Vonage 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

C

onversion of

C

onvertible Notes in 2010.

A

tt

h

et

i

m

e

of conversions of the remaining

$

5,695 principal amoun

t

of Convertible Notes (includin

g$

2,400 principal amount o

f

C

onvertible Notes, which were held by certain affiliates o

r

associates of the

C

ompany’s directors

)

, which converted

i

nto 19,638 shares of our common stock, we determine

d

t

hat the a

gg

re

g

ate fair value of the conversion feature o

f

t

hose Convertible Notes was

$

32,358, which was a

n

i

ncrease in value of

$

7,308 from the fair value of the con-

v

ersion

f

eature as o

f

December 31, 2009. This chan

g

ein

fa

ir v

a

l

ue

w

as

r

eco

r

ded as

in

co

m

e

within

o

th

e

rin

co

m

e

(expense), net for the year ended December 31, 2010. The

a

gg

re

g

ate

f

air value o

f

the common stock issued by us i

n

t

he conversion was $35,404 at the time of conversion

,

whi

c

hw

as

r

eco

r

ded as co

mm

o

n

s

t

oc

k

a

n

d add

iti

o

n

al

p

aid-in ca

p

ital. In addition, in connection with th

e

extin

g

uishment of the converted Convertible Notes, w

e

r

ecorded a loss on extin

g

uishment of $786 for the year

ended December 31, 2010, which re

p

resented the di

ff

er-

ence in the carryin

g

value of those Convertible Note

s

i

ncludin

g

the

f

air value o

f

the conversion

f

eature, whic

h

was reduced by the discount of $515 and debt related

costs of $683 for the year ended December 31, 2010

,

associated with those Convertible Notes, and the fai

r

va

l

ue of

th

eco

mm

o

n

s

t

oc

ki

ssued a

tth

e

tim

eofco

n

-

v

ersion and the pa

y

ment made to note holders of $2,23

7

t

o

i

n

d

uce convers

i

on.

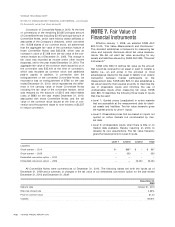

N

O

TE 7.

Fa

ir V

a

l

ue of

Fi

nanc

i

a

lI

nstruments

Effective Januar

y

1, 2008, we adopted FA

S

BA

SC

820

-

10

-

2

5

,

“F

a

i

r

V

a

l

ue

M

easurements an

dDi

sc

l

osure

s

.

”

This standard establishes a framework for measuring fai

r

value and expands disclosure about fair value measure

-

m

ents. We did not elect fair value accounting for any

assets and liabilities allowed b

y

FA

S

BA

SC

825,

“Fi

nanc

i

a

l

I

nstruments

”

.

F

A

S

BA

SC

820-10 defines fair value as the amoun

t

that would be received for an asset or paid to transfer a

liabilit

y(

i.e., an exit price

)

in the principal or most

a

dvantageous market for the asset or liability in an orderly

transact

i

on

b

etween mar

k

et part

i

c

i

pants on t

h

e

measurement date. FA

S

BA

SC

820-10 also establishes

a

f

air value hierarch

y

that requires an entit

y

to maximize the

use of observable inputs and minimize the use o

f

unobservable inputs when measuring fair value. FA

S

B

ASC

820-10 describes the followin

g

three levels of inputs

that may be used:

>

L

evel 1:

Q

uoted

p

rices

(

unad

j

usted

)

in active markets

th

a

t

a

r

e access

i

b

l

ea

tth

e

m

easu

r

e

m

e

nt

da

t

efo

ri

de

nti-

c

al assets and liabilities. The

f

air value hierarchy

g

ive

s

the hi

g

hest priority to Level 1 inputs

.

>

L

evel 2: Observable

p

rices that are based on in

p

uts not

q

uoted on active markets but corroborated by mar-

k

e

t

da

t

a

.

>

L

evel 3: Unobservable in

p

uts when there is little or n

o

market data available, thereby requirin

g

an entity t

o

d

evelop its own assumptions. The

f

air value hierarch

y

g

ives the lowest priority to Level 3 inputs

.

L

eve

l

1

L

eve

l2 L

eve

l3 T

ota

l

Li

a

bili

t

i

es

:

S

tock warrant — 2010

$

–

$

897

$

–

$

897

S

tock warrant — 2009 – 553 – 55

3

E

m

b

e

dd

e

d

convers

i

on opt

i

on — 2010 – — –

–

E

m

b

e

dd

e

d

convers

i

on opt

i

on — 2009 – — 25,050 25,050

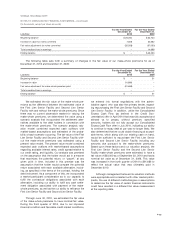

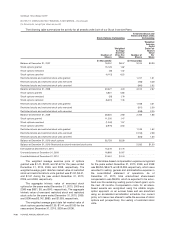

All

C

onvertible Notes were converted as of December 31, 2010. The following tables set forth the inputs as o

f

December 31, 2009 and a summary of chan

g

es in the fair value of our embedded conversion option for the year ende

d

December 31

,

2010 and December 31

,

2009

:

D

ecember 31

,

2

009

M

aturit

y

dat

e

O

ctober 31, 201

5

R

i

s

k-fr

ee

int

e

r

es

tr

a

t

e

2

.95

%

P

ri

ce o

f

co

mm

o

n

s

t

oc

k

$

1.40

Volatilit

y

109.3

%

F

-

22

VO

NA

G

E ANN

U

AL REP

O

RT 2010