Vonage 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

N

ote 12.

Q

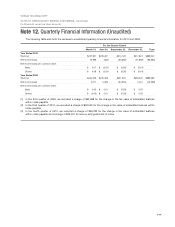

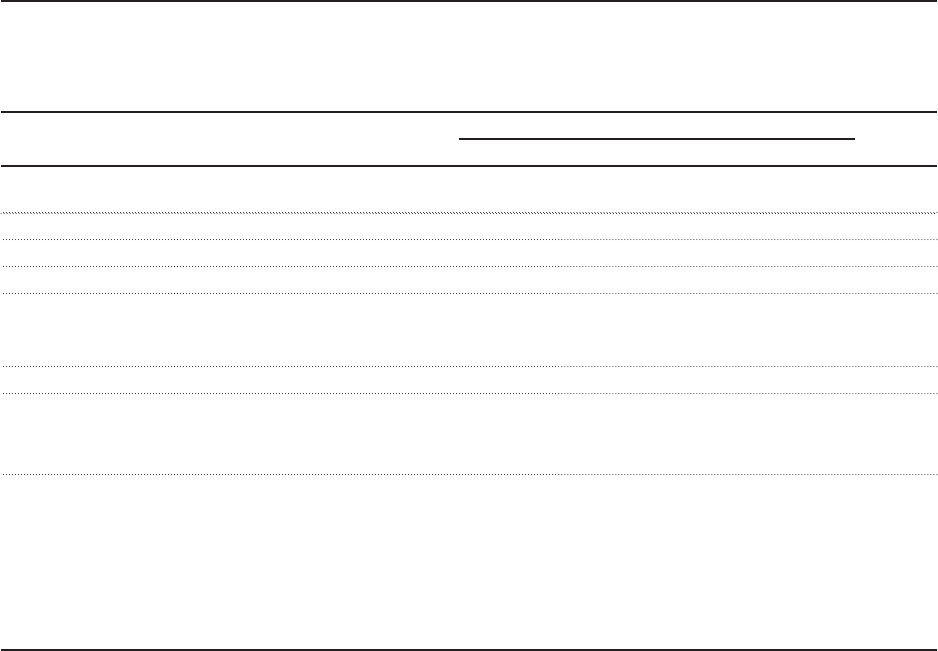

uarterly Financial Information (Unaudited)

T

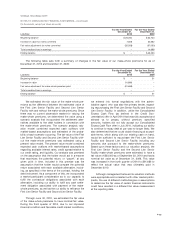

he following table sets forth the reviewed consolidated quarterly financial information for 2010 and 2009

:

For the

Q

uarter Ended

March 31, June 30,

S

eptember 30, December 31, Total

Y

ear

E

n

d

e

d20

1

0

R

evenue $227

,

951 $225

,

341 $214

,

126 $217

,

624 $885

,

042

Net income (loss) 13,968 (562) (55,382) (41,689) (83,665)

Net income (loss) per common share

:

B

asic $ 0.07 $ (0.00) $ (0.26) $ (0.19

)

D

iluted $ 0.06 $ (0.00) $ (0.26) $ (0.19

)

Y

ear

E

n

d

e

d 2009

R

evenue

$

224,005

$

220,028

$

221,505

$

223,542

$

889,080

Net income

(

loss

)

5,271 2,285

(

54,555

)

4,401

(

42,598

)

Net income

(

loss

)p

er common share

:

B

asic

$

0.03

$

0.01

$(

0.33

)$

0.02

D

iluted $

(

0.03

)

$ 0.01 $

(

0.33

)

$ 0.02

(1) In the third quarter of 2009, we recorded a charge of $62,998 for the change in the fair value of embedded feature

s

wi

t

hi

n notes pa

y

a

bl

e.

(2) In the third quarter of 2010, we recorded a charge of

$

62,030 for the change in fair value of embedded features withi

n

notes pa

y

a

bl

e

.

(3) In the fourth quarter of 2010, we recorded a charge of

$

29,782 for the change in fair value of embedded features

w

ithin notes payable and a charge of

$

26,531 for loss on extinguishment of notes

.

F

-33