Vonage 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

We participated in the

S

tate of New Jerse

y

’s corpo-

r

ation business tax benefit certificate transfer program

,

which allows certain hi

g

h technolo

g

y and biotechnolo

gy

companies to transfer unused New Jersey net operatin

g

l

oss carryovers to other New Jersey corporation busines

s

t

axpayers. Durin

g

2003 and 2004, we submitted an appli

-

cation to the New Jersey Economic Development Author-

i

ty, or EDA, to participate in the pro

g

ram and th

e

a

pp

lication was a

pp

roved. The EDA then issued a certi

f

i-

cate certi

f

yin

g

our eli

g

ibility to participate in the pro

g

ram.

T

he pro

g

ram requires that a purchaser pay at least 75%

of the amount of the surrendered tax benefit. In tax years

2008, 2009, and 2010, we sold approximately,

$

10,051

,

$

0, and

$

2,194, respectively, of our New Jersey State ne

t

operatin

g

loss carry forwards for a reco

g

nized benefit of

approximately

$

605 in 2008,

$

0 in 2009, and

$

168 i

n

2010.

C

ollectively, all transactions represent approx-

i

mately 85

%

o

f

the surrendered tax bene

f

it each year an

d

h

ave been reco

g

nized in the year received.

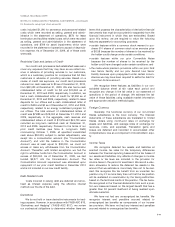

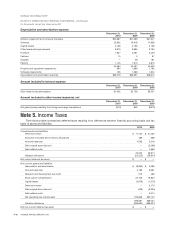

No

te 6.

L

on

g

-

T

erm

D

e

bt

A

schedule o

f

lon

g

-term debt at December 31, 2010 and 2009 is as

f

ollows:

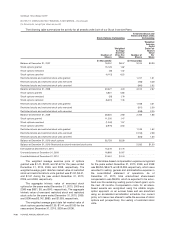

D

ecember 31

,

2

0

1

0

D

ecember 31

,

2

009

9

.75% Credit Facility — due 2015, net of discount

$

173,004

$—

16% First Lien

S

enior Facility — due 2013, net of discount — 107,246

2

0%

S

econd Lien

S

enior Facility — due 2015, net of discount — 86,61

4

2

0% Third Lien

C

onvertible Notes — due 2015, net of discount — 6,60

8

$

173,004

$

200,468

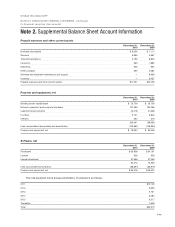

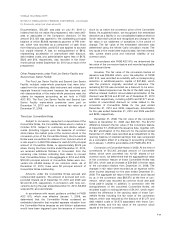

At December 31, 2010,

f

uture payments under lon

g

-term debt obli

g

ations over each o

f

the next

f

ive years and there-

af

t

e

r

a

r

easfo

ll

o

w

s:

C

redit Facilit

y

2011

$

20,000

2012

20

,

000

2013

20

,

000

2014

20

,

000

2015

120

,

000

Minimum future payments of principa

l

200

,

000

Pl

us acc

r

e

t

ed

int

e

r

es

t

—

L

ess u

n

a

m

o

rtiz

ed d

i

scou

n

t

6

,

996

C

urrent

p

ortio

n

20

,

000

L

ong-term port

i

on $173

,

00

4

December 2010 Financin

g

O

n December 14, 2010, we entered into a credit

a

g

reement (the “Credit Facility”) consistin

g

of a $200,00

0

se

ni

o

r

secu

r

ed

t

e

rm l

oa

n. Th

eco

-

bo

rr

o

w

e

r

su

n

de

rth

e

C

redit Facility are us and Vona

g

e America Inc., our wholl

y

owned subsidiary. Obli

g

ations under the Credit Facilit

y

are

g

uaranteed,

f

ully and unconditionally, by our other

U

nited States subsidiaries and are secured by sub-

s

tantially all o

f

the assets o

f

each borrower and each o

f

t

he

g

uarantors. An a

ff

iliate o

f

the chairman o

f

our board o

f

directors and one o

f

our

p

rinci

p

al stockholders is a lender

under the Credit Facility.

Use of Proceeds

We used the net proceeds of the

C

redit Facilit

y

o

f

$

194,000 (

$

200,000 principal amount less ori

g

inal dis-

count of $6,000), plus $102,090 of cash on hand, t

o

(i) exercise our existing right to retire debt under our Firs

t

Lien

S

enior Facilit

y

, for 100% of the contractual make

-

whole price,

(

ii

)

retire debt under our

S

econd Lien

S

enior

Facilit

y

at a more than 25% discount to the contractual

m

ake-whole price, and

(

iii

)

cause the conversion of all

outstanding

C

onvertible Notes into 8,276 shares of our

common stock

(

the

C

onvertible Notes together with th

e

First Lien

S

enior Facilit

y

and the

S

econd Lien

S

enior

Facility, the “Prior Financing”). We also incurred

$

11,44

4

of fees in connection with the

C

redit Facilit

y

and repa

y

-

m

ent of the Prior Financing. We agreed to make an addi

-

t

ional cash pa

y

ment to the holders of our

S

econd Lie

n

Senior Facility in an aggregate amount of

$

9,000 if w

e

engage in

Q

ualifying Discussions

(

as defined in the Maste

r

Agreement

)

prior to June 30, 2011 that result in a merge

r

or acquisition transaction

(

as defined in the Maste

r

Agreement

)

that is consummated prior to June 30, 2012.

F-1

8

VO

NA

G

E ANN

U

AL REP

O

RT 2010