Vonage 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

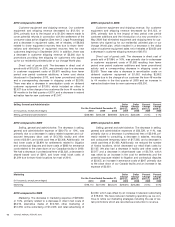

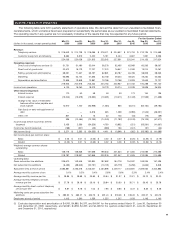

T

e

l

ep

h

ony serv

i

ces revenue

.

T

e

l

ep

h

on

y

serv

i

ces revenu

e

g

enerally has been flat on a quarterly basis with the exception o

f

t

he first and second

q

uarters of 2010. The increases in tele

p

h

-

ony services revenue in the first and second quarters of 2010

were related to fewer service credits due to pro

g

ram

s

i

m

p

lemented in 2010, lower bad debt due to im

p

roved collec

-

t

ions and fewer delinquent accounts, and sli

g

htly hi

g

her U

S

F

fees.

C

ustomer equipment and shippin

g

revenue.

C

ustomer

e

quipment and shippin

g

revenue was lower in the secon

d

throu

g

h

f

ourth quarters o

f

2009 due to the introduction o

f

ane

w

p

romotion in May 2009 that eliminated equipment and shippin

g

f

ees

f

or customers who si

g

ned up

f

or our residential unlimite

d

p

lan. In 2010, customer equipment and shippin

g

revenue was

lower than 2009 due to lower equipment recovery

f

ees

f

rom

f

ewer terminations. In addition, durin

g

the third quarter o

f

2010,

a

$1,500 reserve was made to cover

p

otential refunds in con-

nection with the

p

ro

p

osed settlement o

f

the consumer clas

s

a

ction liti

g

ation (See Item 3. Le

g

al Proceedin

g

s)

.

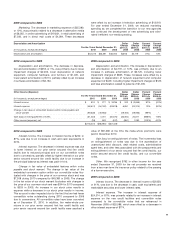

D

irect cost o

f

telephony services

.

D

irect cost o

f

telephon

y

services beginning in the

f

ourth quarter o

f

2009 through the

second quarter o

f

2010 increased as expected due call termi-

n

ation costs

f

rom higher international call volume

f

ollowing the

introduction o

f

our Vonage World plan. In the third and

f

ourth

q

uarters of 2010, these increases in call volumes have bee

n

partially offset by more favorable rates negotiated with our serv-

ice providers resulting in lower direct cost of telephony services.

D

irect cost o

f

goods sold

.

T

he change in direct cost o

f

g

oods sold expenses between the quarters was due to fluctua-

t

i

ons

i

nsu

b

scr

ib

er

li

ne a

ddi

t

i

ons.

I

n 2009 an

d

2010

,

t

h

e amor-

tization of deferred customer equipment costs has generall

y

d

iminished as historical amounts have been full

y

amortized an

d

have not been replaced with new deferred costs due to th

e

introduction of a new promotion in Ma

y

2009 that eliminate

d

a

ctivation fees and thus the corresponding cost deferral fo

r

c

ustomers who signed up for our residential unlimited plan or

o

ur

V

onage

W

or

ld

p

l

an

.

S

elling, general and administrative

.

S

elling, general an

d

ad

m

i

n

i

strat

i

ve expenses genera

ll

y

h

ave

d

ecrease

d

on a quarter

l

y

b

asis as a result of our cost management initiatives. In 2009

,

s

e

lli

ng, genera

l

an

d

a

d

m

i

n

i

strat

i

ve cost

d

ec

li

ne

d

pr

i

mar

il

y

d

ue t

o

a

decrease in professional fees and lower selling expenses du

e

to a reduction in the number of kiosk locations. The furthe

r

r

e

d

uct

i

on

i

nse

lli

ng, genera

l

an

d

a

d

m

i

n

i

strat

i

ve cost

i

n 2010 was

p

r

i

mar

ily d

ue to a

d

ecrease

i

n outsource

d

customer care cost

s

a

nd professional fees.

M

ar

k

et

i

ng

.

M

ar

k

et

i

ng expense

d

ec

li

ne

d

t

h

roug

h

out 2009 a

s

we comp

l

ete

d

t

h

e trans

i

t

i

on to our new agenc

i

es an

d

cont

i

nue

d

the development of new advertising and eliminated inefficien

t

non-me

di

a spen

di

n

g

.

I

n 2010, mar

k

et

i

n

g

expense was re

l

at

i

ve

l

y

f

lat as we allocated a fixed marketin

g

spend across channel

s

b

ased u

p

on

p

erformance as we continued to refine our market

-

in

g

strate

g

y

.

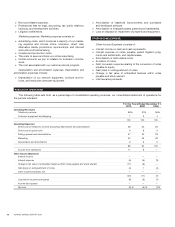

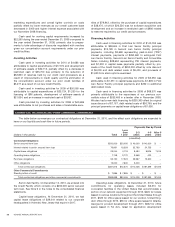

LIQUIDITY AND CAPITAL RESOURCES

O

vervie

w

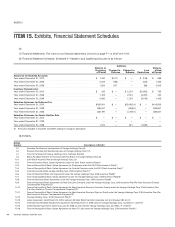

The following table sets forth a summary of our cash flows for the periods indicated:

For the Years Ende

d

D

ecember 31

,

(

dollars in thousands

)

20

1

0 2009 2008

N

et cas

h

prov

id

e

db

y operat

i

ng act

i

v

i

t

i

e

s

$

194

,

212 $ 38

,

396 $ 3

,

55

5

N

et cash (used in) provided by investing activities

(

4,686) (50,565) 40,486

N

et cash used in

f

inancing activitie

s

(

143,762) (3,253) (68,370)

For the year ended December 31, 2010, we

g

enerated

i

ncome

f

rom operations and positive operatin

g

cash

f

low. We

expect to continue to balance e

ff

orts to

g

row our customer bas

e

while consistently achievin

g

operatin

g

pro

f

itability. To

g

row ou

r

customer base, we continue to make investments in marketin

g,

a

pp

lication develo

p

ment as we seek to launch new services,

network quality and expansion, and customer care. Althou

g

hw

e

b

elieve we will achieve consistent pro

f

itability in the

f

uture, w

e

ultimately may not be success

f

ul and we may never achieve

consistent operatin

g

pro

f

itability. We believe that cash

f

low

f

ro

m

o

p

erations and cash on hand will

f

und our o

p

erations

f

or at leas

t

the

n

e

xt tw

el

v

e

m

o

nt

hs.

D

ecem

b

er 2010

Fi

nanc

i

ng

O

n December 14, 2010, we entered into a credit agreemen

t

(the “Credit Facility”) consistin

g

of a

$

200,000 senior secured

t

erm loan. The co-borrowers under the

C

redit Facilit

y

are us an

d

Vona

g

e America Inc., our wholly owned subsidiary.

O

bli

g

ations

under the

C

redit Facility are

g

uaranteed, fully and uncondition

-

ally, by our other United

S

tates subsidiaries and are secured b

y

s

ubstantially all o

f

the assets o

f

each borrower and each o

f

th

e

g

uarantors. An a

ff

iliate o

f

the chairman o

f

our board o

f

directors

and one o

f

our

p

rinci

p

al stockholders is a lender under th

e

C

redit Facility.

Use of Proceed

s

We used the net proceeds of the Credit Facilit

y

of

$

194,000

(

$

200,000 principal amount less ori

g

inal discount of

$

6,000)

,

p

lus

$

102,090 of cash on hand, to (i) exercise our existin

g

ri

g

ht

t

o retire debt under our senior secured first lien credit facility

(

th

e

“First Lien

S

enior Facility”

)

for 100% of the contractual make

-

whole

p

rice,

(

ii

)

retire debt under our senior secured second lien

credit facility

(

the “

S

econd Lien

S

enior Facility”

)

at a more than

25% discount to the contractual make-whole

p

rice, an

d

(

iii

)

cause the conversion of all outstandin

g

third lien convertible

notes

(

the “

C

onvertible Notes”

)

into 8,276 shares of our com

-

mon stock. We also incurred

$

11,444 of debt related costs i

n

connection with the Credit Facility and repayment of our First

Lien Senior Facility and our Second Lien Senior Facility, an

d

conversion of our

C

onvertible Notes

.

36

VO

NA

G

E ANN

U

AL REP

O

RT 2010