Vonage 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

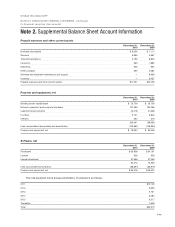

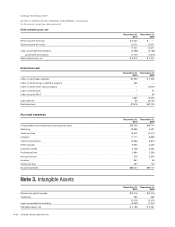

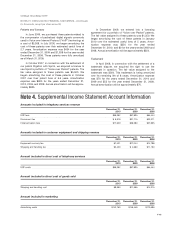

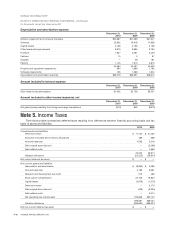

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

Li

a

bili

t

i

es:

F

or t

h

e

Y

ear

E

n

d

e

d

D

ecem

b

er

3

1,

20

1

0

F

or t

h

e

Y

ear

E

n

d

e

d

D

ecem

b

er

3

1,

2009

B

eg

i

nn

i

ng

b

a

l

ance

$

25

,

050 $ 32

,

720

I

ncrease in value

f

or notes converted 7

,

308 34

,

68

2

F

air value adjustment for notes converted

(

32,358

)(

57,050

)

T

ota

l

unrea

li

ze

dl

oss

i

n earn

i

ng

s

–14

,

69

8

E

n

di

ng

b

a

l

anc

e

$

–$25

,

05

0

T

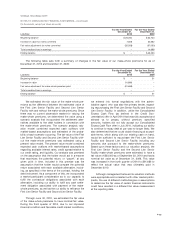

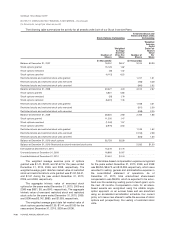

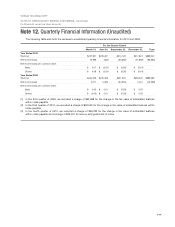

he following table sets forth a summary of changes in the fair value of our make-whole premiums for as o

f

December 31

,

2010 and December 31

,

2009

:

Li

ab

iliti

es

:

F

o

rth

e

Y

ea

rEn

ded

December 31

,

2

0

1

0

F

o

rth

e

Y

ea

rEn

ded

D

ecember 31

,

2

009

B

e

g

innin

g

balance

$

–

$

–

I

n

c

r

ease

in v

a

l

ue

91,686

–

F

air value ad

j

ustment for make-whole

p

remium

p

aid

(

91,686

)–

T

otal unrealized loss in earnin

gs

––

E

n

di

ng

b

a

l

anc

e

$

–

$–

We estimated the fair value of the make-whole

p

re-

mi

u

m

sas

th

ed

iff

e

r

e

n

ce be

tw

ee

nth

ees

tim

a

t

ed

v

a

l

ue of

t

he First Lien

S

enior Facilit

y

and

S

econd Lien

S

enior

Facility with and without the make-whole premiums.

S

ince

t

here was no current observable market for valuin

g

the

make-whole premiums, we determined the value usin

g

a

s

cenario analysis that incorporated the settlement alter

-

n

a

tiv

es a

v

a

il

ab

l

e

t

o

th

e deb

th

o

l

de

r

s

in

co

nn

ec

ti

o

n wit

h

t

he make-whole premiums. The scenario analysis valu-

ation model combined ex

p

ected cash out

f

lows with

market-based assum

p

tions and estimated o

f

the

p

roba

-

b

ility o

f

each scenario occurrin

g

. The

f

air value o

f

the Firs

t

Lien Senior Facility and Second Lien Senior Facility with

-

out the make-whole premiums was estimated usin

ga

p

resent value model. The

p

resent value model combined

ex

p

ected cash out

f

lows with market-based assum

p

tion

s

r

e

g

ardin

g

available interest rates, credit spread relative t

o

our credit ratin

g

, and liquidity. Our analysis was premise

d

on the assum

p

tion that the holder would act in a manner

t

hat maximizes the potential return, or “payo

ff

,” at an

y

g

iven point in time. Included in this premise was th

e

assum

p

tion that the holder would com

p

are the

p

otentia

l

r

eturn associated with each available alternative, includ

-

i

n

g

, as speci

f

ied in the terms o

f

the contract, holdin

g

the

debt instrument. As a com

p

onent o

f

this, we incor

p

orated

a mar

k

et part

i

c

i

pant cons

id

erat

i

on as to our capac

i

ty t

o

f

ul

f

ill the contractual obli

g

ations associated with eac

h

alternative, includin

g

our ability to

f

ul

f

ill any cash settle

-

ment obli

g

ation associated with payment o

f

the make

-

whole premiums, as well as the our abilit

y

to re

f

inance th

e

First Lien Senior Facilit

y

and Second Lien Senior Facilit

y.

T

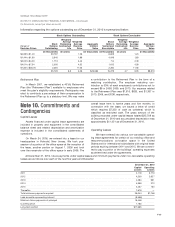

hrough June 30, 2010, we estimated the fair value

of the make-whole premiums to have nominal fair value.

During the third quarter of 2010, due to our improved

financial condition and favorable credit market conditions

,

we entered into

f

ormal negotiations with the admin

-

i

strat

i

ve agent, w

h

o was a

l

so t

h

epr

i

mary

l

en

d

er, regar

d

-

i

ng repurchasing the First Lien

S

enior Facility and

S

econd

Lien

S

enior Facilit

y

. In addition, unlike the

C

onsolidate

d

Excess

C

ash Flow

(

as defined in the

C

redit Doc

-

u

mentation

)

offer in April 2010 that was full

y

accepted an

d

allowed us to prepa

y

, without premium, specifie

d

amounts, holders did not full

y

accept our

C

onsolidated

Excess

C

ash Flow offer in July 2010, indicating our abilit

y

t

o cont

i

nue to repay

d

e

b

t at par was no

l

onger

lik

e

l

y.

We

also determined that we could obtain financing at accept-

a

bl

e terms, w

hi

c

h

a

l

ong w

i

t

h

our ex

i

st

i

ng cas

h

on

h

an

d

,

would be sufficient to repurchase the First Lien

S

enior

Facility and

S

econd Lien

S

enior Facility including any

amounts

d

ue pursuant to t

h

ema

k

e-w

h

o

l

e prem

i

ums.

Based upon these factors and our valuation anal

y

sis, th

e

First Lien

S

enior Facilit

y

and the

S

econd Lien

S

enior

F

ac

ili

t

y

ma

k

e-w

h

o

l

e prem

i

ums were est

i

mate

d

to

h

ave

a

fair value of

$

60,000 as of September 30, 2010 and had

a

n

ominal fair value as of December 31

,

2009. This valu

e

was increased in the fourth

q

uarter of 2010 to

$

91,686 to

reflect the actual value that was ultimatel

y

paid in

D

ece

m

be

r2

0

1

0

.

Althou

g

h mana

g

ement believed its valuation method

s

were a

pp

ro

p

riate and consistent with other market

p

artic-

i

pants, the use o

f

di

ff

erent methodolo

g

ies or assumption

s

to de

t

e

rmin

e

th

efa

ir v

a

l

ue of ce

rt

a

in

f

in

a

n

c

i

a

lin

s

tr

u

m

e

nt

s

cou

l

d

h

a

v

e

r

esu

lt

ed

in

ad

i

ffe

r

e

nt

fa

ir v

a

l

ue

m

easu

r

e

m

e

n

t

at the reportin

g

date

.

F

-23