term Derivatives Other(v) (i) 9 15 9 15 Trade receivables include receivables relating to airport operations, fuel rebates, marketing programs and ancillary revenue products and services... -

Page 90

-

Page 91

... Officer Stock exchange listing Shares in WestJet stock are publicly traded on the Toronto Stock Exchange under the symbols WJA and WJA.A. Investor relations contact information Phone: 1-877-493-7853 Email: [email protected] WestJet headquarters 22 Aerial Place NE Calgary, Alberta...