Vonage 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

In thousands, except per share amounts

)

Loss per

S

hare

B

as

i

can

d dil

ute

dl

oss per s

h

are

h

as

b

een compute

d

according to FA

S

BA

SC

260

,

“Earnings per

S

hare”

.

B

as

i

c

l

oss per s

h

are represents net

l

oss

di

v

id

e

db

yt

h

ewe

i

g

h

te

d

a

verage number of common shares outstanding during a

r

eported period. Diluted loss per share reflects the poten

-

tial dilution that could occur if securities or other contracts

to

i

ssue common stoc

k

,

i

nc

l

u

di

ng warrants, stoc

k

opt

i

ons,

a

nd restricted stock units under our 2001

S

tock Incentiv

e

P

lan and 2006 Incentive Plan

,

and the

C

onvertible Notes

,

were exerc

i

se

d

or converte

di

nto common stoc

k

.

The

e

ffects of potentially dilutive common shares, includin

g

sh

ares attr

ib

uta

bl

e to our outstan

di

ng common stoc

k

warrant an

d

our restr

i

cte

d

stoc

k

un

i

ts an

d

stoc

k

opt

i

on

s

o

utstandin

g

usin

g

the treasury stock method, have bee

n

e

xcluded

f

rom the calculation o

f

diluted loss

p

er commo

n

s

hare because o

f

their anti-dilutive e

ff

ects. In applyin

g

the

treasury stock method

f

or stock-based compensatio

n

a

rran

g

ements, the assumed proceeds are computed as

the sum o

f

the amount the employee must pay upo

n

e

xercise and the amounts o

f

avera

g

e unreco

g

nize

d

c

om

p

ensation cost attributed to

f

uture services. In addi

-

tion, the e

ff

ects o

f

potentially dilutive common shares i

n

c

onnection with our Convertible Notes usin

g

th

e

i

f

-

co

nv

e

rt

ed

m

e

th

od

h

a

v

e bee

n

e

x

c

l

uded f

r

o

mth

eca

l

cu

-

lation o

f

diluted loss per common share because o

f

thei

r

a

nti-dilutive e

ff

ects is re

f

lected in diluted earnings pe

r

sh

are

.

The

f

ollowin

g

shares were excluded

f

rom the calculation o

f

diluted loss per share because o

f

their anti-dilutive e

ff

ects

:

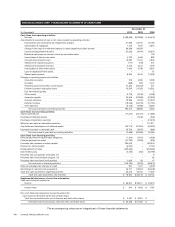

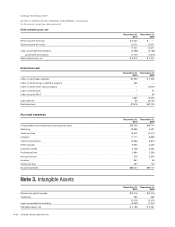

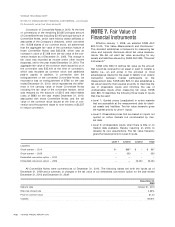

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1

,

20

1

0 2009 2008

C

ommon stock warrant

5

14 514 514

C

onvertible notes 10

,

421 19

,

638 62

,

069

R

estr

i

cte

d

stoc

k

un

i

t

s

2

,

332 2

,

792 3

,

100

E

mp

l

o

y

ee stoc

k

opt

i

on

s

3

5

,

729 28

,

528 29

,

22

7

4

8

,

996 51

,

472 94

,

910

C

omprehensive Income

(

Loss

)

C

omprehensive income

(

loss

)

consists of net loss

and other comprehensive items.

O

ther comprehensive

i

tems include foreign currency translation adjustments

and unrealized gains

(

losses

)

on available for sale invest-

ments. Assets and liabilities of foreign operations ar

e

t

rans

l

ate

d

at t

h

e per

i

o

d

-en

d

exc

h

ange rate an

d

revenu

e

an

d

expense amounts are trans

l

ate

d

at t

h

e average rates

of exchange prevailing during the period and represent

s

th

e

b

a

l

ance

i

n accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncom

e

(

loss

).

S

hare-Based Com

p

ensatio

n

We account

f

or share-based com

p

ensation in accord

-

ance with FASB ASC 718,

“

Com

p

ensation-Stock

C

om

p

ensation”. Under the

f

air value reco

g

nition provi

-

s

ions o

f

this

p

ronouncement, share-based com

p

ensatio

n

cost is measured at the

g

rant date based on the

f

air valu

e

o

f

the award, reduced as a

pp

ro

p

riate based on estimated

f

or

f

eitures, and is reco

g

nized as expense over the appli-

cable vestin

g

period o

f

the stock award usin

g

the accel-

e

r

a

t

ed

m

e

th

od.

R

ecent

A

ccount

i

ng

P

ronouncements

In

O

ctober 2009, the FA

S

B issued Accounting

S

tan-

dards Update No. 2009-13

(

“A

S

U 2009-13”

)

“R

evenu

e

R

ecognition

(

Topic 605

)

, Multiple-Deliverable Revenu

e

Arrangements a consensus of the FA

S

B Emerging Issues

Task Force

(

“EITF”

)

”

.

T

his Accounting

S

tandards Update

p

rovides amendments to the criteria in FA

S

BA

SC

605-2

5

for separating consideration in multiple-deliverabl

e

arrangements. A

S

U 2009-13 changes existing rule

s

r

egarding recognition of revenue in multiple deliverable

arrangements an

d

expan

d

s ongo

i

ng

di

sc

l

osures a

b

out t

he

s

ignificant judgments used in applying its guidance. It wil

l

b

e effective for revenue arrangements entered into or

materially modified in the fiscal year beginning on or after

J

une 15, 2010.

E

ar

ly

a

d

opt

i

on

i

s perm

i

tte

d

on a pro

-

s

pect

i

ve or retrospect

i

ve

b

as

i

s.

W

e

d

o not expect t

he

adoption of A

S

U 2009-13 to have a material impact on

our financial statements

.

R

ec

l

ass

ifi

ca

ti

o

n

s

C

ertain reclassifications have been made to

p

rio

r

y

ears’

f

inancial statements in order to con

f

orm to the

current year’s presentation. The reclassi

f

ications had no

i

mpact on net earnin

g

s previously reported

.

F

-

12

VO

NA

G

E ANN

U

AL REP

O

RT 2010