Vonage 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

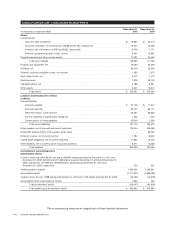

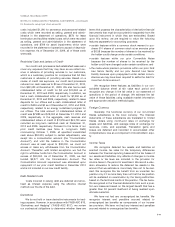

VONAGE HOLDINGS CORP. CONSOLIDATED STATEMENTS OF OPERATIONS

F

or t

h

e

Y

ears

E

n

d

e

d

D

ecem

b

er

3

1

,

(

In thousands, except per share amounts)

20

1

0 2009 2008

Operating Revenues

:

Telephony services

$

872,934

$

864,848

$

865,76

5

C

ustomer equipment and shippin

g

12,108 24,232 34,35

5

88

5,

042 889

,

080 900

,

120

O

peratin

g

Expenses

:

Direct cost of telephony services (excluding depreciation and amortization of $18,725, $18,958

,

and $20,254, respectivel

y)

2

43

,

794 213

,

553 226

,

21

0

Direct cost o

f

goods sol

d

5

5

,

965 71

,

488 79

,

382

S

elling, general and administrative 238,986 265,456 298,985

M

ar

k

et

i

n

g

198

,

170 227

,

990 253

,

37

0

D

eprec

i

at

i

on an

d

amort

i

zat

i

o

n

5

3

,

073 53

,

391 48

,

612

7

89

,

988 831

,

878 906

,

55

9

Income (loss) from operation

s

95,054 57,202 (6,439

)

O

ther Income

(

Ex

p

ense

):

Int

e

r

es

tin

co

m

e

5

19 2

77

3

,

236

Interest ex

p

ens

e

(

48,541

)(

54,192

)(

29,878

)

C

han

g

e in fair value of embedded features within notes payable and stock warrant

(

99,338

)(

49,933

)

—

(

Loss

)g

ain on extin

g

uishment of notes

(

31,023

)

4,041

(

30,570

)

O

ther

(

ex

p

ense

)

income, ne

t

(

18

)

843

(

247

)

(

178,401

)(

98,964

)(

57,459

)

Loss be

f

ore income tax expens

e

(

83,347

)(

41,762

)(

63,898

)

I

ncome tax expens

e

(

318

)(

836

)(

678

)

N

et

l

os

s

$

(83,665) $ (42,598) $ (64,576

)

Net loss

p

er common share

:

B

as

i

ca

n

dd

il

u

t

ed

$(

0.40

)$ (

0.25

)$ (

0.41

)

W

e

i

g

h

te

d

-average common s

h

ares outstan

di

ng:

B

as

i

can

d dil

ute

d

2

09

,

868 170

,

314 156

,

25

8

T

he accompanyin

g

notes are an inte

g

ral part of these financial statement

s

F

-5