Vonage 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.w

i

t

h

t

h

e

i

r current te

l

ep

h

one serv

i

ce prov

id

er or ma

y

c

h

oose t

o

r

eturn to service provided b

y

traditional telephone companies

.

O

ur emergency and E-911 calling services may expose u

s

to signi

f

icant liability

.

T

he F

CC

rules for the provision of 911 service b

y

inter

-

connected VoIP

p

roviders, such as the VoIP service we

p

rovide

,

r

equire that for all

g

eo

g

raphic areas covered by the traditiona

l

wire line E-911 network, interconnected VoIP

p

roviders must

p

ro-

v

ide E-911 service as defined by the F

CC

’s rules. Under th

e

F

CC

’s rules, E-911 service means that interconnected VoIP

p

ro

-

v

iders must transmit the caller’s telephone number and re

g

istere

d

l

ocation information to the appropriate P

S

AP for the caller’s re

g

is

-

t

ered location. Vona

g

e provides E-911 service, under the F

CC

’

s

r

ules, to approximately 99.97

%

o

f

its subscriber lines

.

T

he remainin

g

subscriber lines do not have E-911 service

f

o

r

a variety of reasons includin

g

refusal by PSAPs to accept VoIP

911 calls, the inability of PSAPs to receive the registered location

data

f

rom us, and the

f

ailure b

y

third part

y

companies with who

m

we contract to provide aspects o

f

our E-911 service to obtain th

e

necessar

y

access or complete implementation o

f

the necessar

y

i

nter

f

aces to the traditional wire line E-911 in

f

rastructure. In addi-

t

ion, certain o

f

our services designed to be highly mobile including

s

o

f

t phone service, which is so

f

tware that enables a customer t

o

make telephone calls from a computer, route callers to a nationa

l

emergency ca

ll

center t

h

at

i

n turns routes t

h

eca

ll

to t

h

e appro

-

p

riate P

S

AP.

We could be subject to enforcement action b

y

the F

CC

for

ou

r

subsc

ri

be

r lin

es

th

a

t

do

n

o

th

a

v

e

E-

9

11

se

rvi

ce

. Thi

s

enforcement action could result in si

g

nificant monetary penaltie

s

and restrictions on our ability to offer non-compliant services.

Delays our customers may encounter when makin

g

emer-

g

ency services calls and any inability of a PSAP to automaticall

y

r

eco

g

nize the caller’s location or telephone number can have

devastatin

g

consequences. Customers have attempted, and may

i

n the

f

uture attempt, to hold us responsible

f

or any loss, dama

g

e,

p

ersonal injur

y

or death su

ff

ered as a result. In Jul

y

2008, the Ne

w

and Emerging Technologies 911 Improvement Act o

f

200

8

b

ecame

l

aw an

d

prov

id

e

d

t

h

at

i

nterconnecte

dV

o

IP

prov

id

er

s

have the same protections

f

rom liabilit

yf

or the operation o

f

91

1

s

erv

i

ce as tra

di

t

i

ona

l

w

i

re

li

ne an

d

w

i

re

l

ess prov

id

ers.

Li

m

i

tat

i

on

s

on liability

f

or the provision o

f

911 service are normally governed

by

state

l

aw an

d

t

h

ese

li

m

i

tat

i

ons t

y

p

i

ca

lly

are not a

b

so

l

ute.

Th

us

,

f

or example, we could be subject to liabilit

yf

or a problem with our

911 service where our

f

ailures are greater than mere negligence. I

t

i

s also unclear under the F

CC

’s rules whether the limitations o

n

li

a

bili

ty wou

ld

app

l

ytot

h

ose su

b

scr

ib

er

li

nes w

h

ere

V

onage

d

oes

not prov

id

e

E

-911 serv

i

ce

.

We are de

p

endent on a small number of individuals, and i

f

we

l

ose

k

ey personne

l

upon w

h

om we are

d

epen

d

ent, ou

r

business will be adversel

y

affected

.

M

an

y

of the ke

y

responsibilities of our business have bee

n

assigned to a relatively small number of individuals.

O

ur future

s

uccess

d

epen

d

s to a cons

id

era

bl

e

d

egree on t

h

ev

i

s

i

on, s

kill

s

,

experience, and effort of our senior management, especiall

y

M

arc P. Lefar

,

our

C

hief Executive

O

fficer. The loss of the service

s

of these officers could have a material adverse effect on our busi

-

ness.

I

na

ddi

t

i

on, our cont

i

nue

d

growt

hd

epen

d

s on our a

bili

ty t

o

attract an

d

reta

i

n exper

i

ence

dk

e

y

emp

l

o

y

ees

.

W

e

h

ave

i

ncurre

dl

osses s

i

nce our

i

ncept

i

on, an

d

we ma

y

co

ntin

ue

t

o

in

cu

rl

osses

in th

e

f

u

t

u

r

e

.

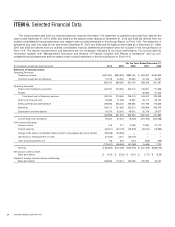

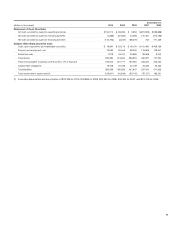

While we achieved profitabilit

y

in certain quarters in 2009 and

2010 under United

S

tates

G

enerally Accepted Accounting Princi-

p

les (“GAAP”), we incurred net losses of

$

42,598 and

$

83,665 for

th

e

y

ears en

d

e

dD

ecem

b

er 31, 2009 an

d

2010, respect

i

ve

ly

.

F

o

r

t

he period from our inception through December 31, 2010, ou

r

accumulated deficit was

$

1,171,901. Our net losses initiall

y

wer

e

driven primarily by start-up costs and the cost of developing our

t

ec

h

no

l

ogy an

dl

ater

b

y patent

li

t

i

gat

i

on sett

l

ements an

d

mar

k

et

-

i

ng expenses.

M

ost recent

l

y, our net

l

osses

h

ave

b

een

d

r

i

ven

p

r

i

nc

i

pa

ll

y

b

y mar

k

et

i

ng expenses,

i

nvestments

i

n researc

h

an

d

d

eve

l

opment an

d

customer care,

i

ncrease

di

nterest expense as

a

r

esult of the financing that we completed in November 2008 and

non-cash charges associated with the conversion feature of th

e

now converte

d

convert

ibl

e notes an

d

our

D

ecem

b

er 2010

r

efinancing.

Althou

g

h we believe we will achieve consistent pro

f

itability in

t

he

f

uture, we ultimately may not be success

f

ul. We believe tha

t

our ability to achieve consistent pro

f

itability will depend, amon

g

other

f

actors, on our ability to continue to achieve and maintain

s

ubstantive o

p

erational im

p

rovements and structural cost reduc

-

ti

ons w

hil

ema

i

nta

i

n

i

n

g

an

dg

row

i

n

g

our net revenues.

I

na

ddi

t

i

on,

ce

rt

a

in

of

th

e cos

t

sofou

r

bus

in

ess a

r

e

n

o

t within

ou

r

co

ntr

o

l

a

n

d

ma

yi

ncrease.

F

or examp

l

e, we an

d

ot

h

er te

l

ecommun

i

cat

i

ons

p

rov

id

ers are su

bj

ect to regu

l

atory term

i

nat

i

on c

h

arges

i

mpose

d

b

y regu

l

atory aut

h

or

i

t

i

es

i

n countr

i

es to w

hi

c

h

customers ma

ke

ca

ll

s, suc

h

as

I

n

di

aw

h

ere regu

l

atory aut

h

or

i

t

i

es

h

ave

b

een pet

i-

ti

one

dbyl

oca

l

prov

id

ers to cons

id

er term

i

nat

i

on rate

i

ncreases.

A

s we attract a

ddi

t

i

ona

li

nternat

i

ona

ll

ong

di

stance

callers, we will be more a

ff

ected b

y

these increases to the exten

t

t

hat we are unable to o

ff

set such costs by passing through pric

e

i

ncreases to customers

.

Jeffrey A.

C

itron, our founder, non-executive

C

hairman,

and a signi

f

icant stockholder, exerts signi

f

icant in

f

luenc

e

o

v

e

r

us.

As of December 31, 2010, Mr.

C

itron beneficiall

y

owne

d

approximately 26.0% of our outstanding common stock, including

outstanding securities exercisable for common stock within 6

0

days of such date. As a result, Mr.

C

itron is able to exert sig

-

nificant influence over all matters presented to our stockholder

s

for approval, including election and removal of our directors an

d

change of control transactions. In addition, as our non-executive

C

hairman

,

Mr.

C

itron has and will continue to have influence ove

r

our strategy and other matters as a board member. Mr.

C

itron’s

i

nterests ma

y

not alwa

y

s coincide with the interests of other

holders of our common stock.

We may be unable to

f

ully realize the bene

f

its o

f

our net

operatin

g

loss (“NOL”) carry forwards if an ownershi

p

c

h

ange occurs

.

I

f

we were to experience another “chan

g

e in ownership

”

under Section 382 of the Internal Revenue Code

(

“Section 382”

)

,

t

he NOL carry forward limitations under Section 382 would

i

m

p

ose an annual limit on the amount o

f

the

f

uture taxable incom

e

t

hat may be offset by our NOL

g

enerated prior to the chan

g

ei

n

ownership. I

f

a chan

g

e in ownership were to occur, we may b

e

unable to use a si

g

nificant portion of our NOL to offset futur

e

1

6

VO

NA

G

E ANN

U

AL REP

O

RT 2010