Vonage 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

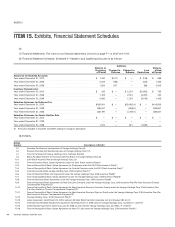

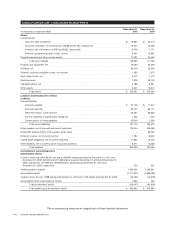

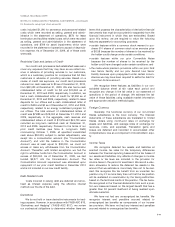

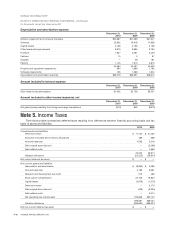

VONAGE HOLDINGS CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS

D

ecem

b

er

3

1

,

(

In thousands

)

20

1

0 2009 2008

C

ash flows from operating activities:

N

et

l

os

s

$

(83,665) $(42,598) $ (64,576

)

A

djustments to reconcile net loss to net cash provided by operatin

g

activities:

D

epreciation and amortization and impairment char

g

es 51,928 52,072 45,79

6

Amortization of intangible

s

1

,

14

5

1

,

319 2

,

816

C

han

g

e in fair value of embedded features in notes payable and stock warrant 99,338 49,933 –

L

oss on extinguishment o

f

note

s

31,023

(

4,041

)

30,570

Be

n

e

fi

c

i

a

l

co

nv

e

r

s

i

o

n

o

n int

e

r

es

t in kin

do

n

co

nv

e

rti

b

l

e

n

o

t

es

––1

08

Am

o

rtiz

a

ti

o

n

of d

i

scou

nt

o

nn

o

t

es

4,

732 5

,

469 88

2

A

ccrue

di

nterest pa

id i

n-

ki

n

d

13,232 17,154 2,900

All

o

w

a

n

ce fo

r

doub

t

fu

l

accou

nt

s

(

711

)(

193

)

20

7

Allowance

f

or obsolete inventory 2,213 2,514 1,519

Amortization of debt related cost

s

1

,

402 2

,7

08 3

,

237

L

oss on dis

p

osal o

ff

ixed asset

s

–

–

12

S

hare-based expense

8

,255 8,473 12,238

C

han

g

es in operatin

g

assets and liabilities

:

A

ccounts rece

i

va

ble

573 2,930 2,028

I

nventory

(

568) 203 7,47

2

P

re

p

aid ex

p

enses and other current assets 21,322

(

22,053

)

50

1

D

eferred customer acquisition costs 15,505 21,523 13,32

2

D

ue

f

rom related

p

arties

–

–

2

O

ther assets

9

,118

(

1,510

)(

7,498

)

A

ccounts pa

y

a

ble

25,606 (22,595) (22,029

)

Accrued ex

p

enses 19,966

(

4,764

)(

10,507

)

D

eferred revenue (19,446) (22,153) (10,124

)

O

ther liabilitie

s

(

6,756

)(

5,995

)(

5,321

)

N

et cas

h

prov

id

e

db

y operat

i

ng act

i

v

i

t

i

es 194,212 38,396 3,55

5

C

ash flows from investing activities

:

C

apital expenditures

(

17,674

)(

23,724

)(

11,386

)

Purchase o

f

intan

g

ible assets

–(

1,250

)(

560

)

Purchase of marketable securitie

s

–

– (21,375

)

Ma

t

u

riti

es a

n

dsa

l

es of

m

a

rk

e

t

ab

l

e secu

riti

es

–

–

101,31

7

A

cquisition and development of software assets (22,712) (21,654) (26,530)

Decrease

(

increase

)

in restricted cas

h

35,700

(

3,937

)(

980

)

Net cash (used in) provided by investing activities (4,686) (50,565) 40,48

6

C

ash flows from financing activities:

Principal payments on capital lease obligations (1,500) (1,251) (1,036

)

Principal pa

y

ments on notes

(

41,792

)(

1,809

)(

326

)

Proceeds

f

rom issuance o

f

notes payabl

e

200,000 – 220,300

Discount on notes pa

y

abl

e

(

6,000

)

–

(

7,167

)

Extin

g

uishment o

f

notes

(

290,660

)

–

(

253,460

)

D

e

b

tre

l

ate

d

costs

(

5,430) (252) (26,799

)

Proceeds

f

rom subscri

p

tion receivable, net

–

–

9

Proceeds from directed share program, ne

t

–

–62

Proceeds from exercise of stock o

p

tion

s

1,620

5

947

Net cash used in financin

g

activities

(

143,762

)(

3,253

)(

68,370

)

Effect of exchange rate changes on cas

h

9

57 1,501 (1,079)

N

et chan

g

e in cash and cash equivalents

4

6,721

(

13,921

)(

25,408

)

Cash and cash equivalents, beginning of period 32,213 46,134 71,542

C

ash and cash e

q

uivalents, end of

p

eriod $ 78,934 $ 32,213 $ 46,134

S

u

pp

lemental disclosures of cash flow information:

Cash paid during the periods for

:

Int

e

r

est

$

63

,

814

$

28

,

671

$

20

,

519

In

co

m

e

t

a

x

es

$

544 $ 1

,

206 $ 1

,

18

1

N

on-cash financin

g

transactions durin

g

the periods for

:

C

onversion of convertible notes into common stock

:

Third lien convertible notes, net of discount and debt related costs $ 4,497 $ 9,361 $

–

Embedded conversion option within third lien convertible notes $ 32,358 $ 57,050 $ –

T

he accompanyin

g

notes are an inte

g

ral part of these financial statement

s

F-6

VO

NA

G

E ANN

U

AL REP

O

RT 2010